Quarterly Financial Report Q1 2012 - Export Development ... - EDC

Quarterly Financial Report Q1 2012 - Export Development ... - EDC

Quarterly Financial Report Q1 2012 - Export Development ... - EDC

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

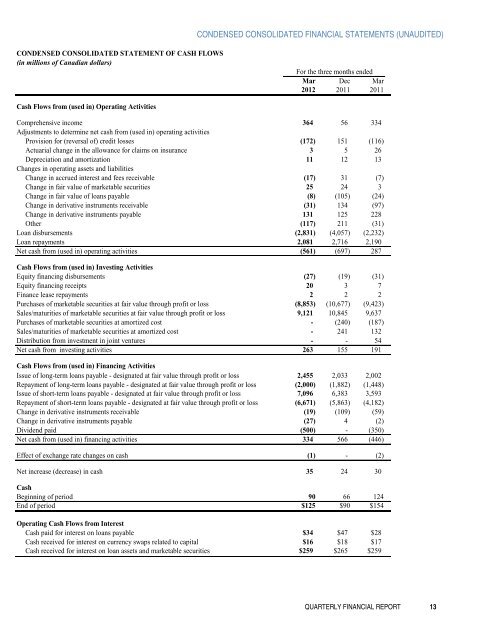

CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)CONDENSED CONSOLIDATED STATEMENT OF CASH FLOWS(in millions of Canadian dollars)For the three months endedMar Dec Mar<strong>2012</strong> 2011 2011Cash Flows from (used in) Operating ActivitiesComprehensive income 364 56 334Adjustments to determine net cash from (used in) operating activitiesProvision for (reversal of) credit losses (172) 151 (116)Actuarial change in the allowance for claims on insurance 3 5 26Depreciation and amortization 11 12 13Changes in operating assets and liabilitiesChange in accrued interest and fees receivable (17) 31 (7)Change in fair value of marketable securities 25 24 3Change in fair value of loans payable (8) (105) (24)Change in derivative instruments receivable (31) 134 (97)Change in derivative instruments payable 131 125 228Other (117) 211 (31)Loan disbursements (2,831) (4,057) (2,232)Loan repayments 2,081 2,716 2,190Net cash from (used in) operating activities (561) (697) 287Cash Flows from (used in) Investing ActivitiesEquity financing disbursements (27) (19) (31)Equity financing receipts 20 3 7Finance lease repayments 2 2 2Purchases of marketable securities at fair value through profit or loss (8,853) (10,677) (9,423)Sales/maturities of marketable securities at fair value through profit or loss 9,121 10,845 9,637Purchases of marketable securities at amortized cost - (240) (187)Sales/maturities of marketable securities at amortized cost - 241 132Distribution from investment in joint ventures - - 54Net cash from investing activities 263 155 191Cash Flows from (used in) Financing ActivitiesIssue of long-term loans payable - designated at fair value through profit or loss2,455 2,033 2,002Repayment of long-term loans payable - designated at fair value through profit or loss(2,000) (1,882) (1,448)Issue of short-term loans payable - designated at fair value through profit or loss7,096 6,383 3,593Repayment of short-term loans payable - designated at fair value through profit or loss(6,671) (5,863) (4,182)Change in derivative instruments receivable (19) (109) (59)Change in derivative instruments payable (27) 4 (2)Dividend paid (500) - (350)Net cash from (used in) financing activities 334 566 (446)Effect of exchange rate changes on cash (1) - (2)Net increase (decrease) in cash 35 24 30CashBeginning of period 90 66 124End of period $125 $90 $154Operating Cash Flows from InterestCash paid for interest on loans payable $34 $47 $28Cash received for interest on currency swaps related to capital $16 $18 $17Cash received for interest on loan assets and marketable securities $259 $265 $259QUARTERLY FINANCIAL REPORT 13