PED guidebook main sxn rev6. FINAL.pdf - LGRC DILG 10

PED guidebook main sxn rev6. FINAL.pdf - LGRC DILG 10

PED guidebook main sxn rev6. FINAL.pdf - LGRC DILG 10

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

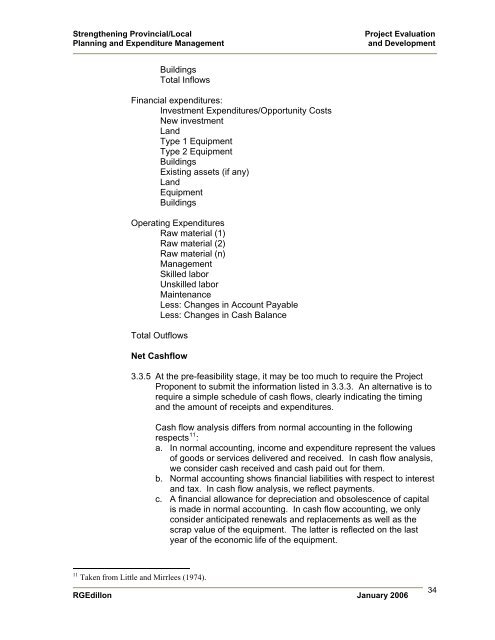

Strengthening Provincial/LocalPlanning and Expenditure ManagementProject Evaluationand DevelopmentBuildingsTotal InflowsFinancial expenditures:Investment Expenditures/Opportunity CostsNew investmentLandType 1 EquipmentType 2 EquipmentBuildingsExisting assets (if any)LandEquipmentBuildingsOperating ExpendituresRaw material (1)Raw material (2)Raw material (n)ManagementSkilled laborUnskilled laborMaintenanceLess: Changes in Account PayableLess: Changes in Cash BalanceTotal OutflowsNet Cashflow3.3.5 At the pre-feasibility stage, it may be too much to require the ProjectProponent to submit the information listed in 3.3.3. An alternative is torequire a simple schedule of cash flows, clearly indicating the timingand the amount of receipts and expenditures.Cash flow analysis differs from normal accounting in the followingrespects 11 :a. In normal accounting, income and expenditure represent the valuesof goods or services delivered and received. In cash flow analysis,we consider cash received and cash paid out for them.b. Normal accounting shows financial liabilities with respect to interestand tax. In cash flow analysis, we reflect payments.c. A financial allowance for depreciation and obsolescence of capitalis made in normal accounting. In cash flow accounting, we onlyconsider anticipated renewals and replacements as well as thescrap value of the equipment. The latter is reflected on the lastyear of the economic life of the equipment.11 Taken from Little and Mirrlees (1974).RGEdillon January 200634