Compliance & Ethics Professional - Society of Corporate ...

Compliance & Ethics Professional - Society of Corporate ...

Compliance & Ethics Professional - Society of Corporate ...

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

2012Basic<strong>Compliance</strong>& <strong>Ethics</strong>doN’t miSSyour CHANCEto AttENdAN ACAdEmyiN 2012AcademiesBecome a Certifi ed<strong>Compliance</strong> & <strong>Ethics</strong>pr<strong>of</strong>essional (CCEp) ®following this intensivetraining sessionJune 11–14Scottsdale, aZJuly 9–12Shanghai, Chinaaugust 13–16Boston, manovember 12–15orlando, Fldecember 10–13San diego, CaSPACE iS limitEd.rEgiStEr EArly!Learn more & register atwww.corporatecompliance.org/academies

Letter from the CEOby Roy SnellWhat does your compliance<strong>of</strong>ficer know that you,the CEO…don’t?SnellThis is not to imply that compliance<strong>of</strong>ficers are smarter than anyone else.It’s just that compliance <strong>of</strong>ficers have aunique seat in your house. Your other advisorsmight have a predilection for finding thingsthat “make your day.” The compliance andethics <strong>of</strong>ficer has been asked to prevent,find, and fix problems that maynot “make your day.” Dealing withthe problems when they are small is,<strong>of</strong> course, preferable. However, dealingwith problems even when theyare small can be stressful. Your otheradvisors may not know how importantit is to deal with the issue early.They may not always tell you what you needto know.It’s not that your compliance <strong>of</strong>ficer doesn’twant you to smile. In fact, I am sure they livefor those moments. We published the firstevercompliance pr<strong>of</strong>essional stress surveyreport just yesterday. About 60% <strong>of</strong> compliancepr<strong>of</strong>essionals have awakened in the middle<strong>of</strong> the night and/or wanted to quit in the lasttwelve months, all due to job-related stress.And it’s pretty clear from the results that theCEO’s support and interest in what they knowaffects their stress level. So asking them whatthey know might just help on two fronts. Youwill be more aware <strong>of</strong> current issues, and youmight help their stress level by being involved.They know about more problems becausethey are looking. They know about more problemsbecause employees trust them or believethey might do something about the problem.As a CEO myself, I know I have to work atdrawing things out <strong>of</strong> some <strong>of</strong> my advisors.Some advisors are reluctant to tell you badnews. If you want to know where ethical orregulatory trouble lurks, there is no one else inyour organization with more information thanyour compliance <strong>of</strong>ficer.Most <strong>of</strong> all, they know which problemswon’t go away or get better with age. Theyknow the price you pay when your advisorssuggest you choose to deny and defend orlook the other way. They know the benefits<strong>of</strong> preventing, finding, and fixing problems.They know the damage that legal and ethicalproblems can cause. No one cares more aboutthis. No one knows more about preventing,finding, and fixing problems than the compliance<strong>of</strong>ficer. What do they know that you don’tknow? They know just what you are payingthem to know. ✵Contact Roy Snell at roy.snell@corporatecompliance.org<strong>Compliance</strong> & <strong>Ethics</strong> <strong>Pr<strong>of</strong>essional</strong> March/April 2012+1 952 933 4977 or 888 277 4977 | www.corporatecompliance.org 3

“ ”You tell the truth, youdon’t lie; you comeforward when you seesomething that’s wrong.See page 17<strong>Compliance</strong> & <strong>Ethics</strong><strong>Pr<strong>of</strong>essional</strong>Editor-in-ChiefJoseph Murphy, Esq., CCEP, Of Counsel, CSLG, Haddonfield, NJ,jemurphy@cslg.comExecutive EditorRoy Snell, CCEP, CHC, CEO, roy.snell@corporatecompliance.orgArticles40 Powerful witness preparation:The most important personBy Dan Small and Robert F. RoachThe second in a series <strong>of</strong> articles about preparing to give testimonyin court or during a deposition.44 Nuts & bolts for boards: What ethicsoversight really means [CEU]By Frank J. NavranAn in-depth look at the roles and responsibilities <strong>of</strong> individual board members,the ethics committee, and the board as a whole.55 Multinationals and due diligence:What are the red flags?By Charles ThomasSix key principles to prevent bribery and seven warning signs to considerwhen performing due diligence on vendors and suppliers.59 Computers and copyrights:A continuing source <strong>of</strong>avoidable liability [CEU]By Thomas W. KirbySeemingly innocent sharing by employees can expose employersto stiff penalties.63 Is your ethics and compliance trainingreally preparing your employees? [CEU]By Charles RuthfordEffective compliance training helps stressed employees think clearlyand develop good habits that lead to good performance.Advisory BoardCharles Elson, JD, Edgar S. Woolard, Jr. Chair in <strong>Corporate</strong>Governance, Director <strong>of</strong> the John L. Weinberg Center for<strong>Corporate</strong> Governance at University <strong>of</strong> Delaware.Jay Cohen, <strong>Compliance</strong> Consultant, Assurant Inc.John Dienhart, PhD, The Frank Shrontz Chairfor Business <strong>Ethics</strong>, Seattle University; Director,Northwest <strong>Ethics</strong> Network; Director, Albers Business<strong>Ethics</strong> Initiative; Fellow, <strong>Ethics</strong> Resource CenterOdell Guyton, JD, CCEP, Senior <strong>Corporate</strong> Attorney,Director <strong>of</strong> <strong>Compliance</strong>, U.S. Legal–Finance & Operations,Micros<strong>of</strong>t CorporationRebecca Walker, JD, Partner, Kaplan & Walker LLPRick Kulevich, JD, Senior Director, <strong>Ethics</strong> and <strong>Compliance</strong>,CDW CorporationSteve LeFar, President, Sg2Stephen A. Morreale, DPA, CHC, CCEP, Principal,<strong>Compliance</strong> and Risk DynamicsMarcia Narine, JD, Vice President Global <strong>Compliance</strong>and Business Standards, Deputy General Counsel,Ryder System, Inc.Ann L. Straw, General Counsel US, Votorantim CimentosNorth America, Inc.Greg Triguba, JD, CCEP, Principal,<strong>Compliance</strong> Integrity Solutions, LLCStory Editor/AdvertisingLiz Hergert, +1 952 933 4977 or 888 277 4977liz.hergert@corporatecompliance.orgCopy EditorPatricia Mees, CCEP, CHC, +1 952 933 4977 or 888 277 4977patricia.mees@corporatecompliance.orgDesign & LayoutSarah Anondson, +1 952 933 4977 or 888 277 4977sarah.anondson@corporatecompliance.org<strong>Compliance</strong> & <strong>Ethics</strong> <strong>Pr<strong>of</strong>essional</strong> (CEP) (ISSN 1523-8466)is published by the <strong>Society</strong> <strong>of</strong> <strong>Corporate</strong> <strong>Compliance</strong> and <strong>Ethics</strong>(SCCE), 6500 Barrie Road, Suite 250, Minneapolis, MN 55435.Subscriptions are free to members. Periodicals postage‐paid atMinneapolis, MN 55435. Postmaster: Send address changes to<strong>Compliance</strong> & <strong>Ethics</strong> <strong>Pr<strong>of</strong>essional</strong> Magazine, 6500 Barrie Road,Suite 250, Minneapolis, MN 55435. Copyright © 2012 <strong>Society</strong><strong>of</strong> <strong>Corporate</strong> <strong>Compliance</strong> and <strong>Ethics</strong>. All rights reserved. Printedin the USA. Except where specifically encouraged, no part <strong>of</strong> thispublication may be reproduced, in any form or by any means,without prior written consent from SCCE. For subscriptioninformation and advertising rates, call +1 952 933 4977or 888 277 4977. Send press releases to SCCE CEP PressReleases, 6500 Barrie Road, Suite 250, Minneapolis, MN55435. Opinions expressed are those <strong>of</strong> the writers and not <strong>of</strong>this publication or SCCE. Mention <strong>of</strong> products and services doesnot constitute endorsement. Neither SCCE nor CEP is engaged inrendering legal or other pr<strong>of</strong>essional services. If such assistanceis needed, readers should consult pr<strong>of</strong>essional counsel or otherpr<strong>of</strong>essional advisors for specific legal or ethical questions.Volume 9, Issue 2<strong>Compliance</strong> & <strong>Ethics</strong> <strong>Pr<strong>of</strong>essional</strong> March/April 2012+1 952 933 4977 or 888 277 4977 | www.corporatecompliance.org 5

