Compliance &Ethics - Society of Corporate Compliance and Ethics

Compliance &Ethics - Society of Corporate Compliance and Ethics

Compliance &Ethics - Society of Corporate Compliance and Ethics

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Letter from the CEOby Roy Snell, CHC, CCEP‐FWhat we have accomplishedSnellFour <strong>of</strong> us from SCCE/HCCA wererecently invited to meet with the head<strong>of</strong> the Department <strong>of</strong> Justice, the head<strong>of</strong> the Securities <strong>and</strong> Exchange Commission’sDivision <strong>of</strong> Enforcement, <strong>and</strong> the head <strong>of</strong>the Department <strong>of</strong> Justice’s FCPAdivision. They asked for a shortdescription <strong>of</strong> our organization. Ithought I would share with you whatI shared with them. Our growth hasbeen explosive. We have not spentmuch time looking back. It was interestingto reflect on what we haveaccomplished as a very young pr<strong>of</strong>ession.The <strong>Society</strong> <strong>of</strong> <strong>Corporate</strong> <strong>Compliance</strong><strong>and</strong> <strong>Ethics</strong> <strong>and</strong> the Health Care <strong>Compliance</strong>Association are part <strong>of</strong> a single 501(c)(6) organizationdedicated to helping educate, network,<strong>and</strong> certify compliance <strong>and</strong> ethics pr<strong>of</strong>essionals.Our mission is to help compliance <strong>and</strong> ethicspr<strong>of</strong>essionals become more effective in theirjobs <strong>and</strong> help them implement effective complianceprograms. We have 10,500 members whoare primarily in-house compliance <strong>and</strong> ethicspr<strong>of</strong>essionals managing their organizations’compliance <strong>and</strong> ethics programs. We have individualsfrom academia, government, outsidecounsel, <strong>and</strong> more involved in our organization.We also reach many individuals throughsocial media who are involved in other aspects<strong>of</strong> an effective compliance program, such asaudit, legal, risk, fraud, <strong>and</strong> more. We have over20,000 people following our Twitter feed, 9,500on our dedicated social media site, 15,600 onour LinkedIn compliance groups, <strong>and</strong> 8,000 onFacebook. Through social media we are able tocommunicate news <strong>and</strong> information, <strong>and</strong> sharedocuments that assist our members <strong>and</strong> othersin their efforts to improve their organizations’cultures <strong>and</strong> compliance with the law.We are involved in many aspects <strong>of</strong>compliance <strong>and</strong> ethics education. We havecredentialed <strong>and</strong> assisted in the programdevelopment <strong>of</strong> several colleges that havedeveloped degrees in the compliance <strong>and</strong>ethics field. We hold approximately 60 compliance<strong>and</strong> ethics conferences per year, thelargest <strong>of</strong> which has more than 2,000 attendees.We conduct approximately 35 web conferenceseach year. We publish two magazines with200 articles per year written by compliance<strong>and</strong> ethics pr<strong>of</strong>essionals. We have developedsix basic <strong>and</strong> advanced certification programsfor compliance <strong>and</strong> ethics pr<strong>of</strong>essionals. Over4,000 people hold one <strong>of</strong> the credentials.We have also branched out internationally.We have members from over 50 countries.We will be holding certification training inShanghai, São Paulo, <strong>and</strong> Brussels this year.We have developed numerous national <strong>and</strong>international partnerships with government,industry, <strong>and</strong> other pr<strong>of</strong>essional associations,<strong>and</strong> facilitated collaboration betweenthe compliance <strong>and</strong> ethics pr<strong>of</strong>ession <strong>and</strong> theenforcement community.We have come a long way. We have peoplewho can influence our pr<strong>of</strong>ession asking for ourinput now, when they wouldn’t give us the time<strong>of</strong> day in the past. We are having a few growingpains, but things are very good. We are hiringmore people with expertise that will help takeour pr<strong>of</strong>ession <strong>and</strong> our organization to thenext level. Most <strong>of</strong> all, we have surroundedourselves with lead volunteers that have theright stuff. They are the right people to helpus achieve our mission <strong>of</strong> helping compliancepr<strong>of</strong>essionals be more effective in their jobs<strong>and</strong> implement effective compliance programs.We are looking forward to another great year. ✵Contact Roy Snell at roy.snell@corporatecompliance.org<strong>Compliance</strong> & <strong>Ethics</strong> Pr<strong>of</strong>essional May/June 2012+1 952 933 4977 or 888 277 4977 | www.corporatecompliance.org 3

