Quarterly Financial Report Q1 2012 - Export Development ... - EDC

Quarterly Financial Report Q1 2012 - Export Development ... - EDC

Quarterly Financial Report Q1 2012 - Export Development ... - EDC

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

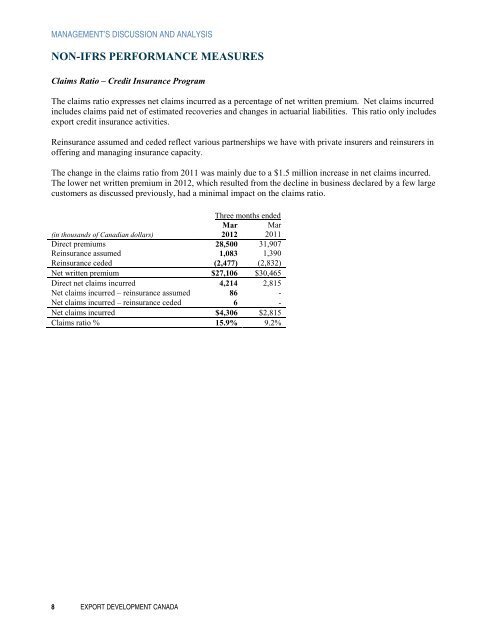

MANAGEMENT’S DISCUSSION AND ANALYSISNON-IFRS PERFORMANCE MEASURESClaims Ratio – Credit Insurance ProgramThe claims ratio expresses net claims incurred as a percentage of net written premium. Net claims incurredincludes claims paid net of estimated recoveries and changes in actuarial liabilities. This ratio only includesexport credit insurance activities.Reinsurance assumed and ceded reflect various partnerships we have with private insurers and reinsurers inoffering and managing insurance capacity.The change in the claims ratio from 2011 was mainly due to a $1.5 million increase in net claims incurred.The lower net written premium in <strong>2012</strong>, which resulted from the decline in business declared by a few largecustomers as discussed previously, had a minimal impact on the claims ratio.Three months ended(in thousands of Canadian dollars)Mar<strong>2012</strong>Mar2011Direct premiums 28,500 31,907Reinsurance assumed 1,083 1,390Reinsurance ceded (2,477) (2,832)Net written premium $27,106 $30,465Direct net claims incurred 4,214 2,815Net claims incurred – reinsurance assumed 86 -Net claims incurred – reinsurance ceded 6 -Net claims incurred $4,306 $2,815Claims ratio % 15.9% 9.2%8 EXPORT DEVELOPMENT CANADA