EBA Guidelines on Stressed Value At Risk (Stressed VaR) EBA/GL ...

EBA Guidelines on Stressed Value At Risk (Stressed VaR) EBA/GL ...

EBA Guidelines on Stressed Value At Risk (Stressed VaR) EBA/GL ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

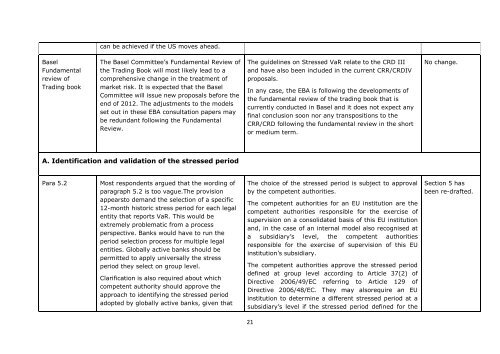

can be achieved if the US moves ahead.BaselFundamentalreview ofTrading bookThe Basel Committee’s Fundamental Review ofthe Trading Book will most likely lead to acomprehensive change in the treatment ofmarket risk. It is expected that the BaselCommittee will issue new proposals before theend of 2012. The adjustments to the modelsset out in these <str<strong>on</strong>g>EBA</str<strong>on</strong>g> c<strong>on</strong>sultati<strong>on</strong> papers maybe redundant following the FundamentalReview.The guidelines <strong>on</strong> <strong>Stressed</strong> <strong>VaR</strong> relate to the CRD IIIand have also been included in the current CRR/CRDIVproposals.In any case, the <str<strong>on</strong>g>EBA</str<strong>on</strong>g> is following the developments ofthe fundamental review of the trading book that iscurrently c<strong>on</strong>ducted in Basel and it does not expect anyfinal c<strong>on</strong>clusi<strong>on</strong> so<strong>on</strong> nor any transpositi<strong>on</strong>s to theCRR/CRD following the fundamental review in the shortor medium term.No change.A. Identificati<strong>on</strong> and validati<strong>on</strong> of the stressed periodPara 5.2Most resp<strong>on</strong>dents argued that the wording ofparagraph 5.2 is too vague.The provisi<strong>on</strong>appearsto demand the selecti<strong>on</strong> of a specific12-m<strong>on</strong>th historic stress period for each legalentity that reports <strong>VaR</strong>. This would beextremely problematic from a processperspective. Banks would have to run theperiod selecti<strong>on</strong> process for multiple legalentities. Globally active banks should bepermitted to apply universally the stressperiod they select <strong>on</strong> group level.Clarificati<strong>on</strong> is also required about whichcompetent authority should approve theapproach to identifying the stressed periodadopted by globally active banks, given thatThe choice of the stressed period is subject to approvalby the competent authorities.The competent authorities for an EU instituti<strong>on</strong> are thecompetent authorities resp<strong>on</strong>sible for the exercise ofsupervisi<strong>on</strong> <strong>on</strong> a c<strong>on</strong>solidated basis of this EU instituti<strong>on</strong>and, in the case of an internal model also recognised ata subsidiary’s level, the competent authoritiesresp<strong>on</strong>sible for the exercise of supervisi<strong>on</strong> of this EUinstituti<strong>on</strong>’s subsidiary.The competent authorities approve the stressed perioddefined at group level according to Article 37(2) ofDirective 2006/49/EC referring to Article 129 ofDirective 2006/48/EC. They may alsorequire an EUinstituti<strong>on</strong> to determine a different stressed period at asubsidiary’s level if the stressed period defined for theSecti<strong>on</strong> 5 hasbeen re-drafted.21