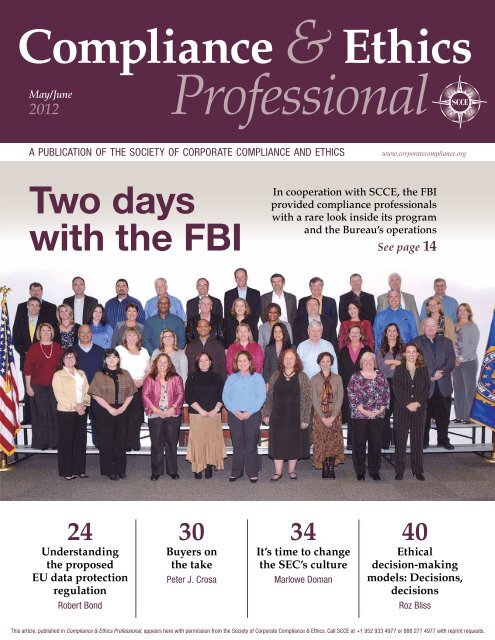

ContentsMay/June 2012FeaturesColumns<strong>Compliance</strong> & <strong>Ethics</strong> Pr<strong>of</strong>essional May/June 201214 Two days with the FBIby Adam TurteltaubAbout 50 compliance pr<strong>of</strong>essionals got an inside look at the FBI’scompliance program <strong>and</strong> how agents are trained.24 Underst<strong>and</strong>ing the proposedEU data protection regulationby Robert BondBusinesses that process the personal data <strong>of</strong> Europeanswill incur significant compliance obligations when the newregulations take effect.30 Buyers on the takeby Peter J. CrosaAssuming that vendor pay<strong>of</strong>fs are a thing <strong>of</strong> the past may be abit naïve in these tougher economic times.34 It’s time to change the SEC’s cultureby Marlowe DomanThe new Office <strong>of</strong> the Whistleblower will have to overcome thepublic’s perception that the SEC protects, rather than prosecutes,high-level financiers.40 Ethical decision-making models:Decisions, decisionsby Roz BlissWhen faced with an ethical challenge, your employees need asimple tool to help them make the right decision.3 Letter from the CEORoy Snell21 Boehme <strong>of</strong> contentionDonna Boehme29 The art <strong>of</strong> complianceArt Weiss33 View from the front linesMeric Craig Bloch39 Kaplan’s courtJeff Kaplan78 The last wordJoseph Murphy6 NewsDepartments12 People on the move22 SCCE welcomes new members69 SCCE congratulatesnew CCEP ® designees79 Takeaways80 Events calendar4 www.corporatecompliance.org +1 952 933 4977 or 888 277 4977