News<strong>Compliance</strong> & <strong>Ethics</strong> <strong>Pr<strong>of</strong>essional</strong> March/April 2012Almost half <strong>of</strong> US workershave observed misconductThe <strong>Ethics</strong> Resource Centerannounced in Januarythe results <strong>of</strong> its NationalBusiness <strong>Ethics</strong> Survey. Inits January 5 press release,it stated “Over the past twoyears, 45 percent <strong>of</strong> U.S.employees observed a violation<strong>of</strong> the law or ethicsstandards at their places <strong>of</strong>employment. Reporting <strong>of</strong>this wrongdoing was at an alltimehigh—65 percent—butso too was retaliation againstemployees who blew thewhistle: more than one in fiveemployees who reported misconductthey saw experiencedsome form <strong>of</strong> retaliation inreturn.” To download thecomplete survey results, visitwww.ethics.org/nbes ✵OECD criticizes corruptionenforcement in three nationsThe Organization forEconomic Development’sWorking Group on Briberyreleased three reports inJanuary to chastise threenations for poor corruptionenforcement. The internationalgroup urged Japan,Italy, and Switzerland todo more to implementthe OECD’s Convention<strong>of</strong> Combating Bribery <strong>of</strong>Foreign Public Officials, anagreement that all threecountries had previouslysigned. The group assertedthat Japan and Switzerlandeach had only completed twoprosecutions since signingthe convention, and Italy hadonly sanctioned three companiesand nine individuals,after bringing 60 defendantsto trial. ✵“‘Over the past two years, 45 percent<strong>of</strong> U.S. employees observed a violation<strong>of</strong> the law or ethics standards at theirplaces <strong>of</strong> employment…more thanone in five employees who reportedmisconduct they saw experiencedsome form <strong>of</strong> retaliation in return.’”Read the latest news online · www.corporatecompliance.org/newsEx-SEC<strong>of</strong>ficial finedfor taking jobwith allegedPonzi schemerThe complex fraud case<strong>of</strong> Robert Allen Stanfordis far from resolution, butone segment <strong>of</strong> the casehas concluded. The JusticeDepartment reported inJanuary that a formerSecurities and ExchangeCommission <strong>of</strong>ficial hasagreed to pay a $50,000 finefor working with the allegedPonzi schemer after allegedlytaking part in SEC decisionsnot to investigate him.Spencer C. Barasch, alawyer who was head <strong>of</strong>enforcement in the SEC’sFort Worth regional <strong>of</strong>fice,left the SEC in 2005 andwent on to briefly representStanford in an agencyprobe. According to theSEC’s Inspector General, thatwas after Barasch had beeninvolved in SEC decisions notto pursue warnings aboutStanford. Barasch has deniedany allegations <strong>of</strong> wrongdoing,the Justice Departmenthas reported. However, undera civil settlement, he agreedto pay the maximum fine fora violation <strong>of</strong> the statute. ✵6 www.corporatecompliance.org +1 952 933 4977 or 888 277 4977

NewsSEC changes policy onadmission <strong>of</strong> guiltThe US Securities andExchange Commissionannounced a fundamentalpolicy shift in Januaryregarding its practice <strong>of</strong>allowing defendants to settlefraud charges with only afine payment. In a January 6announcement, Securitiesand Exchange CommissionEnforcement DirectorRobert Khuzami stated thatUK fraud increases50 percent to $3.25BAn analysis <strong>of</strong> publiclyreported cases <strong>of</strong> fraud in theUnited Kingdom reveals thatit rose to £2.1 billion ($3.25billion) in 2011, a 50 percentincrease over 2010. The 2011FraudTrack report, producedby the accounting firm BDOLLP, based its analysis oncases <strong>of</strong> fraud <strong>of</strong> more than£50,000 in publicly availablecorporations and individualswill no longer be able toassert that they “neither admitnor deny” civil fraud charges,if they have also admitted toor were convicted <strong>of</strong> a criminalviolation in a parallelcriminal case. The policy willalso apply to defendants whoenter deferred prosecutionagreements with criminalauthorities. ✵reports, including the UK’snational, regional, and localpress.Tax fraud, which accountsfor 36 percent <strong>of</strong> the total,was significantly higher thanother forms. Employee fraudaccounted for 10 percent,management fraud for 5 percent,and corruption for lessthan 1 percent.” ✵RegulatorsapproveDodd-FrankinvestorprotectionsThe Commodity FuturesTrading Commissionapproved in January new rulesdesigned to rein in banksand their derivatives tradingefforts. The new regulationsinclude requirements that customerfunds must be storedin separate accounts from aninstitutions’ own collateral.The rule targets brokeragefirms and derivative clearingorganizations. “Segregation<strong>of</strong> customer funds is the corefoundation <strong>of</strong> customer protectionin the commodityfutures and swaps markets,”said agency Chairman GaryGensler. The change occurredshortly after the collapse <strong>of</strong> MFGlobal, in which $1.2 billion incustomer money disappeared,and nearly a third has still notbeen located. ✵Thankyou!Has someone done something great for you,for the compliance pr<strong>of</strong>ession, or for SCCE? Ifyou would like to give recognition by submittinga public “Thank You,” please send it toliz.hergert@corporatecompliance.org.Entries should be 50 words or fewer.Read the latest news online · www.corporatecompliance.org/news<strong>Compliance</strong> & <strong>Ethics</strong> <strong>Pr<strong>of</strong>essional</strong> March/April 2012+1 952 933 4977 or 888 277 4977 | www.corporatecompliance.org 7

SCCE NewsSCCE conference NewsNational conferences<strong>Compliance</strong> & <strong>Ethics</strong> Institute, October14–17, Las Vegas at Aria: New to the agendathis year is the Multinational/Internationaltrack to go along with tracks in Risk, <strong>Ethics</strong>,Case Studies, General/Hot Topics, andAdvanced Discussion Group. View topics andspeakers, along with other information:www.complianceethicsinstitute.orgHigher Education <strong>Compliance</strong> Conference,June 3–6, Austin, Texas: Make sure to registerbefore Wednesday, April 25 to save $250.www.highereducationcompliance.orgAcademiesAcademies address methods for implementingand managing compliance programs basedon the Seven Element Approach. Courseswill address subject matter in each <strong>of</strong> theseareas and better prepare interested parties forthe CCEP exam. The Academy is designedfor participants with a general knowledge <strong>of</strong>compliance concepts and anyone working in acompliance function.www.corporatecompliance.org/academiesRegional conferencesSCCE’s regional conferences are one-dayprograms designed to provide the hot topicsand practical information that compliancepr<strong>of</strong>essionals need to create and maintaincompliance programs in a variety <strong>of</strong> industries.The 2012 regional conferences include:··Chicago, April 27··New York, May 18··Anchorage, June 15··San Francisco, June 22··Atlanta, October 12··Houston, Nov 2www.corporatecompliance.org/regionalWeb conferencesSCCE members save $850 by purchasing asubscription. Select ten individual session foronly $900 vs. $1,750 if purchased separately.www.corporatecompliance.org/webconferencesThankyou!“Thank you to all the SCCE staff, but especially themeeting planners for their continued hard workand dedication to delivering the best complianceand ethics programs available anywhere!”—Art WeissFind the latest conference information online · www.corporatecompliance.org/events<strong>Compliance</strong> & <strong>Ethics</strong> <strong>Pr<strong>of</strong>essional</strong> March/April 2012+1 952 933 4977 or 888 277 4977 | www.corporatecompliance.org 9

SCCE NewsSCCE website NewsContact Tracey Page at 952-405-7936 or email her at tracey.page@corporatecompliance.org with any questions about SCCE’s website.<strong>Compliance</strong> & <strong>Ethics</strong> <strong>Pr<strong>of</strong>essional</strong> March/April 2012<strong>Corporate</strong> <strong>Compliance</strong> and <strong>Ethics</strong> WeekMay 6–12 marks the 8th annual <strong>Corporate</strong><strong>Compliance</strong> and <strong>Ethics</strong> Week! This is a greattime for your <strong>of</strong>fice to set up a new compliancetraining program, raise awareness,and thank employees fortheir dedication to compliance andethics. SCCE has a complimentaryweb conference and downloadableposters, and you can also purchaseproducts online and get greatideas to educate your <strong>of</strong>fice on compliance andethics. For more information visit:www.corporatecompliance.org/candeweekUsing incentives in your compliance andethics programA new addition to SCCE’s resource centeris Joe Murphy’s paper on using incentivesin your compliance and ethics program. Itprovides a road map for organizations thatunderstand, yet struggle with, adequate control<strong>of</strong> incentives. To download a free copy,check out the Issues & Answer’s section underthe Resources tab.www.hcca-info.org/incentivesThird-party essentialsDo you know the risks posed by your agentsand contractors? Third Party Essentials:A Reputation/Liability Checkup When UsingThird Parties Globally, written by MarjorieW. Doyle, is now available for download onSCCE’s website. This complimentary bookletincludes a checklist to test the health <strong>of</strong> yourorganization’s third-party controls.www.corporatecompliance.org/compliancebasicsWeb conferencesSeveral web conferences covering many differenttopics are coming up soon. You canregister online for upcoming live webinars.Can’t make the time commitment? Pastweb conferences can be viewed instantlyby streaming the recorded session to yourcomputer. It’s a great way to earn 1.2 CEUstowards your certifications and catch up onthe latest compliance issues.www.corporatecompliance.org/webconferencesFind the latest SCCE website updates online · www.corporatecompliance.orgViewing your CEUs onlineDon’t get stressed out about your certificationrenewal date at the last minute. To stay on top<strong>of</strong> your CEU credits, make sure they are alllisted in your account. View them under the“Member” tab by clicking on “My Account,”then click on “Activities” and “CEUs.”www.corporatecompliance.orgSCCE’s stress survey results now availableA new survey sponsoredjointly by SCCE and the HealthCare <strong>Compliance</strong> Associationreveals that the stress levels forcompliance and ethics pr<strong>of</strong>essionalsare very high. Overall,58% <strong>of</strong> survey respondentsreported that they <strong>of</strong>ten wakeup during the middle <strong>of</strong> the night worryingabout job-related stress and 60% report havingconsidered leaving their job in the last 12months due to job-related stress. Download acomplimentary PDF <strong>of</strong> the survey results fromSCCE’s website.www.corporatecompliance.org/surveys10 www.corporatecompliance.org +1 952 933 4977 or 888 277 4977

