Doing Business with the World - Mapeo de Promotores de RSE

Doing Business with the World - Mapeo de Promotores de RSE

Doing Business with the World - Mapeo de Promotores de RSE

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

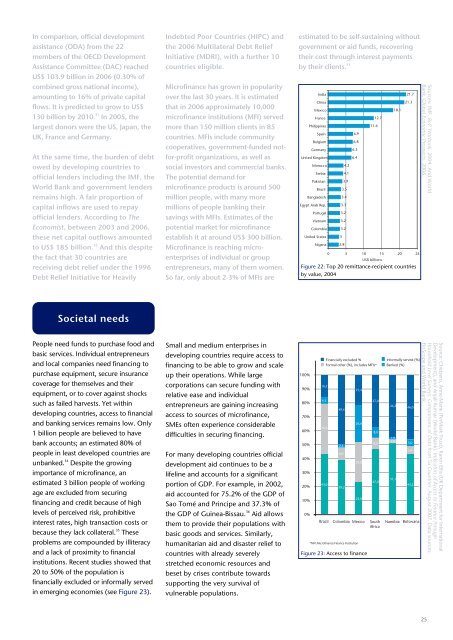

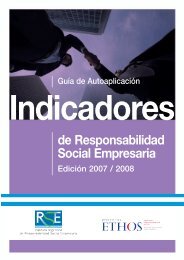

In comparison, official <strong>de</strong>velopmentassistance (ODA) from <strong>the</strong> 22members of <strong>the</strong> OECD DevelopmentAssistance Committee (DAC) reachedUS$ 103.9 billion in 2006 (0.30% ofcombined gross national income),amounting to 16% of private capitalflows. It is predicted to grow to US$130 billion by 2010. 31 In 2005, <strong>the</strong>largest donors were <strong>the</strong> US, Japan, <strong>the</strong>UK, France and Germany.At <strong>the</strong> same time, <strong>the</strong> bur<strong>de</strong>n of <strong>de</strong>btowed by <strong>de</strong>veloping countries toofficial len<strong>de</strong>rs including <strong>the</strong> IMF, <strong>the</strong><strong>World</strong> Bank and government len<strong>de</strong>rsremains high. A fair proportion ofcapital inflows are used to repayofficial len<strong>de</strong>rs. According to TheEconomist, between 2003 and 2006,<strong>the</strong>se net capital outflows amountedto US$ 185 billion. 32 And this <strong>de</strong>spite<strong>the</strong> fact that 30 countries arereceiving <strong>de</strong>bt relief un<strong>de</strong>r <strong>the</strong> 1996Debt Relief Initiative for HeavilyIn<strong>de</strong>bted Poor Countries (HIPC) and<strong>the</strong> 2006 Multilateral Debt ReliefInitiative (MDRI), <strong>with</strong> a fur<strong>the</strong>r 10countries eligible.Microfinance has grown in popularityover <strong>the</strong> last 30 years. It is estimatedthat in 2006 approximately 10,000microfinance institutions (MFI) servedmore than 150 million clients in 85countries. MFIs inclu<strong>de</strong> communitycooperatives, government-fun<strong>de</strong>d notfor-profitorganizations, as well associal investors and commercial banks.The potential <strong>de</strong>mand formicrofinance products is around 500million people, <strong>with</strong> many moremillions of people banking <strong>the</strong>irsavings <strong>with</strong> MFIs. Estimates of <strong>the</strong>potential market for microfinanceestablish it at around US$ 300 billion.Microfinance is reaching microenterprisesof individual or groupentrepreneurs, many of <strong>the</strong>m women.So far, only about 2-3% of MFIs areestimated to be self-sustaining <strong>with</strong>outgovernment or aid funds, recovering<strong>the</strong>ir cost through interest paymentsby <strong>the</strong>ir clients. 33IndiaChinaMexicoFrancePhilippinesSpainBelgiumGermanyUnited KingdomMoroccoSerbiaPakistanBrazilBangla<strong>de</strong>shEgypt Arab Rep.PortugalVietnamColombiaUnited StatesNigeria33.43.33.23.23.22.84.24.13.93.56.96.86.56.411.612.718.121.721.30 5 10 15 20 25US$ billionsFigure 22: Top 20 remittance-recipient countriesby value, 2004Sources: IMF. BoP Yearbook. 2004. And <strong>World</strong>Bank. Global Economic Prospects. 2006.Societal needsPeople need funds to purchase food andbasic services. Individual entrepreneursand local companies need financing topurchase equipment, secure insurancecoverage for <strong>the</strong>mselves and <strong>the</strong>irequipment, or to cover against shockssuch as failed harvests. Yet <strong>with</strong>in<strong>de</strong>veloping countries, access to financialand banking services remains low. Only1 billion people are believed to havebank accounts; an estimated 80% ofpeople in least <strong>de</strong>veloped countries areunbanked. 34 Despite <strong>the</strong> growingimportance of microfinance, anestimated 3 billion people of workingage are exclu<strong>de</strong>d from securingfinancing and credit because of highlevels of perceived risk, prohibitiveinterest rates, high transaction costs orbecause <strong>the</strong>y lack collateral. 35 Theseproblems are compoun<strong>de</strong>d by illiteracyand a lack of proximity to financialinstitutions. Recent studies showed that20 to 50% of <strong>the</strong> population isfinancially exclu<strong>de</strong>d or informally servedin emerging economies (see Figure 23).Small and medium enterprises in<strong>de</strong>veloping countries require access tofinancing to be able to grow and scaleup <strong>the</strong>ir operations. While largecorporations can secure funding <strong>with</strong>relative ease and individualentrepreneurs are gaining increasingaccess to sources of microfinance,SMEs often experience consi<strong>de</strong>rabledifficulties in securing financing.For many <strong>de</strong>veloping countries official<strong>de</strong>velopment aid continues to be alifeline and accounts for a significantportion of GDP. For example, in 2002,aid accounted for 75.2% of <strong>the</strong> GDP ofSao Tomé and Principe and 37.3% of<strong>the</strong> GDP of Guinea-Bissau. 36 Aid allows<strong>the</strong>m to provi<strong>de</strong> <strong>the</strong>ir populations <strong>with</strong>basic goods and services. Similarly,humanitarian aid and disaster relief tocountries <strong>with</strong> already severelystretched economic resources andbeset by crises contribute towardssupporting <strong>the</strong> very survival ofvulnerable populations.100%90%80%70%60%50%40%30%20%10%0%16,24,5Financially exclu<strong>de</strong>d % Informally served (%)Formal o<strong>the</strong>r (%), inclu<strong>de</strong>s MFIs* Banked (%)36,343,049,42,58,939,221,426,629,023,037,08,08,047,0Brazil Colombia Mexico SouthAfrica*MFI: Microfinance Finance InstitutionFigure 23: Access to finance44,21,92,851,146,05,05,843,2Namibia BotswanaSource: Chidzero, Anne-Marie (FinMark Trust), Karen Ellis (UK Department for InternationalDevelopment), and Anjali Kumar (<strong>World</strong> Bank). Indicators of Access to Finance throughHousehold Level Surveys: Comparisons of Data from Six Countries. August 2007. Data sources:FinScope and <strong>World</strong> Bank.25