“ ”<strong>Ethics</strong> <strong>and</strong> compliance operativesshould be aware that inappropriatevendor influence is not alwaysblatant <strong>and</strong> easy to spot.See story on page 30<strong>Compliance</strong> & <strong>Ethics</strong>Pr<strong>of</strong>essionalEditor-in-ChiefJoseph Murphy, Esq., CCEP, Of Counsel, CSLG, Haddonfield, NJ,jemurphy@cslg.comExecutive EditorRoy Snell, CHC, CCEP‐F, CEO, roy.snell@corporatecompliance.orgArticles44 Powerful witness preparation:The pure <strong>and</strong> simple truthby Dan Small <strong>and</strong> Robert F. RoachGetting to the truth <strong>and</strong> bringing it out effectively requires preparation.48 The economy, compliance, <strong>and</strong> ethicsby Adam TurteltaubResults <strong>of</strong> SCCE’s latest survey on <strong>Compliance</strong> budgets <strong>and</strong> staffing.50 Overzealous I-9 compliance can result ina discrimination lawsuit [CEU]by Justin EstepCompanies must follow a consistent policy for verifying the employmenteligibility <strong>of</strong> both U.S. citizens <strong>and</strong> non-citizens.52 Meet Frederico Melville Novella<strong>and</strong> Christie Ippischby Adam TurteltaubThe founding father <strong>of</strong> one <strong>of</strong> Guatemala’s leading companies instilled a legacy<strong>of</strong> ethics, values, <strong>and</strong> right conduct.54 <strong>Corporate</strong> codes <strong>of</strong> conduct in theUnited States [CEU]by Gilbert Geis, PhD <strong>and</strong> Henry N. Pontell, PhDA desire to protect the company from vicarious liability runs through thehistory <strong>of</strong> codes <strong>of</strong> conduct.66 Social media evidence: A new accountability [CEU]by Dawn LomerPotential legal issues can arise when discovering evidence on social mediasites <strong>and</strong> authenticating it for use in a courtroom.70 Building transparency, accountability, <strong>and</strong>ethics in government contractingby Eric R. FeldmanContractors who ignore increasingly complex federal regulations <strong>and</strong>self-disclosure requirements may find themselves suspended or debarred.Advisory BoardCharles Elson, JD, Edgar S. Woolard, Jr. Chair in <strong>Corporate</strong>Governance, Director <strong>of</strong> the John L. Weinberg Center for<strong>Corporate</strong> Governance at University <strong>of</strong> Delaware.Jay Cohen, <strong>Compliance</strong> Consultant, Assurant Inc.John Dienhart, PhD, The Frank Shrontz Chairfor Business <strong>Ethics</strong>, Seattle University; Director,Northwest <strong>Ethics</strong> Network; Director, Albers Business<strong>Ethics</strong> Initiative; Fellow, <strong>Ethics</strong> Resource CenterOdell Guyton, JD, CCEP, Senior <strong>Corporate</strong> Attorney,Director <strong>of</strong> <strong>Compliance</strong>, U.S. Legal–Finance & Operations,Micros<strong>of</strong>t CorporationRebecca Walker, JD, Partner, Kaplan & Walker LLPRick Kulevich, JD, Senior Director, <strong>Ethics</strong> <strong>and</strong> <strong>Compliance</strong>,CDW CorporationSteve LeFar, President, Sg2Stephen A. Morreale, DPA, CHC, CCEP, Principal,<strong>Compliance</strong> <strong>and</strong> Risk DynamicsMarcia Narine, JD, Vice President Global <strong>Compliance</strong><strong>and</strong> Business St<strong>and</strong>ards, Deputy General Counsel,Ryder System, Inc.Ann L. Straw, General Counsel US, Votorantim CimentosNorth America, Inc.Greg Triguba, JD, CCEP, Principal,<strong>Compliance</strong> Integrity Solutions, LLCStory Editor/AdvertisingLiz Hergert, +1 952 933 4977 or 888 277 4977liz.hergert@corporatecompliance.orgCopy EditorPatricia Mees, CCEP, CHC, +1 952 933 4977 or 888 277 4977patricia.mees@corporatecompliance.orgDesign & LayoutSarah Anondson, +1 952 933 4977 or 888 277 4977sarah.anondson@corporatecompliance.org<strong>Compliance</strong> & <strong>Ethics</strong> Pr<strong>of</strong>essional (CEP) (ISSN 1523-8466)is published by the <strong>Society</strong> <strong>of</strong> <strong>Corporate</strong> <strong>Compliance</strong> <strong>and</strong> <strong>Ethics</strong>(SCCE), 6500 Barrie Road, Suite 250, Minneapolis, MN 55435.Subscriptions are free to members. Periodicals postage‐paid atMinneapolis, MN 55435. Postmaster: Send address changes to<strong>Compliance</strong> & <strong>Ethics</strong> Pr<strong>of</strong>essional Magazine, 6500 Barrie Road,Suite 250, Minneapolis, MN 55435. Copyright © 2012 <strong>Society</strong><strong>of</strong> <strong>Corporate</strong> <strong>Compliance</strong> <strong>and</strong> <strong>Ethics</strong>. All rights reserved. Printedin the USA. Except where specifically encouraged, no part <strong>of</strong> thispublication may be reproduced, in any form or by any means,without prior written consent from SCCE. For subscriptioninformation <strong>and</strong> advertising rates, call +1 952 933 4977or 888 277 4977. Send press releases to SCCE CEP PressReleases, 6500 Barrie Road, Suite 250, Minneapolis, MN55435. Opinions expressed are those <strong>of</strong> the writers <strong>and</strong> not <strong>of</strong>this publication or SCCE. Mention <strong>of</strong> products <strong>and</strong> services doesnot constitute endorsement. Neither SCCE nor CEP is engaged inrendering legal or other pr<strong>of</strong>essional services. If such assistanceis needed, readers should consult pr<strong>of</strong>essional counsel or otherpr<strong>of</strong>essional advisors for specific legal or ethical questions.Volume 9, ISSUE 3+1 952 933 4977 or 888 277 4977 | www.corporatecompliance.org 5<strong>Compliance</strong> & <strong>Ethics</strong> Pr<strong>of</strong>essional May/June 2012

