Need to Know: IFRS 10 - Consolidated Financial ... - BDO Canada

Need to Know: IFRS 10 - Consolidated Financial ... - BDO Canada

Need to Know: IFRS 10 - Consolidated Financial ... - BDO Canada

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

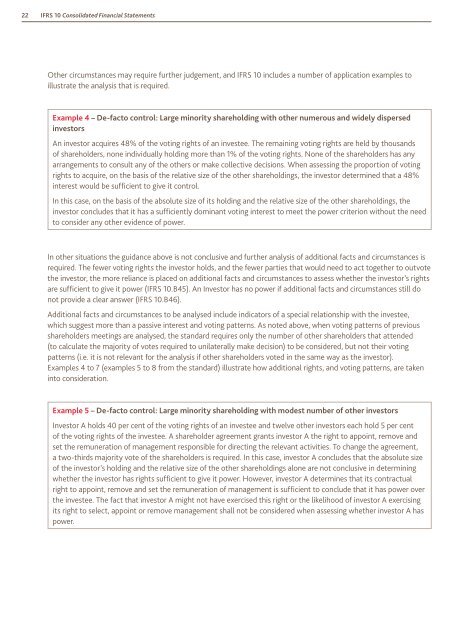

22 <strong>IFRS</strong> <strong>10</strong> <strong>Consolidated</strong> <strong>Financial</strong> StatementsOther circumstances may require further judgement, and <strong>IFRS</strong> <strong>10</strong> includes a number of application examples <strong>to</strong>illustrate the analysis that is required.Example 4 – De-fac<strong>to</strong> control: Large minority shareholding with other numerous and widely dispersedinves<strong>to</strong>rsAn inves<strong>to</strong>r acquires 48% of the voting rights of an investee. The remaining voting rights are held by thousandsof shareholders, none individually holding more than 1% of the voting rights. None of the shareholders has anyarrangements <strong>to</strong> consult any of the others or make collective decisions. When assessing the proportion of votingrights <strong>to</strong> acquire, on the basis of the relative size of the other shareholdings, the inves<strong>to</strong>r determined that a 48%interest would be sufficient <strong>to</strong> give it control.In this case, on the basis of the absolute size of its holding and the relative size of the other shareholdings, theinves<strong>to</strong>r concludes that it has a sufficiently dominant voting interest <strong>to</strong> meet the power criterion without the need<strong>to</strong> consider any other evidence of power.In other situations the guidance above is not conclusive and further analysis of additional facts and circumstances isrequired. The fewer voting rights the inves<strong>to</strong>r holds, and the fewer parties that would need <strong>to</strong> act <strong>to</strong>gether <strong>to</strong> outvotethe inves<strong>to</strong>r, the more reliance is placed on additional facts and circumstances <strong>to</strong> assess whether the inves<strong>to</strong>r’s rightsare sufficient <strong>to</strong> give it power (<strong>IFRS</strong> <strong>10</strong>.B45). An Inves<strong>to</strong>r has no power if additional facts and circumstances still donot provide a clear answer (<strong>IFRS</strong> <strong>10</strong>.B46).Additional facts and circumstances <strong>to</strong> be analysed include indica<strong>to</strong>rs of a special relationship with the investee,which suggest more than a passive interest and voting patterns. As noted above, when voting patterns of previousshareholders meetings are analysed, the standard requires only the number of other shareholders that attended(<strong>to</strong> calculate the majority of votes required <strong>to</strong> unilaterally make decision) <strong>to</strong> be considered, but not their votingpatterns (i.e. it is not relevant for the analysis if other shareholders voted in the same way as the inves<strong>to</strong>r).Examples 4 <strong>to</strong> 7 (examples 5 <strong>to</strong> 8 from the standard) illustrate how additional rights, and voting patterns, are takenin<strong>to</strong> consideration.Example 5 – De-fac<strong>to</strong> control: Large minority shareholding with modest number of other inves<strong>to</strong>rsInves<strong>to</strong>r A holds 40 per cent of the voting rights of an investee and twelve other inves<strong>to</strong>rs each hold 5 per cen<strong>to</strong>f the voting rights of the investee. A shareholder agreement grants inves<strong>to</strong>r A the right <strong>to</strong> appoint, remove andset the remuneration of management responsible for directing the relevant activities. To change the agreement,a two-thirds majority vote of the shareholders is required. In this case, inves<strong>to</strong>r A concludes that the absolute sizeof the inves<strong>to</strong>r’s holding and the relative size of the other shareholdings alone are not conclusive in determiningwhether the inves<strong>to</strong>r has rights sufficient <strong>to</strong> give it power. However, inves<strong>to</strong>r A determines that its contractualright <strong>to</strong> appoint, remove and set the remuneration of management is sufficient <strong>to</strong> conclude that it has power overthe investee. The fact that inves<strong>to</strong>r A might not have exercised this right or the likelihood of inves<strong>to</strong>r A exercisingits right <strong>to</strong> select, appoint or remove management shall not be considered when assessing whether inves<strong>to</strong>r A haspower.