SCCE NewsNewsContact Eric Newman at 952-405-7938 or email him at eric.newman@hcca-info.org with any questions about SCCEnet.SCCEnet (www.corporatecompliance.org /sccenet) is thecomprehensive social network for compliance and ethicspr<strong>of</strong>essionals. Subscribe to dozens <strong>of</strong> discussion groupsand get your compliance questions answered. Share yourexperience with your colleagues. Offer your resources andpolicies in the libraries.Download the SCCEnet Mobile App··The SCCEnet mobile app runs on Apple,Android, and Blackberry Devices. Youcan read and post new discussions, searchand download compliancedocuments fromour libraries, and searchthrough the 9,000 SCCEnetmembers in the directory.www.corporatecompliance.org/mobileUpdate your SCCEnet pr<strong>of</strong>ile using yourLinkedIn ® account··Now you can update your SCCEnet pr<strong>of</strong>ilewith the information you have on yourLinkedIn pr<strong>of</strong>ile. This includes your pr<strong>of</strong>ilepicture, work history, and your LinkedIn ®contacts that are also on SCCEnet.Instructions at http://bit.ly/sccepr<strong>of</strong>ileSCCE is now on Google+··Add SCCE to your circles:www.corporatecompliance.org/googleSubscribe to the following SCCEnet compliancediscussion groups:··Go to www.corporatecompliance.org/groups and click“My Subscriptions” to subscribe to discussiongroups and participate.––2012 SCCE <strong>Compliance</strong> and <strong>Ethics</strong> Institute––Auditing and Monitoring <strong>Compliance</strong> Network––Chief <strong>Compliance</strong> <strong>Ethics</strong> Officer Network––Communication Training and Curriculum Development––Competition Law and Antitrust Network––<strong>Compliance</strong> Diversity Forum––<strong>Compliance</strong> Risk Management––<strong>Ethics</strong> Forum––European <strong>Compliance</strong> and <strong>Ethics</strong>––FCPA: Foreign Corrupt Practices Act Forum––Financial Institutions Network––Global <strong>Compliance</strong> and <strong>Ethics</strong> Community––Higher Education Forum––Investment Management Forum––SCCE <strong>Compliance</strong> Academies––Social Media <strong>Compliance</strong>––Social Responsibility Forum––Utilities and Energy NetworkPopular resource: Exiting Employee<strong>Compliance</strong> Considerations··Outline <strong>of</strong> considerations when employeesleave, including trade secrets, recordsmanagement, compliance functions.Available at http://corporatecompliance.org/exitWatch compliance videos on YouTube··Subscribe to SCCE’s YouTube channel:www.youtube.com/compliancevideosPopular discussions··2011 National Business <strong>Ethics</strong> Survey:http://corporatecompliance.org/NBES··Handbook vs. Policies vs. Code:http://corporatecompliance.org/HPCFind the latest SCCEnet updates online · www.corporatecompliance.org/sccenet<strong>Compliance</strong> & <strong>Ethics</strong> <strong>Pr<strong>of</strong>essional</strong> March/April 2012+1 952 933 4977 or 888 277 4977 | www.corporatecompliance.org 11

People on the Move<strong>Compliance</strong> & <strong>Ethics</strong> <strong>Pr<strong>of</strong>essional</strong> March/April 2012· Scott Killingsworth hasjoined the Board <strong>of</strong> Governors<strong>of</strong> the Center for <strong>Ethics</strong> and<strong>Corporate</strong> Responsibility atGeorgia State University. Aunit <strong>of</strong> the J. Mack RobinsonCollege <strong>of</strong> Business at GeorgiaState University, the Centerintegrates the best insights<strong>of</strong> scholars and businesspeople to develop strategiesfor addressing the complexethical challenges faced byorganizations. Formerlythe Southern Institute forBusiness and <strong>Pr<strong>of</strong>essional</strong><strong>Ethics</strong>, the Center was establishedin 1993 and became apart <strong>of</strong> the Robinson Collegein 2007.· Chris DePippo has beenappointed Vice President,Chief <strong>Ethics</strong> and <strong>Compliance</strong>Officer at CSC, a leadingglobal IT services companyin Falls Church, Virginia.DePippo will report to theAudit Committee <strong>of</strong> the CSCBoard <strong>of</strong> Directors and, foradministrative purposes,to William Deckelman, thecompany’s Vice President,General Counsel. MichaelW. Laphen, CSC Chairman,President and CEO said, “TheBoard <strong>of</strong> Directors and ourexecutive management havebeen very impressed with hispassion and capabilities in thedisciplines <strong>of</strong> ethics and compliance,and we are confidenthe will provide extraordinaryleadership as we continue tostrengthen our commitmentto building and maintaininga culture <strong>of</strong> integritythroughout CSC.” DePippojoined CSC in 2008 and holdsan undergraduate degreefrom Cornell Universityand an MBA from GeorgeWashington University.Peopleon theMove· The Board <strong>of</strong> Directors <strong>of</strong>Eli Lilly and Company haselected Katherine Baicker,PhD as a new member,effective December 12,2011. Baicker is Pr<strong>of</strong>essor<strong>of</strong> Health Economics in theDepartment <strong>of</strong> Health Policyand Management at theHarvard School <strong>of</strong> PublicHealth. She is also a ResearchAssociate at the NationalBureau <strong>of</strong> Economic Researchand an elected member <strong>of</strong>the Institute <strong>of</strong> Medicine. Asa member <strong>of</strong> Lilly’s board,Pr<strong>of</strong>essor Baicker will serveon the Public Policy and<strong>Compliance</strong> committee. Shewill serve under interimelection and will stand forelection by Lilly shareholdersat the company’s annualmeeting in April 2012.· DCG, a leading provider<strong>of</strong> corporate services, hasmade two new appointmentsto strengthen its realestate and compliance teams.Andrew McNulty has beenappointed Senior Managerin DCG Real Estate. Andrewis a member <strong>of</strong> the RoyalInstitution <strong>of</strong> CharteredSurveyors and is also a directoron a number <strong>of</strong> Jerseycompanies with exposureto commercial real estate inthe UK. Paul Martlew hasbeen appointed <strong>Compliance</strong>Manager. His role includesmonitoring and reportingon internal procedures andregulation across DCG’s threebusiness units, <strong>Corporate</strong>Services and Capital Markets,Real Estate, and Fund Services,as well as internal audit forDCG’s Luxembourg <strong>of</strong>fice.Paul joined DCG in 2009 asassistant compliance managerand has over 8 years’ experiencein compliance, includingthe prevention <strong>of</strong> moneylaundering and combatingthe financing <strong>of</strong> terrorism.Paul holds the InternationalDiploma in <strong>Compliance</strong> and12 www.corporatecompliance.org +1 952 933 4977 or 888 277 4977

People on the Movethe International Diploma inAnti-Money Laundering. Heis a Fellow <strong>of</strong> the International<strong>Compliance</strong> Associationand a Member <strong>of</strong> theJersey <strong>Compliance</strong> OfficersAssociation.· Maggie Wetzell has beenappointed Vice President <strong>of</strong>Contracts and <strong>Compliance</strong> atOasis Systems in Lexington,Massachusetts, a leader inInformation Technology,Systems Engineering,Enterprise Applications,and Program ManagementServices to the Department<strong>of</strong> Defense. Maggie will beresponsible for supportingall aspects <strong>of</strong> new proposalgeneration, including contracts,sub-contracts andpricing, as well as post awardcontract compliance. She isa retired senior executive,GS-15 with 38 years <strong>of</strong> experiencein Contracting andProgram Management withthe Department <strong>of</strong> the AirForce and 7 years <strong>of</strong> ProgramManagement/Contracting inthe private sector.Received a promotion? Have anew hire in your department? ·If you’ve received a promotion, award, or degree;accepted a new position; or added a new staffmember to your <strong>Compliance</strong> department, please letus know. It’s a great way to keep the compliancecommunity up-to-date. Send your updates toliz.hergert@corporatecompliance.org.Get the executive trainingDVDs that workThe <strong>Ethics</strong> Serieswith Dr. MarianneJenningsProduced by DuPont Sustainable Solutions• “<strong>Ethics</strong> Is a CompetitiveAdvantage” lists five keyreasons why ethics matter. Thisprogram explores why workingin the gray areas is risky.(20 min.)• “Speaking Up WithoutFear” discusses howorganizations can draw outwrongdoing and help create aculture where employees feelempowered. (15 min.)• “Ethical Leadership: Tone at All Levels”explores how employees can handle the tensionbetween increasing an organization’s bottom lineand protecting its good reputation. (20 min.)SCCE members:$450 per segment,or $1,175 for the seriesNon-members:$495 per segment,or $1,295 for the seriesEach segmentis availableindividually,or all togetheron one DVD.Learn more and purchase online atwww.corporatecompliance.org<strong>Compliance</strong> & <strong>Ethics</strong> <strong>Pr<strong>of</strong>essional</strong> March/April 2012+1 952 933 4977 or 888 277 4977 | www.corporatecompliance.org 13