News<strong>Compliance</strong> & <strong>Ethics</strong> Pr<strong>of</strong>essional May/June 2012<strong>Compliance</strong> <strong>of</strong>ficer ranks highin best business sector jobs listThe work <strong>of</strong> compliance <strong>of</strong>ficershas been spotlighted in aFebruary report in U.S. News<strong>and</strong> World Report. Its “BestJobs <strong>of</strong> 2012” is based on theLabor Department’s employmentprojections. In anoverview, the report detailsthat 50 jobs were selectedfrom five “quick-to-hire”industries: business, creativeservices, health care, science<strong>and</strong> technology, <strong>and</strong> socialservices. The job <strong>of</strong> compliance<strong>of</strong>ficer ranked 13thon the list <strong>of</strong> best businessjobs. The report states, “TheBureau <strong>of</strong> Labor Statisticsprojects compliance <strong>of</strong>ficeremployment growth <strong>of</strong> 15percent between 2010 <strong>and</strong>2020. That’s 32,400 new jobs<strong>and</strong> 26,200 replacement jobs.”To view the entire report:http://money.usnews.com/money/careers/articles/2012/02/27/the-best-jobs-<strong>of</strong>-2012Public rebuke <strong>of</strong> culture atGoldman Sachs opens debateWhen Greg Smith, a midlevel executive at Goldman Sachs,delivered his resignation in The New York Times on March 14,2012, he sparked a new round <strong>of</strong> debates about ethical failures<strong>and</strong> their impact on Wall Street. The 33-year-old confessed hisdisillusionment in the form <strong>of</strong> an Op-Ed article, “Why I AmLeaving Goldman Sachs.” Among the sentiments he revealed:“It makes me ill how callously people still talk about ripping <strong>of</strong>fclients.” Smith further states, “It astounds me how little seniormanagement gets a basic truth: If clients don’t trust you, theywill eventually stop doing business with you.”Worldwide media coverage <strong>of</strong> the resignation generallyfocused on the question <strong>of</strong> whether anything has changedon Wall Street in the three years since the financial crisistook down so many once pr<strong>of</strong>itable firms. Opinion pieces ranthe gamut, including “Why Greg Smith is Dead Right,” to“Goldman Rant a Case <strong>of</strong> Sour Grapes.”Read the latest news online · www.corporatecompliance.org/newsEU agenciessay Googlebreaking lawA European Union (EU)Justice Commissioner,Viviane Reding, assertedin March that Google’s newprivacy policy is in breach<strong>of</strong> European law. Google’snew policy, implemented onMarch 1, 2012, means privatedata collected by one<strong>of</strong> Google services can beshared with its other platforms,including YouTube,gmail <strong>and</strong> Blogger. Userscannot opt out <strong>of</strong> the newpolicy if they want tocontinue using Google’sservices.In a March 1 interviewwith BBC Radio Four, Redingstated “[The new policy] isnot in accordance with thelaw on transparency <strong>and</strong> itutilizes the data <strong>of</strong> privatepersons in order to h<strong>and</strong> itover to third parties, whichis not what the users haveagreed to.” In addition,France’s data regulationauthority (the CNIL) hasindicated that it plans tolead a European-wide investigationinto the policy.“It astounds me how little senior management gets a basictruth: If clients don’t trust you, they will eventually stopdoing business with you.” Greg Smith, former executive at Goldman Sachs6 www.corporatecompliance.org +1 952 933 4977 or 888 277 4977

