Need to Know: IFRS 10 - Consolidated Financial ... - BDO Canada

Need to Know: IFRS 10 - Consolidated Financial ... - BDO Canada

Need to Know: IFRS 10 - Consolidated Financial ... - BDO Canada

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

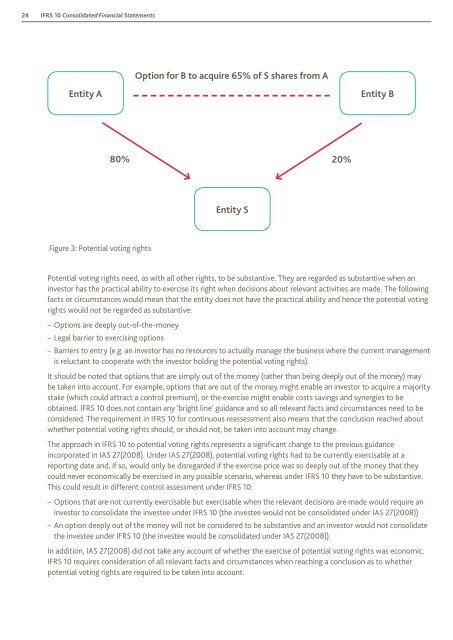

24 <strong>IFRS</strong> <strong>10</strong> <strong>Consolidated</strong> <strong>Financial</strong> StatementsOption for B <strong>to</strong> acquire 65% of S shares from AEntity AEntity B80%20%Entity SFigure 3: Potential voting rightsPotential voting rights need, as with all other rights, <strong>to</strong> be substantive. They are regarded as substantive when aninves<strong>to</strong>r has the practical ability <strong>to</strong> exercise its right when decisions about relevant activities are made. The followingfacts or circumstances would mean that the entity does not have the practical ability and hence the potential votingrights would not be regarded as substantive:––Options are deeply out-of-the-money––Legal barrier <strong>to</strong> exercising options––Barriers <strong>to</strong> entry (e.g. an inves<strong>to</strong>r has no resources <strong>to</strong> actually manage the business where the current managementis reluctant <strong>to</strong> cooperate with the inves<strong>to</strong>r holding the potential voting rights).It should be noted that options that are simply out of the money (rather than being deeply out of the money) maybe taken in<strong>to</strong> account. For example, options that are out of the money might enable an inves<strong>to</strong>r <strong>to</strong> acquire a majoritystake (which could attract a control premium), or the exercise might enable costs savings and synergies <strong>to</strong> beobtained. <strong>IFRS</strong> <strong>10</strong> does not contain any ‘bright line’ guidance and so all relevant facts and circumstances need <strong>to</strong> beconsidered. The requirement in <strong>IFRS</strong> <strong>10</strong> for continuous reassessment also means that the conclusion reached aboutwhether potential voting rights should, or should not, be taken in<strong>to</strong> account may change.The approach in <strong>IFRS</strong> <strong>10</strong> <strong>to</strong> potential voting rights represents a significant change <strong>to</strong> the previous guidanceincorporated in IAS 27(2008). Under IAS 27(2008), potential voting rights had <strong>to</strong> be currently exercisable at areporting date and, if so, would only be disregarded if the exercise price was so deeply out of the money that theycould never economically be exercised in any possible scenario, whereas under <strong>IFRS</strong> <strong>10</strong> they have <strong>to</strong> be substantive.This could result in different control assessment under <strong>IFRS</strong> <strong>10</strong>:––Options that are not currently exercisable but exercisable when the relevant decisions are made would require aninves<strong>to</strong>r <strong>to</strong> consolidate the investee under <strong>IFRS</strong> <strong>10</strong> (the investee would not be consolidated under IAS 27(2008))––An option deeply out of the money will not be considered <strong>to</strong> be substantive and an inves<strong>to</strong>r would not consolidatethe investee under <strong>IFRS</strong> <strong>10</strong> (the investee would be consolidated under IAS 27(2008)).In addition, IAS 27(2008) did not take any account of whether the exercise of potential voting rights was economic.<strong>IFRS</strong> <strong>10</strong> requires consideration of all relevant facts and circumstances when reaching a conclusion as <strong>to</strong> whetherpotential voting rights are required <strong>to</strong> be taken in<strong>to</strong> account.