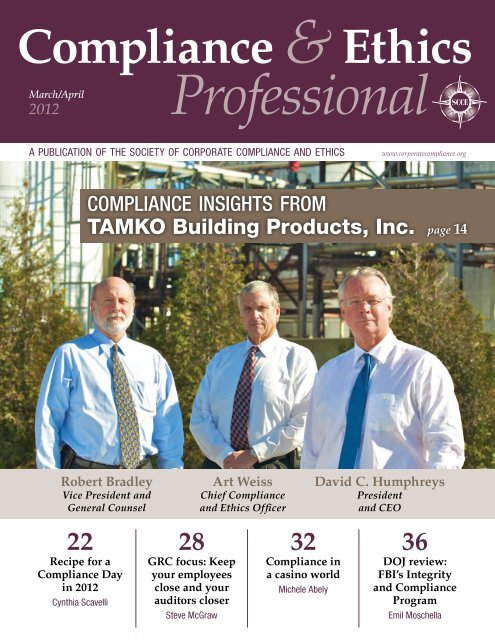

FeatureQ & Apictured from right to leftDavid C. HumphreysPresident and CEOArt WeissChief <strong>Compliance</strong>and <strong>Ethics</strong> OfficerRobert BradleyVice President andGeneral Counselan interview by Art WeissMeet David C. Humphreysand Robert Bradley<strong>Compliance</strong> & <strong>Ethics</strong> <strong>Pr<strong>of</strong>essional</strong> March/April 2012AW: David, please tell us a bit aboutTAMKO and yourself.DCH: At the age <strong>of</strong> 69, my grandfatherE.L. Craig started TAMKO in 1944 with asingle ro<strong>of</strong>ing line, housed in a former streetcarbarn in Joplin, Missouri. Eight years later,he suffered a stroke and my grandmother tookover the leadership <strong>of</strong> the company. Later, mymother managed the company until she leftto raise her family, so that my father becamepresident in 1960. He led the company’sgrowth for the next 33 years, until his deathin 1993. I succeeded him the next year. Mymother continues today to serve as Chairman<strong>of</strong> the Board.Over the course <strong>of</strong> TAMKO’s 68 years, wehave continued to grow both in the number<strong>of</strong> manufacturing facilities and in our productlines. In addition to asphalt ro<strong>of</strong>ing products,such as shingles and rolls, we also producewaterpro<strong>of</strong>ing, window and door wraps,composite decking and railing systems, andcements and coatings. In addition, we are veryvertically integrated as we manufacture anumber <strong>of</strong> our raw materials, such as recycledfelt paper, polyester and fiberglass mats, and14 www.corporatecompliance.org +1 952 933 4977 or 888 277 4977

Q & AFeaturefiberglass fibers, and we process our ownasphalt and ground limestone.My pr<strong>of</strong>essional background is as botha trial defense and corporate tax lawyer.Complex regulatory and statutory constructionwas part <strong>of</strong> that career. Understandingthat there need to be clearly defined black-andwhiteboundaries, but recognizing that thereare shades <strong>of</strong> gray, is important in being successfulin attaining compliance. Our “betweenthe hash marks” compliance metaphor reflectsthe need for clearly defined boundaries inorder for employees without legal training tosucceed at real world compliance, as we wantto stay in the center“As a lawyer, I had beenprogrammed to avoid allrisk possible. In the world<strong>of</strong> business, risk is part <strong>of</strong>the daily challenge andI had to learn to acceptsome risk <strong>of</strong> failure.”<strong>of</strong> the field where thelights are bright andthe rules are mostclear, and away fromthe sidelines wherethe visibility is not asgood and the opportunityfor bias on thepart <strong>of</strong> regulatory refereesis more likely t<strong>of</strong>ind us out <strong>of</strong> bounds.Taking on the top job at TAMKO was avery real change in responsibility and necessitatedan adjustment in my risk tolerance. Asa lawyer, I had been programmed to avoid allrisk possible. In the world <strong>of</strong> business, risk ispart <strong>of</strong> the daily challenge and I had to learnto accept some risk <strong>of</strong> failure. And as “theclient” instead <strong>of</strong> the lawyer, I had to learn tolive with some risk. <strong>Compliance</strong> is one aspect<strong>of</strong> risk that must be managed.AW: TAMKO believes in a free marketeconomy, continuous improvement, Six Sigma,and follows the Deming principles. How dothese principles mesh with compliance?DCH: If you look at compliance from thetotal quality management perspective—we’llcall it a Deming or Six Sigma perspective(because Six Sigma is an extrapolation <strong>of</strong>Deming with enhanced tools and people withhigh-level skill sets)—you will understandthat all processes are subject to variation fromat least five different sources, including people,and that it is critical as to what that variationis, how wide it is, and where it comes from.Then you have to learn how to figure out howto minimize the variation.So in the context <strong>of</strong> compliance, we als<strong>of</strong>ocus on people and our processes. For example,in the environmental compliance, variationcan come from machines from normal wearand tear, from breakdown, from defects inthe machines themselves, or in the manner inwhich they are operated,installed, or maintained.As such, environmentalcontrol equipment can failor even just quit workingas the result <strong>of</strong> a poweroutage. We try to avoidthose failures by understandingour processthat affect environmentalequipment and try to addbackstops to our processesto avoid failures. When those failures happen,environmental noncompliance can be avoideddespite equipment failure. If the environmentalcontrols fail, production automatically shutsdown, which maintains compliance. As wehave come to map out and understand our processesbetter, we can now see the possibility <strong>of</strong>implementing failsafe controls.It’s the same thing in terms <strong>of</strong> personalcompliance: Understanding the existence <strong>of</strong>variation in human behavior led us to rethinkhow we manage issues, like avoidance <strong>of</strong>sexual harassment. We now see training asproviding bright–line boundaries as to whatbehavior is not acceptable. Knowing thatpeople are variable, we accept that trainingalone is not sufficient, because there are toomany opportunities for miscommunications<strong>Compliance</strong> & <strong>Ethics</strong> <strong>Pr<strong>of</strong>essional</strong> March/April 2012+1 952 933 4977 or 888 277 4977 | www.corporatecompliance.org 15

FeatureQ & A<strong>Compliance</strong> & <strong>Ethics</strong> <strong>Pr<strong>of</strong>essional</strong> March/April 2012between the trainer and the trainee; traineesdon’t understand all <strong>of</strong> what they are hearingand they certainly don’t retain all they hear.And, whatever they did learn will erode overtime. More training helps, but it never getsyou to 100% understanding. That tells you acouple <strong>of</strong> things: One is that training has to bevery simple in providing very bright lines forpeople, so they don’t have to make judgmentcalls, so they know what’s good and what’sbad. I think the other is to provide all sorts <strong>of</strong>mitigation mechanisms, so that bad behavior,if it happens, is reported quickly and handledquickly. You have to expect and trust peopleto do what they should do, but when they fail,you need to act quickly to mitigate the failure.AW: What does it mean to place people intoa state <strong>of</strong> self-control and how does that benefitcompliance?DCH: The state <strong>of</strong> self-control meansknowing what you’re doing and what you’resupposed to do. The training really does that;it puts people in a state <strong>of</strong> self-control. Butagain, I think there would need to be verybright lines given. You can’t expect to trainpeople to all be experts. We don’t want ouremployees playing outside the hash marks,near nebulous boundaries that may turn outto be shifting around. So, to me, self-controlcomes through training continuous improvementby example <strong>of</strong> the failures.AW: How would you describe TAMKO’sculture to someone outside the company?DCH: I would say our culture is one wherepeople feel that they’re given the responsibilityto do their jobs, the freedom to do theirjobs, and they’re held accountable for that.But, I think in large part, if I had to say, it’sa cultural trust where we trust people to dotheir jobs and they trust us to take care <strong>of</strong>them in return. And it’s also one where weexpect people to take the initiative to come towork, get their jobs done well, and perform aswell as they’re expected to, or better. It’s nota culture where people who need proddingor people who feel entitled do well. It’s verymuch a culture where the expectations arehigh for performance.AW: TAMKO is privately held, and doesn’tdo business in foreign countries. TAMKO isnot subject to many <strong>of</strong> the government regulationsand laws that others are, and yet youdecided to have a compliance <strong>of</strong>ficer. Whatdrove that decision?“You have to expect andtrust people to do what theyshould do, but when theyfail, you need to act quicklyto mitigate the failure.“DCH: It had nothing to do with being apotential target or not. I think it had everythingto do with having an additional resourceto focus on compliance, as contrasted with theLegal department, which has a whole otherrange <strong>of</strong> responsibilities. So, focusing on complianceis a broad spectrum in itself, but I thinkit’s a better way to attack. I think it’s a betterway to make compliance an important aspect<strong>of</strong> how we do business, separate in its ownright, separate from the Legal department. Andeven though we’re relatively small and we’reprivately held (so we don’t have SEC reportingobligations or FCPA issues to deal with sincewe don’t operate in foreign countries), still therisks <strong>of</strong> non-compliance in a variety <strong>of</strong> areaswe do operate in are significant, not in terms<strong>of</strong> how many laws or regulations we may besubject to, but just because the severity <strong>of</strong> thepenalties for non-compliance have an evenlarger proportional effect on a smaller firm.If we do an outstanding job in environmentalcompliance and employment law–related compliance,and I think we do, then the risks thatwe do face are minimized.16 www.corporatecompliance.org +1 952 933 4977 or 888 277 4977

