Need to Know: IFRS 10 - Consolidated Financial ... - BDO Canada

Need to Know: IFRS 10 - Consolidated Financial ... - BDO Canada

Need to Know: IFRS 10 - Consolidated Financial ... - BDO Canada

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

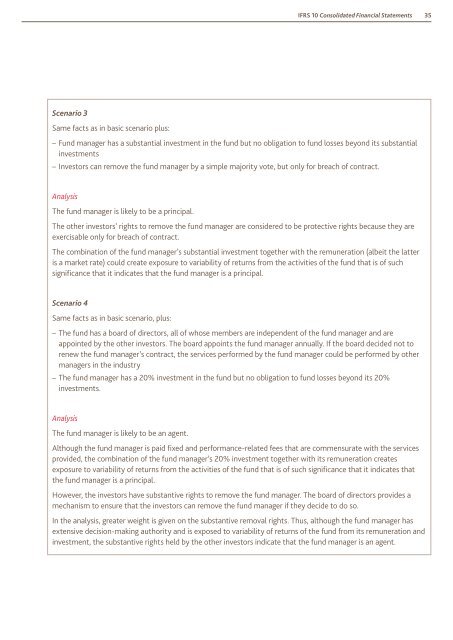

<strong>IFRS</strong> <strong>10</strong> <strong>Consolidated</strong> <strong>Financial</strong> Statements35Scenario 3Same facts as in basic scenario plus:––Fund manager has a substantial investment in the fund but no obligation <strong>to</strong> fund losses beyond its substantialinvestments––Inves<strong>to</strong>rs can remove the fund manager by a simple majority vote, but only for breach of contract.AnalysisThe fund manager is likely <strong>to</strong> be a principal.The other inves<strong>to</strong>rs’ rights <strong>to</strong> remove the fund manager are considered <strong>to</strong> be protective rights because they areexercisable only for breach of contract.The combination of the fund manager’s substantial investment <strong>to</strong>gether with the remuneration (albeit the latteris a market rate) could create exposure <strong>to</strong> variability of returns from the activities of the fund that is of suchsignificance that it indicates that the fund manager is a principal.Scenario 4Same facts as in basic scenario, plus:––The fund has a board of direc<strong>to</strong>rs, all of whose members are independent of the fund manager and areappointed by the other inves<strong>to</strong>rs. The board appoints the fund manager annually. If the board decided not <strong>to</strong>renew the fund manager’s contract, the services performed by the fund manager could be performed by othermanagers in the industry––The fund manager has a 20% investment in the fund but no obligation <strong>to</strong> fund losses beyond its 20%investments.AnalysisThe fund manager is likely <strong>to</strong> be an agent.Although the fund manager is paid fixed and performance-related fees that are commensurate with the servicesprovided, the combination of the fund manager’s 20% investment <strong>to</strong>gether with its remuneration createsexposure <strong>to</strong> variability of returns from the activities of the fund that is of such significance that it indicates thatthe fund manager is a principal.However, the inves<strong>to</strong>rs have substantive rights <strong>to</strong> remove the fund manager. The board of direc<strong>to</strong>rs provides amechanism <strong>to</strong> ensure that the inves<strong>to</strong>rs can remove the fund manager if they decide <strong>to</strong> do so.In the analysis, greater weight is given on the substantive removal rights. Thus, although the fund manager hasextensive decision-making authority and is exposed <strong>to</strong> variability of returns of the fund from its remuneration andinvestment, the substantive rights held by the other inves<strong>to</strong>rs indicate that the fund manager is an agent.