Quarterly Financial Report Q1 2012 - Export Development ... - EDC

Quarterly Financial Report Q1 2012 - Export Development ... - EDC

Quarterly Financial Report Q1 2012 - Export Development ... - EDC

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

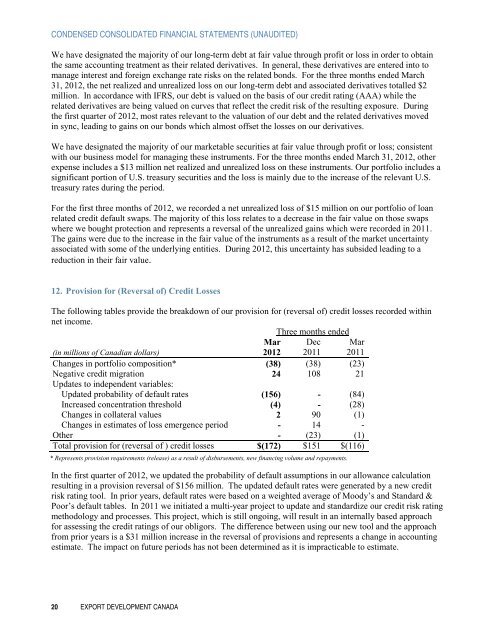

CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)We have designated the majority of our long-term debt at fair value through profit or loss in order to obtainthe same accounting treatment as their related derivatives. In general, these derivatives are entered into tomanage interest and foreign exchange rate risks on the related bonds. For the three months ended March31, <strong>2012</strong>, the net realized and unrealized loss on our long-term debt and associated derivatives totalled $2million. In accordance with IFRS, our debt is valued on the basis of our credit rating (AAA) while therelated derivatives are being valued on curves that reflect the credit risk of the resulting exposure. Duringthe first quarter of <strong>2012</strong>, most rates relevant to the valuation of our debt and the related derivatives movedin sync, leading to gains on our bonds which almost offset the losses on our derivatives.We have designated the majority of our marketable securities at fair value through profit or loss; consistentwith our business model for managing these instruments. For the three months ended March 31, <strong>2012</strong>, otherexpense includes a $13 million net realized and unrealized loss on these instruments. Our portfolio includes asignificant portion of U.S. treasury securities and the loss is mainly due to the increase of the relevant U.S.treasury rates during the period.For the first three months of <strong>2012</strong>, we recorded a net unrealized loss of $15 million on our portfolio of loanrelated credit default swaps. The majority of this loss relates to a decrease in the fair value on those swapswhere we bought protection and represents a reversal of the unrealized gains which were recorded in 2011.The gains were due to the increase in the fair value of the instruments as a result of the market uncertaintyassociated with some of the underlying entities. During <strong>2012</strong>, this uncertainty has subsided leading to areduction in their fair value.12. Provision for (Reversal of) Credit LossesThe following tables provide the breakdown of our provision for (reversal of) credit losses recorded withinnet income.Three months ended(in millions of Canadian dollars)Mar<strong>2012</strong>Dec2011Mar2011Changes in portfolio composition* (38) (38) (23)Negative credit migration 24 108 21Updates to independent variables:Updated probability of default rates (156) - (84)Increased concentration threshold (4) - (28)Changes in collateral values 2 90 (1)Changes in estimates of loss emergence period - 14 -Other - (23) (1)Total provision for (reversal of ) credit losses $(172) $151 $(116)* Represents provision requirements (release) as a result of disbursements, new financing volume and repayments.In the first quarter of <strong>2012</strong>, we updated the probability of default assumptions in our allowance calculationresulting in a provision reversal of $156 million. The updated default rates were generated by a new creditrisk rating tool. In prior years, default rates were based on a weighted average of Moody’s and Standard &Poor’s default tables. In 2011 we initiated a multi-year project to update and standardize our credit risk ratingmethodology and processes. This project, which is still ongoing, will result in an internally based approachfor assessing the credit ratings of our obligors. The difference between using our new tool and the approachfrom prior years is a $31 million increase in the reversal of provisions and represents a change in accountingestimate. The impact on future periods has not been determined as it is impracticable to estimate.20 EXPORT DEVELOPMENT CANADA