Q & AFeatureAW: TAMKO has a saying, “100% compliance,100% <strong>of</strong> the time.” That’s more than justa goal or a slogan, isn’t it?DCH: That’s the minimum, so yeah. I mean,if we’re going to have compliance, we need tobe compliant. You can’t be partially complaint.AW: Can you explain the concept <strong>of</strong> operating“between the hash marks?”DCH: As I mentioned before, the concept <strong>of</strong>operating between the hash marks is a footballmetaphor based on the fact that if you playbetween the hash marks, that’s where the lightsare the brightest. Not only the referees, buteveryone in the stands can see where you are,and you know where you are as a team. Thecloser you get to the sidelines outside the hashmarks, the closer you come to the boundaries.And in football, if you step on the line, you’reout <strong>of</strong> bounds. In the world <strong>of</strong> compliance, if youstep on the line, you may have severe penalties.The other thing is that, in the businessworld, you can be running down the field ona breakaway for great success (a touchdownin football), but then find that, retroactively,the boundaries have been moved. Where youthought you’d been doing a great job, you’vebeen out <strong>of</strong> bounds the past 60 yards. And so,operating in a world where the boundaries canmove against you, it’s much safer to stay in themiddle <strong>of</strong> the field.In addition, in the world <strong>of</strong> business andregulatory compliance, you’re operating in aworld where the referees have a vested interest,in effect, a bias toward seeing you step out<strong>of</strong> bounds. It’s probably best to play where thelights are brightest and where everyone elsecan see where you are, so that if the referee callsyou out <strong>of</strong> bounds, it will ultimately be overturnedas a bad call, because everyone can seethat you were right in the middle <strong>of</strong> the field.AW: Can you explain TAMKO’s Rule <strong>of</strong>Basic Honesty?DCH: The Rule <strong>of</strong> Basic Honesty is whatit says. We expect people to be honest in thenormal context <strong>of</strong> what honesty means, whichis: You tell the truth, you don’t lie; you comeforward when you see something that’s wrong.I would say it can be summed up as: You dothe right thing. Bob, can you add to that?RB: It means, along with complying withboth the letter and spirit <strong>of</strong> the law, it formsthe backbone <strong>of</strong> all our policies. It means morethan simply telling the truth. It includes doingyour job the way it should be done, not takingshort cuts that may save time but do notproduce the right result. It means that everyTAMKO employee has the right to rely onevery other employee to do their jobs. It meansour customers and vendors can rely on us.“The Rule <strong>of</strong> Basic Honesty iswhat it says. We expect people tobe honest in the normal context<strong>of</strong> what honesty means, which is:You tell the truth, you don’t lie;you come forward when you seesomething that’s wrong.”AW: Bob, even though TAMKO has independent<strong>Compliance</strong> and Legal functions, wework together almost daily.RB: That’s true. Many <strong>of</strong> TAMKO’s policieswere in place before we had a Chief<strong>Compliance</strong> and <strong>Ethics</strong> Officer. Since you cameon board, many <strong>of</strong> TAMKO’s policies havegone through revisions to clarify the messageand remove the “legalese.” The Legaldepartment has primary responsibility forinvestigating potential policy violations, butwe work with <strong>Compliance</strong> to apply our policiesto the facts and recommend responses.AW: David, you mentioned coming forwardin your discussion <strong>of</strong> the Rule <strong>of</strong> BasicHonesty. The Federal Sentencing Guidelinesrequire an anonymous system for reporting<strong>Compliance</strong> & <strong>Ethics</strong> <strong>Pr<strong>of</strong>essional</strong> March/April 2012+1 952 933 4977 or 888 277 4977 | www.corporatecompliance.org 17

FeatureQ & A<strong>Compliance</strong> & <strong>Ethics</strong> <strong>Pr<strong>of</strong>essional</strong> March/April 2012violations <strong>of</strong> law. Do you remember what youtold me when we first talked about creatingwhat most people call a “hotline”?DCH: I recall that I was not excited aboutit, because I saw people using it as a place tocomplain anonymously about whatever isbugging them that day, rather than for anyvaluable purpose.AW: Your direction was to design a systemwhere employees could report violations <strong>of</strong>TAMKO policy or culture, through the abilityto anonymously <strong>of</strong>fer feedback to seniormanagement through questions, comments,concerns, or requests for guidance, in additionto having the required mechanism to reportsuspected violations <strong>of</strong> law. The vendor wechose used the name Silent Whistle.DCH: Yeah, I really did not like the term.It sounded like a whistleblowing system, andI really didn’t see that that was the right wayto approach any <strong>of</strong> these issues, if you wantcompliance. You’ll have people complaining,but they won’t give you ideas or suggestions,so the fact that we changed it into the TAMKOEmployee Feedback System turned it awayfrom an “us against them” concept, a whistleblowerconcept, and into a way to give bothnegative and positive feedback, which I thinkis important.AW: In the three years that we’ve had ourformal feedback system, we’ve received over300 entries; 87% are from employees asking aquestion, seeking guidance, <strong>of</strong>fering a suggestion,or giving an opinion. Our vendor’s datashows that, among all <strong>of</strong> its clients, 75% <strong>of</strong> allentries are reports <strong>of</strong> violations. We have theexact opposite side <strong>of</strong> the universe for that.What does that tell you about TAMKO employeesand their willingness to <strong>of</strong>fer feedback?DCH: We’re special. Seriously!RB: You know, I think it’s important tonote in those statistics the portion <strong>of</strong> TAMKOemployees who aren’t reporting a violation<strong>of</strong> law. We have not received a single report<strong>of</strong> an employee violating any law or regulation.Instead, they are reporting violations<strong>of</strong> TAMKO’s own policies, which keep ourconduct between the hash marks, and keep usfrom getting to a violation <strong>of</strong> law.DCH: I think what it tells us is that wehave, for the most part, a group <strong>of</strong> people whobelieve in doing the right thing, who acceptour Rule <strong>of</strong> Basic Honesty, and that there arevery limited instances <strong>of</strong> behavior that may benon-compliant. And as a result <strong>of</strong> that, I thinkthat’s why we don’t have a lot <strong>of</strong> reports <strong>of</strong>non-compliance or any illegal activity.AW: On another note that speaks toTAMKO’s culture and philosophy, TAMKOrecently came to the aid <strong>of</strong> employees and thecommunity, because you felt it was the rightthing to do. Can you talk about the April andMay tornados and what drove TAMKO’s decisionto go above and beyond?DCH: When the Tuscaloosa (Alabama) tornadohit, I think we had five people who hadhomes affected, and a lot <strong>of</strong> people who hadcars that were damaged or destroyed. And sothat caused me to think about what can we doto help these people, because I’m sure they’resitting there—although they may have insurance—they’rein a period <strong>of</strong> time in their liveswhere they don’t have the insurance proceeds,they don’t have a place to live, and they probablydon’t have a lot <strong>of</strong> money in the bank.I wouldn’t be surprised if many live frompaycheck to paycheck, so it seemed like theyprobably needed some assistance.And then when the tornado hit Joplin,it brought that thinking home even more,because we had, I think, another 20–25 peoplewho lost homes and some who lost cars. It wasreally a function <strong>of</strong> just trying to help peoplewho were in a situation that had to be verydifficult. They lost a place to live, probably hadno place to live, and lost not only their house,18 www.corporatecompliance.org +1 952 933 4977 or 888 277 4977

Q & AFeaturebut everything in it. I don’t know what I’d doif I lost everything and found myself doingwithout. I guess our impulse was to try to helpfolks get through the period <strong>of</strong> time whiletheir insurance was being sorted out, and tohelp them (to some extent) cover the loss ontheir deductible for their house and for theircar, because those are large out-<strong>of</strong>-pockets forthe average person, which are usually verydifficult to absorb. So we thought we’d at leasttry to help on that front, in terms <strong>of</strong> helpingour employees. So I think, at the end <strong>of</strong> theday, we helped our employees and if they hadimmediate family who lost houses, we tried tohelp them as well.In terms <strong>of</strong> contributions to the community,TAMKO as a company has given to the RedCross, and I have personally to the SalvationArmy and some other groups. We did that tosome extent in Tuscaloosa, but on a much largerscale here in Joplin, because it’s our hometownand because we felt that immediately afterthe storm, it was important to immediatelymake some contributions and set an examplefor others in the area to do the same. I thinkwhen TAMKO gave a million dollars to theRed Cross, I think it set a very high bar locally,which was met by at least one other local companyand a couple <strong>of</strong> national companies thathad a presence. I think that it at least led theway for a significant amount <strong>of</strong> contributions.AW: What’s the most important thing thatyou look for when you hire somebody to joinTAMKO?DCH: I didn’t know what that was until afew years ago, when I was getting ready tohire a chief financial <strong>of</strong>ficer and I brought in asearch firm to help. We spent a day and a halftalking about the position and, at the end <strong>of</strong>the day, the representative said, “I know whatyou’re looking for.” I said, “Really? What’sthat?” And he said, “You’re looking for someoneyou can trust.” That probably sums upwhat I look for in people I hire myself or forthe company. I look for someone I can trust,which basically means I’m looking for someonewho is honest, who is humble, and whomI can depend on.AW: We also hear about the concept <strong>of</strong> “gettingthe right person on the bus.” What doesthat mean?DCH: It means hiring people you can trust,number one. You can hire talented people thatyou can’t trust, and then you have a bunch<strong>of</strong> people with a lot <strong>of</strong> talent, but you end upnot knowing whether you can get anythingdone. Hiring attitude over talent is extremelyimportant. You get the right people, the rightattitudes, presumably with the right skills, andyou get them to the right place where they canmake a difference.“Hiring attitude over talentis extremely important. Youget the right people, the rightattitudes, presumably withthe right skills, and you getthem to the right place wherethey can make a difference.”AW: What advice would you have for otherCEOs as they attempt to build a compliant andethical culture in their organizations?”DCH: Understand that any compliancefailure puts the organization at significantrisk (financial, operational, and reputation)such that 100% compliance, 100% <strong>of</strong> the timerequires an appreciation <strong>of</strong> that risk and leadershipfrom the top to establish a compliantand ethical culture.AW: Thank you, gentlemen. ✵Art Weiss is Chief <strong>Compliance</strong> and <strong>Ethics</strong> Officer for TAMKO BuildingProducts in Joplin, MO. He may be reached at art_weiss@tamko.com.<strong>Compliance</strong> & <strong>Ethics</strong> <strong>Pr<strong>of</strong>essional</strong> March/April 2012+1 952 933 4977 or 888 277 4977 | www.corporatecompliance.org 19

