EBA Guidelines on Stressed Value At Risk (Stressed VaR) EBA/GL ...

EBA Guidelines on Stressed Value At Risk (Stressed VaR) EBA/GL ...

EBA Guidelines on Stressed Value At Risk (Stressed VaR) EBA/GL ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

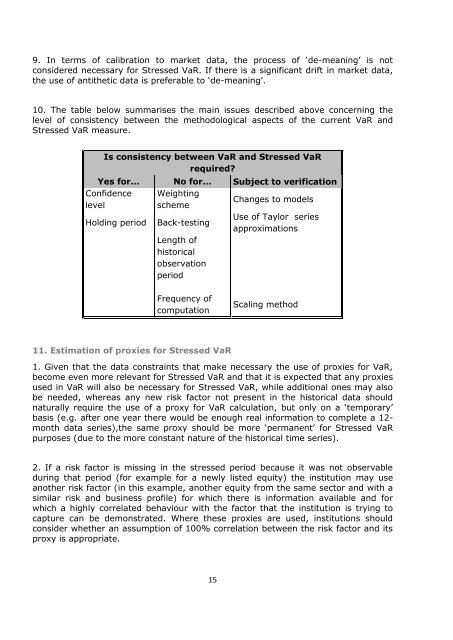

9. In terms of calibrati<strong>on</strong> to market data, the process of ‘de-meaning’ is notc<strong>on</strong>sidered necessary for <strong>Stressed</strong> <strong>VaR</strong>. If there is a significant drift in market data,the use of antithetic data is preferable to ‘de-meaning’.10. The table below summarises the main issues described above c<strong>on</strong>cerning thelevel of c<strong>on</strong>sistency between the methodological aspects of the current <strong>VaR</strong> and<strong>Stressed</strong> <strong>VaR</strong> measure.Is c<strong>on</strong>sistency between <strong>VaR</strong> and <strong>Stressed</strong> <strong>VaR</strong>required?Yes for… No for… Subject to verificati<strong>on</strong>C<strong>on</strong>fidence WeightinglevelschemeChanges to modelsHolding period Back-testingUse of Taylor seriesapproximati<strong>on</strong>sLength ofhistoricalobservati<strong>on</strong>periodFrequency ofcomputati<strong>on</strong>Scaling method11. Estimati<strong>on</strong> of proxies for <strong>Stressed</strong> <strong>VaR</strong>1. Given that the data c<strong>on</strong>straints that make necessary the use of proxies for <strong>VaR</strong>,become even more relevant for <strong>Stressed</strong> <strong>VaR</strong> and that it is expected that any proxiesused in <strong>VaR</strong> will also be necessary for <strong>Stressed</strong> <strong>VaR</strong>, while additi<strong>on</strong>al <strong>on</strong>es may alsobe needed, whereas any new risk factor not present in the historical data shouldnaturally require the use of a proxy for <strong>VaR</strong> calculati<strong>on</strong>, but <strong>on</strong>ly <strong>on</strong> a ‘temporary’basis (e.g. after <strong>on</strong>e year there would be enough real informati<strong>on</strong> to complete a 12-m<strong>on</strong>th data series),the same proxy should be more ‘permanent’ for <strong>Stressed</strong> <strong>VaR</strong>purposes (due to the more c<strong>on</strong>stant nature of the historical time series).2. If a risk factor is missing in the stressed period because it was not observableduring that period (for example for a newly listed equity) the instituti<strong>on</strong> may useanother risk factor (in this example, another equity from the same sector and with asimilar risk and business profile) for which there is informati<strong>on</strong> available and forwhich a highly correlated behaviour with the factor that the instituti<strong>on</strong> is trying tocapture can be dem<strong>on</strong>strated. Where these proxies are used, instituti<strong>on</strong>s shouldc<strong>on</strong>sider whether an assumpti<strong>on</strong> of 100% correlati<strong>on</strong> between the risk factor and itsproxy is appropriate.15