EBA Guidelines on Stressed Value At Risk (Stressed VaR) EBA/GL ...

EBA Guidelines on Stressed Value At Risk (Stressed VaR) EBA/GL ...

EBA Guidelines on Stressed Value At Risk (Stressed VaR) EBA/GL ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

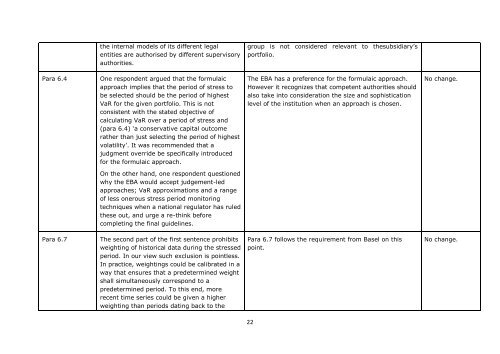

the internal models of its different legalentities are authorised by different supervisoryauthorities.group is not c<strong>on</strong>sidered relevant to thesubsidiary’sportfolio.Para 6.4One resp<strong>on</strong>dent argued that the formulaicapproach implies that the period of stress tobe selected should be the period of highest<strong>VaR</strong> for the given portfolio. This is notc<strong>on</strong>sistent with the stated objective ofcalculating <strong>VaR</strong> over a period of stress and(para 6.4) ‘a c<strong>on</strong>servative capital outcomerather than just selecting the period of highestvolatility’. It was recommended that ajudgment override be specifically introducedfor the formulaic approach.The <str<strong>on</strong>g>EBA</str<strong>on</strong>g> has a preference for the formulaic approach.However it recognizes that competent authorities shouldalso take into c<strong>on</strong>siderati<strong>on</strong> the size and sophisticati<strong>on</strong>level of the instituti<strong>on</strong> when an approach is chosen.No change.On the other hand, <strong>on</strong>e resp<strong>on</strong>dent questi<strong>on</strong>edwhy the <str<strong>on</strong>g>EBA</str<strong>on</strong>g> would accept judgement-ledapproaches; <strong>VaR</strong> approximati<strong>on</strong>s and a rangeof less <strong>on</strong>erous stress period m<strong>on</strong>itoringtechniques when a nati<strong>on</strong>al regulator has ruledthese out, and urge a re-think beforecompleting the final guidelines.Para 6.7The sec<strong>on</strong>d part of the first sentence prohibitsweighting of historical data during the stressedperiod. In our view such exclusi<strong>on</strong> is pointless.In practice, weightings could be calibrated in away that ensures that a predetermined weightshall simultaneously corresp<strong>on</strong>d to apredetermined period. To this end, morerecent time series could be given a higherweighting than periods dating back to thePara 6.7 follows the requirement from Basel <strong>on</strong> thispoint.No change.22