SCCE welcomes New MembersAlabamaGeorgiaMichigan··Susan Cotten, Health InformationDesigns, LLC··Deborah Key, Southern Nuclear··Barbara A. Stephens, Poarch CreekIndians··Jeffery Davis, Southern Company··Blair Marks, Lockheed Martin··Elaine Neely, Kaplan Higher Education··Mark Snyderman, Laureate Education, Inc··Earl Blackburn III, Terumo CardiovascularSystems··Frederick H<strong>of</strong>fman, NHBP GamingCommission··Rick Hrivnak, Auto Club GroupArizona··Jennifer McAleer, Northern ArizonaRegional Behavioral Health Authority··James Rough, Navigant Consulting, Inc··Shirley Stang, DMB Associates, IncArkansas··Patricia C. Calderon, Tyson Foods, IncCalifornia··Robert Bragaw, Liquidity Services, Inc··Otto Sanchez Cocino, MAAC··Glenda Estioko, Asian Americans forCommunity Involvement (AACI)··Patrick Hamblin, Gemological Institute <strong>of</strong>America··Jeff Hecht, The Word & Brown CompaniesIllinois··Garin Bergman, IDEX Corporation··Rolf Christiansen, Jr, Caesar’sEnterainment, Inc··Kirk Dobbins, CVS Caremark··Ann Kafer, GROWMARK··Tracie Wilcox, Fidelis SeniorCareIndiana··Lori Cochrane··Sherry Davis, Eli Lilly & Company··Joel Gibbons, National FFA Organization··Jeffery Maxwell, Eli Lilly and CoIowa··Karen Steggerda, Brighton ConsultingGroup··Rochelle J. Hunter, Johnson Controls, Inc··Cris Mattoon, The Auto Club GroupMinnesota··Mary E. Gale, William MitchellCollege <strong>of</strong> Law··Cheryl Hayne, 3M··Kathleen Panciera, William MitchellCollege <strong>of</strong> Law··Michelle D. Rovang Burke, University <strong>of</strong> StThomas, Veritas Institute··JoAnn Thompson, Otter Tail PowerCompanyMissouri··Gregory Billhartz, Ralcorp Holdings, Inc··Kent Swagler, Bi-State DevelopmentAgency (d/b/a Metro St Louis)<strong>Compliance</strong> & <strong>Ethics</strong> <strong>Pr<strong>of</strong>essional</strong> March/April 2012··Kelly Hoevelkamp, Allergan··Megan Janis, PG&E··Janie Mah, Cisco Systems··Avi Moscowitz, Corinthian Colleges, Inc··Diana Olin, Adobe Systems Incorporated··Annemarie O’Shea··Sammy Pen, Unity Care Group Inc··John Sega, Northrop GrummanCorporationColorado··Kristin Zompa, Gartner IncFlorida··Karen Clapsaddle, Lockheed Martin··Salem Flores Alatorre, Sr., SFA··Laura M. Paredes, Ingram Micro Inc··Nancy Stephenson, The Nemours Foundation··Teresa Wong, Physicians United PlanKansas··Margaret VoorheesKentucky··Susan Reinach-Lannan, RecoverCare LLCMaryland··Jessica H<strong>of</strong>fman, Lockheed Martin··Leo Mackay, Jr, Lockheed Martin··James D. Massey, MedImmune, LLC··Laurin Mathson, Lockheed Martin··Rielle Miller Gabriel, Lockheed Martin··Mike Mulleavey, Lockheed Martin··Julia Pallozzi-Ruhm, US Government··Mark Shaffer, Barnes Group Inc··Michaela Wheeler, AerotekMassachusetts··Patricia Moks, PricewaterhouseCoopers LLPNew Jersey··Meghan Davis, Johnson & Johnson··Dean Forbes, Johnson & Johnson··Thomas Hardin, Johnson & Johnson··Deborah Lake, Johnson & Johnson··Chris Matteson, Johnson & Johnson··Sheila O’Rourke, Caldwell College··Chris Petersen, Johnson & Johnson··Iskah C. Singh, Unilever United States, Inc··Nancy Waltermire, AvetaNew Mexico··Brandt Graham, URENCO, USA··Perry Robinson, URENCO, USA20 www.corporatecompliance.org +1 952 933 4977 or 888 277 4977

New York··James Dixon, ConEdison Energy··Ann M. Florkowski, ACE Group Holdings··Paul M. Holstein, FBI··Emile Kattan, DZ BANK AG··Josh Leicht, FJL Associates, LLC··Tara Mancinelli, Lockheed Martin··Susan McCormack, Long Island Center forIndependent Living, Inc··Ana Taras, William F. Ryan CommunityHealth Center··Sonya Tennell, MetroPlus Health Plan. Inc··Melinda Ward, Rochester Institute <strong>of</strong>TechnologyNorth Carolina··Heather Adams, Family Dollar··Michael LeClair, Alliance One InternationalOregon··Edward Boehmer, Acumed LLC··Eva Kripalani, Eva Kripalani Legal andConsulting ServicesPennsylvania··Holly L. Belton, P.H. Glatfelter Company··Scott Caulfield, Capital Principles, LLC··Tom Cornely, Johnson & Johnson··Rob McBryde, GSI Commerce··Leonard Swantek, Victaulic CompanySouth Carolina··John L. Miller, Fluor Government GroupTennessee··Donna Champ, Bechtel National, Inc··Kim Davenport··Sharleen Robinson, Chattanooga GoodwillIndustries, IncTexas··Edwin Buckingham, III, Solvay NorthAmerica, LLC··Alexandria Falls, CPS Energy··Patricia MacGibbon, Dresser, Inc··Robert Vander Lugt, Northrop GrummanCorpUtah··Anthony Joy, AusencoVirginia··Eva Bishop, Raytheon Company··Thomas Donovan, Northrop GrummanCorp··Alison Jameson, Department <strong>of</strong> Justice··Beth Mersch, Northrop Grumman Corp··Rebecca Osowski, Morgan, Lewis &Bockius LLPWashington··Jennifer Badgley, Premera Blue Cross··Jasbinder Dhoot, JSJ Consulting··Phillip Downes··Don Ellis, Northshore Utility District··Evelyn Hager, Seattle City Light··Jane Maring, Costco Wholesale Corp··Dan Shea, Micros<strong>of</strong>tWisconsin··Veronica W. Robinson, Milwaukee CountyWashington, DC··Joy Dorsey, Pepco Holdings, Inc··Steven Lawrence, Williams Lea··Sarah Sims, AARP ServicesPuerto Rico··Manuel Sevilla, Sr., Johnson & JohnsonAustralia··Neville Tiffen, Rio Tinto LimitedBarbados··Mark Taitt, Caribbean Development BankBrazil··Fabio Moreno, Sr., Alexandre De MoraesLaw FirmCanada··Jakub Ficner, I-SightMalaysia··Kanakaraja Muthusamy, AR<strong>Compliance</strong> & <strong>Ethics</strong> <strong>Pr<strong>of</strong>essional</strong> March/April 2012+1 952 933 4977 or 888 277 4977 | www.corporatecompliance.org 21

Featureby Cynthia Scavelli, Esq., CCEPRecipe for a <strong>Compliance</strong> Dayin 2012»»Reach out to SCCE and other compliance pr<strong>of</strong>essionals for valuable ideas.»»Events should reflect your company’s culture and stay on budget.»»Contact different company departments for their expertise and suggestions.»»Initiate a Planning Committee early. Things always take longer than you think!»»Plan a simple event for your first year. You can always add more later.»»Engage your employees with fun contests and creative prizes.<strong>Compliance</strong> & <strong>Ethics</strong> <strong>Pr<strong>of</strong>essional</strong> March/April 2012ScavelliAt FIS, the world’s largest provider<strong>of</strong> banking and payments technology,we put our <strong>Compliance</strong> Day“recipe” together to promote ethical behaviorthrough education and awareness. Our first<strong>Compliance</strong> Day—Spotlight on <strong>Ethics</strong>—washeld in August 2011. The goal was toencourage internal reporting <strong>of</strong> ethicalissues and raise awareness <strong>of</strong> theFIS ethics hotline/website as a toolfor reporting potential ethics violations.We chose to put the spotlighton ethics because honesty and ethicalbehavior are integral parts <strong>of</strong> our corporateculture and the foundation <strong>of</strong>our company’s five Guiding Principles.Another selection consideration, in the age<strong>of</strong> the new Dodd-Frank Wall Street Reformand Consumer Protection Act, was the benefitto the company <strong>of</strong> making our internal reportingmechanisms more visible to employees.FIS’s online <strong>Compliance</strong> Day enabled us tosatisfy our employees’ hunger for awarenessregarding the company’s Code <strong>of</strong> BusinessConduct and <strong>Ethics</strong>, other policies, and ethicaldilemmas (such as conflict <strong>of</strong> interest), as wellas the tools used to report misconduct. Thepositive feedback we received from our annual<strong>Ethics</strong> Awareness Survey in December 2011confirmed our goal was achieved.Ingredients—Ideas from SCCESCCE’s website 1 gave us the inspiration andresources to put together our first <strong>Compliance</strong>Day. The website provides a tutorial Web conference,awareness ideas, promotional posters,and articles from other companies documentingtheir various compliance celebrations.As a relatively new member, I found SCCE’s<strong>Compliance</strong> and <strong>Ethics</strong> Academy was also avaluable resource, providing relevant trainingclasses on topics and material which enhancedour vision <strong>of</strong> <strong>Compliance</strong> Day. Attending theAcademy was especially beneficial because <strong>of</strong>the opportunity to meet other compliance pr<strong>of</strong>essionalsand swap “recipes.” One ingredientfor our recipe came from a fellow attendeewho suggested an electronic scavenger hunt.This activity was challenging, educational,and a lot <strong>of</strong> fun for the employees. Details concerningthis activity will be discussed later on.Know the shopping budget—Get creativeEach year, <strong>Corporate</strong> <strong>Compliance</strong> & <strong>Ethics</strong>Week is celebrated in May. Because FIS’sannual client conference is also in May, we22 www.corporatecompliance.org +1 952 933 4977 or 888 277 4977

