Need to Know: IFRS 10 - Consolidated Financial ... - BDO Canada

Need to Know: IFRS 10 - Consolidated Financial ... - BDO Canada

Need to Know: IFRS 10 - Consolidated Financial ... - BDO Canada

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

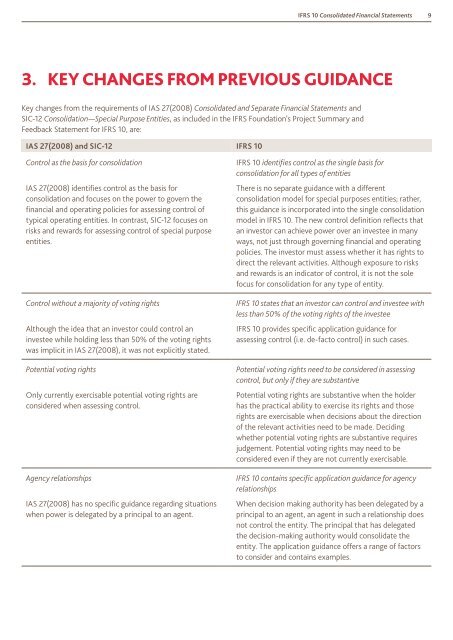

<strong>IFRS</strong> <strong>10</strong> <strong>Consolidated</strong> <strong>Financial</strong> Statements93. Key changes from previous guidanceKey changes from the requirements of IAS 27(2008) <strong>Consolidated</strong> and Separate <strong>Financial</strong> Statements andSIC-12 Consolidation—Special Purpose Entities, as included in the <strong>IFRS</strong> Foundation’s Project Summary andFeedback Statement for <strong>IFRS</strong> <strong>10</strong>, are:IAS 27(2008) and SIC-12 <strong>IFRS</strong> <strong>10</strong>Control as the basis for consolidationIAS 27(2008) identifies control as the basis forconsolidation and focuses on the power <strong>to</strong> govern thefinancial and operating policies for assessing control oftypical operating entities. In contrast, SIC-12 focuses onrisks and rewards for assessing control of special purposeentities.Control without a majority of voting rightsAlthough the idea that an inves<strong>to</strong>r could control aninvestee while holding less than 50% of the voting rightswas implicit in IAS 27(2008), it was not explicitly stated.Potential voting rightsOnly currently exercisable potential voting rights areconsidered when assessing control.Agency relationshipsIAS 27(2008) has no specific guidance regarding situationswhen power is delegated by a principal <strong>to</strong> an agent.<strong>IFRS</strong> <strong>10</strong> identifies control as the single basis forconsolidation for all types of entitiesThere is no separate guidance with a differentconsolidation model for special purposes entities; rather,this guidance is incorporated in<strong>to</strong> the single consolidationmodel in <strong>IFRS</strong> <strong>10</strong>. The new control definition reflects thatan inves<strong>to</strong>r can achieve power over an investee in manyways, not just through governing financial and operatingpolicies. The inves<strong>to</strong>r must assess whether it has rights <strong>to</strong>direct the relevant activities. Although exposure <strong>to</strong> risksand rewards is an indica<strong>to</strong>r of control, it is not the solefocus for consolidation for any type of entity.<strong>IFRS</strong> <strong>10</strong> states that an inves<strong>to</strong>r can control and investee withless than 50% of the voting rights of the investee<strong>IFRS</strong> <strong>10</strong> provides specific application guidance forassessing control (i.e. de-fac<strong>to</strong> control) in such cases.Potential voting rights need <strong>to</strong> be considered in assessingcontrol, but only if they are substantivePotential voting rights are substantive when the holderhas the practical ability <strong>to</strong> exercise its rights and thoserights are exercisable when decisions about the directionof the relevant activities need <strong>to</strong> be made. Decidingwhether potential voting rights are substantive requiresjudgement. Potential voting rights may need <strong>to</strong> beconsidered even if they are not currently exercisable.<strong>IFRS</strong> <strong>10</strong> contains specific application guidance for agencyrelationshipsWhen decision making authority has been delegated by aprincipal <strong>to</strong> an agent, an agent in such a relationship doesnot control the entity. The principal that has delegatedthe decision-making authority would consolidate theentity. The application guidance offers a range of fac<strong>to</strong>rs<strong>to</strong> consider and contains examples.