Need to Know: IFRS 10 - Consolidated Financial ... - BDO Canada

Need to Know: IFRS 10 - Consolidated Financial ... - BDO Canada

Need to Know: IFRS 10 - Consolidated Financial ... - BDO Canada

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

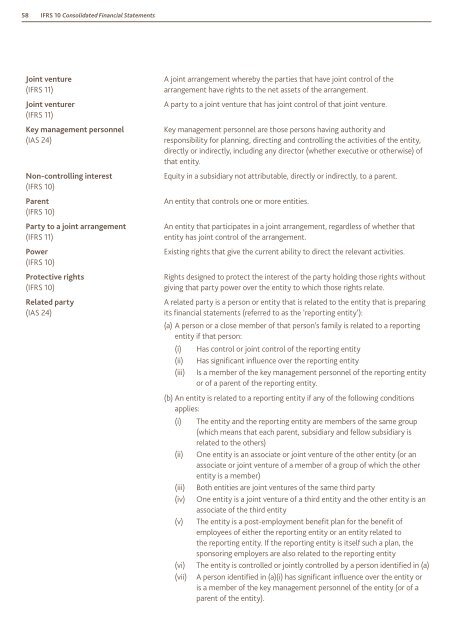

58 <strong>IFRS</strong> <strong>10</strong> <strong>Consolidated</strong> <strong>Financial</strong> StatementsJoint venture(<strong>IFRS</strong> 11)Joint venturer(<strong>IFRS</strong> 11)Key management personnel(IAS 24)Non-controlling interest(<strong>IFRS</strong> <strong>10</strong>)Parent(<strong>IFRS</strong> <strong>10</strong>)Party <strong>to</strong> a joint arrangement(<strong>IFRS</strong> 11)Power(<strong>IFRS</strong> <strong>10</strong>)Protective rights(<strong>IFRS</strong> <strong>10</strong>)Related party(IAS 24)A joint arrangement whereby the parties that have joint control of thearrangement have rights <strong>to</strong> the net assets of the arrangement.A party <strong>to</strong> a joint venture that has joint control of that joint venture.Key management personnel are those persons having authority andresponsibility for planning, directing and controlling the activities of the entity,directly or indirectly, including any direc<strong>to</strong>r (whether executive or otherwise) ofthat entity.Equity in a subsidiary not attributable, directly or indirectly, <strong>to</strong> a parent.An entity that controls one or more entities.An entity that participates in a joint arrangement, regardless of whether thatentity has joint control of the arrangement.Existing rights that give the current ability <strong>to</strong> direct the relevant activities.Rights designed <strong>to</strong> protect the interest of the party holding those rights withoutgiving that party power over the entity <strong>to</strong> which those rights relate.A related party is a person or entity that is related <strong>to</strong> the entity that is preparingits financial statements (referred <strong>to</strong> as the ‘reporting entity’):(a) A person or a close member of that person’s family is related <strong>to</strong> a reportingentity if that person:(i) Has control or joint control of the reporting entity(ii) Has significant influence over the reporting entity(iii) Is a member of the key management personnel of the reporting entityor of a parent of the reporting entity.(b) An entity is related <strong>to</strong> a reporting entity if any of the following conditionsapplies:(i)(ii)(iii)(iv)(v)(vi)(vii)The entity and the reporting entity are members of the same group(which means that each parent, subsidiary and fellow subsidiary isrelated <strong>to</strong> the others)One entity is an associate or joint venture of the other entity (or anassociate or joint venture of a member of a group of which the otherentity is a member)Both entities are joint ventures of the same third partyOne entity is a joint venture of a third entity and the other entity is anassociate of the third entityThe entity is a post-employment benefit plan for the benefit ofemployees of either the reporting entity or an entity related <strong>to</strong>the reporting entity. If the reporting entity is itself such a plan, thesponsoring employers are also related <strong>to</strong> the reporting entityThe entity is controlled or jointly controlled by a person identified in (a)A person identified in (a)(i) has significant influence over the entity oris a member of the key management personnel of the entity (or of aparent of the entity).