Featurechose to hold our compliance event in Augustso that we could draw upon internal FISresources, such as Marketing, <strong>Pr<strong>of</strong>essional</strong>Development Training, and <strong>Corporate</strong>Communications. We knew that our large andgeographically dispersed employee base madeit difficult to host an onsite event. Instead, wedecided to have an online celebration. Ourinitial rollout was targeted to U.S. employeesand featured our inaugural FIS <strong>Corporate</strong><strong>Compliance</strong> “Walk the Talk” newsletter andnew online ethics awareness training. FIS’sinternational locations are scheduled to havetheir own <strong>Compliance</strong> Days throughout2012 with the appropriate customization andtranslations.To garner attention and excitement surroundingthe upcoming day, we announcedan essay contest with a prize. Employees wereencouraged to submitan essay, in 500 wordsor less, on what complianceand ethics meansto them and describehow adherence to theseconcepts influences theday-to-day decisionsthey encounter on thejob. The top three winners won a coveted (and“budget low-cal” item)—an extra vacation day.The first place essay winner was featured inour newsletter. Utilizing our budget low-calapproach, we tried to keep costs to a minimumand relied on internal resources to promoteand host the event.We advertised the event through an e-mailblast and a customized electronic banner onthe FIS Intranet. The banner, featuring an eyecatchinganimation, was created free <strong>of</strong> chargeby our Marketing department and conspicuouslyposted where most employees wouldsee it during the weeks leading up to the day.We also mentioned the event in other online“When trying to createan event that aligns withyour company’s culture,you need to ask someinsightful questions.”communications. Our Marketing departmentalso assisted with the format, branding, andcustomization <strong>of</strong> our newsletter. Fortunately,our customized new ethics awareness trainingwas done in-house by our subsidiary, FIS<strong>Compliance</strong> Solutions, 2 which kept costs downas well. In keeping with our theme <strong>of</strong> a spotlight,the main expense was green (FIS’s mainbrand color) mini-flashlight prizes imprintedwith the FIS <strong>Ethics</strong> website address.Event recipeCombine department input and add a dash <strong>of</strong>your company’s culture.When trying to create an event that alignswith your company’s culture, you need toask some insightful questions. Are you aninformal or formal company? What issues areimportant to your business and why? Who isyour audience? Whattime <strong>of</strong> the year is bestfor an event <strong>of</strong> thisnature? What is yourbudget? What is yourcompany’s culture andcommunications tone?By using your company’sdepartmentalresources, you will be able to spice up your<strong>Compliance</strong> Day. By combining input from differentinternal resources and the answers to theabove questions, you can create your perfectsignature dish using the following quick recipe:1. Start a Planning Committee with executivesupport to achieve the best collaborationpossible. As we learned, tone from the topis very important for success.2. Stir in representatives from Marketing,<strong>Pr<strong>of</strong>essional</strong> Development Training,Human Resources (HR), Legal, InformationSecurity, Risk, Internal Audit, and management.Every area has a differentperspective and can be helpful in serving<strong>Compliance</strong> & <strong>Ethics</strong> <strong>Pr<strong>of</strong>essional</strong> March/April 2012+1 952 933 4977 or 888 277 4977 | www.corporatecompliance.org 23

Feature<strong>Compliance</strong> & <strong>Ethics</strong> <strong>Pr<strong>of</strong>essional</strong> March/April 2012up your creation. The FIS Marketing teamassisted with the customization and layout<strong>of</strong> the newsletter, editing, and onlineadvertising, and, together with HR, <strong>of</strong>feredvaluable insight into past successes (andfailures) in organizing and conductingcompany-wide events. FIS’s InformationSecurity team contributed an article aboutthe importance <strong>of</strong> data security and how toreport a security incident.3. Combine the expertise <strong>of</strong> these groups tosuggest topics, write content for the ethicsawareness training, and be part <strong>of</strong> the pilotgroup to provide feedback on the training.Our signature dish—FIS <strong>Compliance</strong> Day 2011:Spotlight on <strong>Ethics</strong>Several months prior to the event, we plannedan initiative to have employees renew theiracknowledgement <strong>of</strong> the Code <strong>of</strong> BusinessConduct and <strong>Ethics</strong>. By doing so, employeesrefreshed their understanding <strong>of</strong> the company’sethics expectations and were primed tobe receptive to our message about <strong>Compliance</strong>Day. We then mentioned the upcoming eventin an <strong>Ethics</strong> Essentials article featured in ourquarterly HR newsletter. Three weeks prior tothe online event, we sent out a communicationannouncing the essay contest and explainingthat <strong>Compliance</strong> Day would feature brandnew ethics awareness training. We also sentan inaugural FIS <strong>Corporate</strong> <strong>Compliance</strong> “Walkthe Talk” newsletter.On the actual <strong>Compliance</strong> Day, we sentout an electronic communication with a linkto our newsletter and the online training linkthrough FIS <strong>Compliance</strong> Solutions. Our trainingtopics included:··Conflict <strong>of</strong> interest··Gift policy··Fair dealing··<strong>Compliance</strong> with laws··Handling confidential information··Security awareness··Security incident reporting··Privacy··Open door policy··Reporting to our ethics hotline/websiteMini-quizzes after each topic assistedemployees in staying focused on the training.At the end <strong>of</strong> the training, each employeehad to pass an eight-question test and printtheir completion certificate. FIS <strong>Compliance</strong>Solutions’ training platform enabled us tokeep track <strong>of</strong> the completion rate <strong>of</strong> employeesfor auditing purposes and gave us the abilityto send out reminders.“Many employees came forwardwith suggested topics for futurearticles and ways to improveawareness <strong>of</strong> our complianceprogram…We hoped that<strong>Compliance</strong> Day would opennew lines <strong>of</strong> communication andwere pleased that is what it did.”The newsletter featured an introductionwith the purpose <strong>of</strong> the event, a <strong>Compliance</strong>Quick Reference section, the winning essay, anarticle about the importance <strong>of</strong> data securityand how to report a security incident, the ethicalquote <strong>of</strong> the day, an electronic scavengerhunt, and “<strong>Compliance</strong> Talk.” The <strong>Compliance</strong>Quick Reference section provided an overview<strong>of</strong> company’s expectation <strong>of</strong> its employees.Each subsequent newsletter will have thissection with different information and willeventually be combined for concise employeeguidance on multiple issues. The electronicscavenger hunt asked employees questionsabout FIS policies and directed them to useour Intranet to find the answers. This funexercise was not only educational, but it droveemployees to our Intranet to find the policies24 www.corporatecompliance.org +1 952 933 4977 or 888 277 4977

