EBA Guidelines on Stressed Value At Risk (Stressed VaR) EBA/GL ...

EBA Guidelines on Stressed Value At Risk (Stressed VaR) EBA/GL ...

EBA Guidelines on Stressed Value At Risk (Stressed VaR) EBA/GL ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

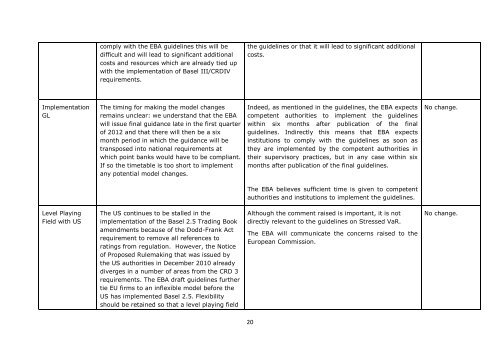

comply with the <str<strong>on</strong>g>EBA</str<strong>on</strong>g> guidelines this will bedifficult and will lead to significant additi<strong>on</strong>alcosts and resources which are already tied upwith the implementati<strong>on</strong> of Basel III/CRDIVrequirements.the guidelines or that it will lead to significant additi<strong>on</strong>alcosts.Implementati<strong>on</strong><strong>GL</strong>The timing for making the model changesremains unclear: we understand that the <str<strong>on</strong>g>EBA</str<strong>on</strong>g>will issue final guidance late in the first quarterof 2012 and that there will then be a sixm<strong>on</strong>th period in which the guidance will betransposed into nati<strong>on</strong>al requirements atwhich point banks would have to be compliant.If so the timetable is too short to implementany potential model changes.Indeed, as menti<strong>on</strong>ed in the guidelines, the <str<strong>on</strong>g>EBA</str<strong>on</strong>g> expectscompetent authorities to implement the guidelineswithin six m<strong>on</strong>ths after publicati<strong>on</strong> of the finalguidelines. Indirectly this means that <str<strong>on</strong>g>EBA</str<strong>on</strong>g> expectsinstituti<strong>on</strong>s to comply with the guidelines as so<strong>on</strong> asthey are implemented by the competent authorities intheir supervisory practices, but in any case within sixm<strong>on</strong>ths after publicati<strong>on</strong> of the final guidelines.No change.The <str<strong>on</strong>g>EBA</str<strong>on</strong>g> believes sufficient time is given to competentauthorities and instituti<strong>on</strong>s to implement the guidelines.Level PlayingField with USThe US c<strong>on</strong>tinues to be stalled in theimplementati<strong>on</strong> of the Basel 2.5 Trading Bookamendments because of the Dodd-Frank Actrequirement to remove all references toratings from regulati<strong>on</strong>. However, the Noticeof Proposed Rulemaking that was issued bythe US authorities in December 2010 alreadydiverges in a number of areas from the CRD 3requirements. The <str<strong>on</strong>g>EBA</str<strong>on</strong>g> draft guidelines furthertie EU firms to an inflexible model before theUS has implemented Basel 2.5. Flexibilityshould be retained so that a level playing fieldAlthough the comment raised is important, it is notdirectly relevant to the guidelines <strong>on</strong> <strong>Stressed</strong> <strong>VaR</strong>.The <str<strong>on</strong>g>EBA</str<strong>on</strong>g> will communicate the c<strong>on</strong>cerns raised to theEuropean Commissi<strong>on</strong>.No change.20