Need to Know: IFRS 10 - Consolidated Financial ... - BDO Canada

Need to Know: IFRS 10 - Consolidated Financial ... - BDO Canada

Need to Know: IFRS 10 - Consolidated Financial ... - BDO Canada

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

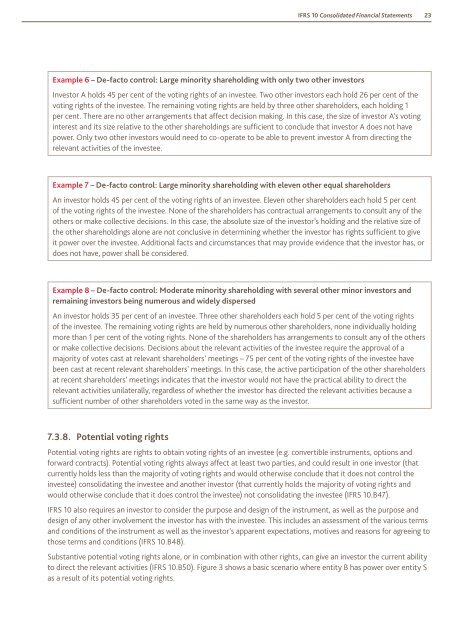

<strong>IFRS</strong> <strong>10</strong> <strong>Consolidated</strong> <strong>Financial</strong> Statements23Example 6 – De-fac<strong>to</strong> control: Large minority shareholding with only two other inves<strong>to</strong>rsInves<strong>to</strong>r A holds 45 per cent of the voting rights of an investee. Two other inves<strong>to</strong>rs each hold 26 per cent of thevoting rights of the investee. The remaining voting rights are held by three other shareholders, each holding 1per cent. There are no other arrangements that affect decision making. In this case, the size of inves<strong>to</strong>r A’s votinginterest and its size relative <strong>to</strong> the other shareholdings are sufficient <strong>to</strong> conclude that inves<strong>to</strong>r A does not havepower. Only two other inves<strong>to</strong>rs would need <strong>to</strong> co-operate <strong>to</strong> be able <strong>to</strong> prevent inves<strong>to</strong>r A from directing therelevant activities of the investee.Example 7 – De-fac<strong>to</strong> control: Large minority shareholding with eleven other equal shareholdersAn inves<strong>to</strong>r holds 45 per cent of the voting rights of an investee. Eleven other shareholders each hold 5 per cen<strong>to</strong>f the voting rights of the investee. None of the shareholders has contractual arrangements <strong>to</strong> consult any of theothers or make collective decisions. In this case, the absolute size of the inves<strong>to</strong>r’s holding and the relative size ofthe other shareholdings alone are not conclusive in determining whether the inves<strong>to</strong>r has rights sufficient <strong>to</strong> giveit power over the investee. Additional facts and circumstances that may provide evidence that the inves<strong>to</strong>r has, ordoes not have, power shall be considered.Example 8 – De-fac<strong>to</strong> control: Moderate minority shareholding with several other minor inves<strong>to</strong>rs andremaining inves<strong>to</strong>rs being numerous and widely dispersedAn inves<strong>to</strong>r holds 35 per cent of an investee. Three other shareholders each hold 5 per cent of the voting rightsof the investee. The remaining voting rights are held by numerous other shareholders, none individually holdingmore than 1 per cent of the voting rights. None of the shareholders has arrangements <strong>to</strong> consult any of the othersor make collective decisions. Decisions about the relevant activities of the investee require the approval of amajority of votes cast at relevant shareholders’ meetings – 75 per cent of the voting rights of the investee havebeen cast at recent relevant shareholders’ meetings. In this case, the active participation of the other shareholdersat recent shareholders’ meetings indicates that the inves<strong>to</strong>r would not have the practical ability <strong>to</strong> direct therelevant activities unilaterally, regardless of whether the inves<strong>to</strong>r has directed the relevant activities because asufficient number of other shareholders voted in the same way as the inves<strong>to</strong>r.7.3.8. Potential voting rightsPotential voting rights are rights <strong>to</strong> obtain voting rights of an investee (e.g. convertible instruments, options andforward contracts). Potential voting rights always affect at least two parties, and could result in one inves<strong>to</strong>r (thatcurrently holds less than the majority of voting rights and would otherwise conclude that it does not control theinvestee) consolidating the investee and another inves<strong>to</strong>r (that currently holds the majority of voting rights andwould otherwise conclude that it does control the investee) not consolidating the investee (<strong>IFRS</strong> <strong>10</strong>.B47).<strong>IFRS</strong> <strong>10</strong> also requires an inves<strong>to</strong>r <strong>to</strong> consider the purpose and design of the instrument, as well as the purpose anddesign of any other involvement the inves<strong>to</strong>r has with the investee. This includes an assessment of the various termsand conditions of the instrument as well as the inves<strong>to</strong>r’s apparent expectations, motives and reasons for agreeing <strong>to</strong>those terms and conditions (<strong>IFRS</strong> <strong>10</strong>.B48).Substantive potential voting rights alone, or in combination with other rights, can give an inves<strong>to</strong>r the current ability<strong>to</strong> direct the relevant activities (<strong>IFRS</strong> <strong>10</strong>.B50). Figure 3 shows a basic scenario where entity B has power over entity Sas a result of its potential voting rights.