Featureand become more savvy about the location <strong>of</strong>items housed on the Intranet. “<strong>Compliance</strong>Talk” featured a Q&A-style format in whichour Chief <strong>Compliance</strong> Officer (CCO) answeredfrequently asked ethics-related questions andprovided additional information about how toreport suspected misconduct.Many employees came forward with suggestedtopics for future articles and ways toimprove awareness <strong>of</strong> our compliance program.Employees who participated in theelectronic scavenger hunt or essay contest,proactively made suggestions, or were the firstto complete the training were awarded a miniflashlightas a prize with a special note fromour CCO thanking them for their participation.We hoped that <strong>Compliance</strong> Day wouldopen new lines <strong>of</strong> communication and werepleased that is what it did.Think to the future…What’s next on yourmenu?<strong>Corporate</strong> <strong>Compliance</strong> & <strong>Ethics</strong> Week for 2012is scheduled for May 6−12. Now that you havea basic recipe, your <strong>Compliance</strong> and <strong>Ethics</strong>department can capitalize on this by servingup a different theme and message each year.At FIS, we are already planning <strong>Compliance</strong>Day 2012: Spotlight on Privacy.Bon appetite! ✵1. SCCE’s website, www.corporatecompliance.org, Resources section:<strong>Corporate</strong> <strong>Compliance</strong> and <strong>Ethics</strong> Week.2. FIS <strong>Compliance</strong> Solutions is FIS’s regulatory compliance s<strong>of</strong>twareand consulting services arm that serves U.S. financial institutions. Itprovides risk assessment s<strong>of</strong>tware, e-learning, instructor-led training,advisory services, regulatory reporting solutions, compliancetools and expert consulting services. For more information, pleasecall 866-355-5150 or email compliance.solutions@fisglobal.com.Cynthia Scavelli is the <strong>Corporate</strong> <strong>Compliance</strong> & <strong>Ethics</strong> Counsel at the FISheadquarters in Jacksonville, Florida. She is responsible for ethics hotlineinvestigations, FCPA third-party due diligence, and global anti-briberytraining, and she monitors legislative/regulatory changes for selectedbusiness units. Cynthia may be contacted at cynthia.scavelli@fisglobal.com.Don’t forget to earn your CCEP CEUs for this issueComplete the <strong>Compliance</strong> & <strong>Ethics</strong> <strong>Pr<strong>of</strong>essional</strong> CEU quizfor the articles below from this issue:··Nuts & bolts for boards: What ethics oversightreally means by Frank J. Navran (page 44)··Computers and copyrights: A continuing source<strong>of</strong> avoidable liability by Thomas W. Kirby (page 59)··Is your ethics and compliance training reallypreparing your employees? by Charles Ruthford(page 63)To complete the quiz:Visit www.corporatecompliance.org/quiz, then selecta quiz, fill in your contact information, and answer thequestions. The online quiz is self-scoring and you will seeyour results immediately.You may also fax or mail the completed quiz to CCB:Fax: +1 952 988 0146mail:<strong>Compliance</strong> Certification Board6500 Barrie Road, Suite 250Minneapolis, MN 55435, United StatesQuestions? Call CCB at +1 952 933 4977 or888 277 4977.To receive one (1) CEU for successfully completing thequiz, you must answer at least three questions correctly.Quizzes received after the expiration date indicated on thequiz will not be accepted. Each quiz is valid for 12 months,starting with the month <strong>of</strong> issue. Only the first attempt ateach quiz will be accepted.<strong>Compliance</strong> & <strong>Ethics</strong> <strong>Pr<strong>of</strong>essional</strong> March/April 2012+1 952 933 4977 or 888 277 4977 | www.corporatecompliance.org 25

Feature Boehme <strong>of</strong> Contentionby Donna BoehmeMachiavelli and the 2011Person <strong>of</strong> the Year<strong>Compliance</strong> & <strong>Ethics</strong> <strong>Pr<strong>of</strong>essional</strong> March/April 2012“There is nothing more difficult to take in hand, more perilous toconduct, or more uncertain in its success, than to take the leadin the introduction <strong>of</strong> a new order <strong>of</strong> things.”(Niccolo Machiavelli, 1532)BoehmeEverything old is new again. Machiavellimay have been the first to observe theperilous nature <strong>of</strong> the chief compliance<strong>of</strong>ficer job (in my book, it’s right up there withcoal miner and deep sea fisherman), but nearlyfive centuries later, former federal prosecutorMichael Volkov has echoed thoseearly observations by naming theCCO the 2011 “Person <strong>of</strong> the Year.” 1CCOs are the “unsung heroes,” saysVolkov, noting “there are institutionalforces which hold them backfrom achieving their mission.” Towhich we can almost hear beaten butyet unbowed CCO’s everywhere responding“THANK YOU!”In many respects, 2011 has been a “perfectstorm” for compliance. Commentators havecited unprecedented levels <strong>of</strong> enforcementand new regulation, the controversial Dodd-Frank whistleblower regime, the Volckerrule and financial reform, UK Bribery Act,record-breaking FCPA and qui tam settlements,the rise <strong>of</strong> social power, and the entry<strong>of</strong> Generation Y into the workforce. 2011also marked the twentieth anniversary <strong>of</strong>the Federal Sentencing Guidelines, promptingthe <strong>Ethics</strong> Resource Center to assemblea committee to <strong>of</strong>fer recommendations topolicymakers. Support for the role <strong>of</strong> theempowered CCO should be at the very top <strong>of</strong>the ERC agenda, because the unspoken truthwe must shout from the ro<strong>of</strong>tops is that, alltoo <strong>of</strong>ten, CCOs are positioned for failure. 2According to a new SCCE/HCCA survey, 58%<strong>of</strong> compliance pr<strong>of</strong>essionals surveyed felt isolatedand in an adversarial position, and 60%considered leaving their jobs in the last yeardue to stress. 3 What the Person <strong>of</strong> the Yearreally needs to be successful is empowerment,direct unfiltered reporting to the board,adequate autonomy from management, andsufficient resources. Earth to Boards: Try thatfor “tone from the top.”Volkov also predicts that the CCO willbe elevated to C-suite status within the nextfive years. This would be fast work, givenMachiavelli’s “institutional forces” underminingthe CCO mission. Will 2012 yield bettercompliance? Only to the extent boards, government,and policymakers create levers <strong>of</strong>empowerment to position the Person <strong>of</strong> theYear for success instead <strong>of</strong> failure. ✵1. Michael Volkov: “The Person <strong>of</strong> the Year – The Chief <strong>Compliance</strong>Officer.” Corruption, Crime & <strong>Compliance</strong> online, December 15,2011. Available at http://corruptioncrimecompliance.com/2011/12/theperson-<strong>of</strong>-the-year-the-chief-compliance-<strong>of</strong>ficer.html2. See RAND Symposium Report “Perspectives <strong>of</strong> Chief <strong>Compliance</strong>and <strong>Ethics</strong> Officers on the Prevention and Detection <strong>of</strong> <strong>Corporate</strong>Misdeeds.” Available at http://www.rand.org/pubs/conf_proceedings/CF258.html3. HCCA and SCCE: “Stress, <strong>Compliance</strong>, and <strong>Ethics</strong>” survey, January2012. Available at http://www.corporatecompliance.org/staticcontent/StressSurvey_report.pdfSend comments to Donna Boehme at dboehme@compliancestrategists.com.26 www.corporatecompliance.org +1 952 933 4977 or 888 277 4977

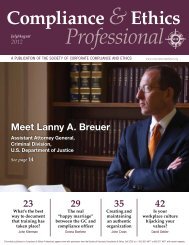

COMPLIANCE PROGRAM ADVISOR Last Year’s Best Practices Are This Year’s Standards“Think about how you might tailor the Guidance to your organization. And know that, as you do, the Criminal Divisioncares about all the things you might be considering – “tone from the top” support, encouragement <strong>of</strong> a culture <strong>of</strong>compliance that rewards ethical behavior and establishes whistle-blowing mechanisms, senior-level oversight anddirect reporting lines, [and] periodic reviews and re-evaluations to test and ensure program effectiveness …— Assistant U.S. Attorney General Lanny Breuer,Prepared Remarks to <strong>Compliance</strong> Week 2010: 5th Annual Conference“Contact Ethisphere today to obtain additional information regarding <strong>Compliance</strong> Program Advisor subscription package optionsat info@ethisphere.com, 1.877.629.8724 and/or www.ethisphere.com/compliance-program-advisor/

Featureby Steve McGrawGRC focus: Keep youremployees close and yourauditors closer»»With regulatory attention continuing to focus on GRC results, corporations need to focus on ensuring compliance is up to par.»»Corporations need to show employees that all internally reported issues will be taken seriously.»»Sharing compliance self-assessments and mitigation programs with auditors can help corporations establish a strong reputation.»»GRC should be viewed as increasingly beneficial, especially when preparing for mergers and acquisitions.»»GRC systems can provide information to show trend lines and correlations to address root-cause issues before regulators ask.<strong>Compliance</strong> & <strong>Ethics</strong> <strong>Pr<strong>of</strong>essional</strong> March/April 2012McGrawAs we continue through 2012, the focus<strong>of</strong> regulatory bodies continues to befirmly focused on Governance, Riskand <strong>Compliance</strong> (GRC) results. Corporationsand their boards <strong>of</strong> directors need to payincreasing attention to reducing compliancethreats. This task <strong>of</strong>ten falls on theshoulders <strong>of</strong> the compliance <strong>of</strong>ficer,along with the need to ensure thatcompliance programs adhere to themost current versions <strong>of</strong> ever-changinglaws and regulations.What many corporations havelearned already is that the best way toprotect a company’s interests is to ensure thatcompliance is up to par internally, before theregulators come calling. This said, there are afew areas that corporations should pay veryclose attention to as we move through the year.Bounty hunter threats are increasingPersonal greed has long been the primarymotivator behind fraud and abuse, and regulatorsare now increasingly using a variety<strong>of</strong> greed-oriented rewards to help identifyand prosecute <strong>of</strong>fenders. The Securities andExchange Commission (SEC) and CommoditiesFutures Trading Commission (CFTC) now haveformal whistleblower bounty hunter programs,using a percentage <strong>of</strong> the sanctions as rewards.As these and similar programs begin to hittheir strides, compliance <strong>of</strong>ficers and theirboards <strong>of</strong> directors will face increasing threatsto their internal compliance programs and,ultimately, their institutional brands.Corporations also need to show theiremployees that the <strong>Compliance</strong> departmentwill follow up on issues that are reported internally.For example, a corporation can removeidentifying facts from the reported claims, thenpost them on in-house blogs to show employeesexamples <strong>of</strong> what is being reported andthat each claim is being taken seriously.Demonstrating compliance effectiveness iscriticalHistorically, regulators have been satisfiedwith companies that have implemented complianceprograms, but now they want pro<strong>of</strong>that the programs are actually working. Moreregulatory authorities will begin to require aprocess that distills data and demonstrates theoverall effectiveness <strong>of</strong> a company’s complianceprogram.28 www.corporatecompliance.org +1 952 933 4977 or 888 277 4977