NewsWebsites uncover petty briberyaround the worldA website started in August2010 (ipaidabribe.com) hasbeen so popular that similarsites have been launchedaround the world. The sitesall provide a similar service:a way for citizens to anonymouslyconfess bribes paid<strong>and</strong> bribes requested butnot paid. Ipaidabribe.com,sponsored by the nonpr<strong>of</strong>itJanaagraha in India, haslogged more than 400,000such confessions since itslaunch. The anonymousreports include everydayrequests for bribes that privatecitizens face in order tohave documentation or servicesdelivered. In a March 5article in The New York Times,Swati Ramanathan, one<strong>of</strong> the website’s founders,said that public <strong>and</strong> privateagencies from 17 countrieshave asked for assistance insetting up equivalent programs.In addition, she saidthat Janaagraha plans t<strong>of</strong>orm an international coalition<strong>of</strong> such groups so theycan share <strong>and</strong> assist eachother.2012 <strong>Compliance</strong> & ETHICS INSTITUTE PREVIEWsession 507: Automating <strong>Compliance</strong> in the iPhone AgeTuesday, October 16, 2012, 11:00 am – 12:00 pmAre you using the power <strong>of</strong> automation inyour compliance program? Are you keepingup with a younger workforce that wantsto communicate via social networking?Are your compliance materials painlesslyRead the latest news online · www.corporatecompliance.org/newsTheodore Banks,President,<strong>Compliance</strong> & CompetitionConsultants, LLCavailable on smartphones or pad computers? Are you harnessing the the latestin behavioral analytics to really underst<strong>and</strong> your corporate culture—<strong>and</strong> theweaknesses that your compliance program must address? Are there ways toleverage automation to make a shrinking budget do more? These <strong>and</strong> otherrelated subjects will be discussed in our session "Automating <strong>Compliance</strong> inthe iPhone Age.”Attend SCCE’s 11th Annual <strong>Compliance</strong> & <strong>Ethics</strong> Institute in Las Vegas, NV,to hear more! Visit www.complianceethicsinstitute.org for more information.<strong>Compliance</strong> & <strong>Ethics</strong> Pr<strong>of</strong>essional May/June 2012+1 952 933 4977 or 888 277 4977 | www.corporatecompliance.org 7

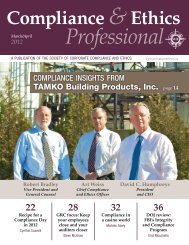

www.corporatecompliance.orgCALL FOR AUTHORSShare your expertise in <strong>Compliance</strong> & <strong>Ethics</strong> Pr<strong>of</strong>essional,published bimonthly by the <strong>Society</strong> <strong>of</strong> <strong>Corporate</strong> <strong>Compliance</strong> <strong>and</strong> <strong>Ethics</strong> (SCCE). For pr<strong>of</strong>essionals in thefield, SCCE is the ultimate source <strong>of</strong> compliance <strong>and</strong> ethics information, providing the most current viewson the corporate regulatory environment, internal controls, <strong>and</strong> overall conduct <strong>of</strong> business. National <strong>and</strong>global experts write informative articles, share their knowledge, <strong>and</strong> provide pr<strong>of</strong>essional support so thatreaders can make informed legal <strong>and</strong> cultural corporate decisions.To do this we need your help!We welcome all who wish to propose corporate compliance topics <strong>and</strong> write articles.CERTIFICATION is a great means for revealing anindividual’s story <strong>of</strong> pr<strong>of</strong>essional growth! <strong>Compliance</strong> &<strong>Ethics</strong> Pr<strong>of</strong>essional wants to hear from anyone with a CCEPor CCEP-Fellow certification who is willing to contributean article on the benefits <strong>and</strong> pr<strong>of</strong>essional growth he orshe has derived from certification. The articles submittedshould detail what certification has meant to the individual<strong>and</strong> his or her organization.<strong>Compliance</strong> & <strong>Ethics</strong>March/April2012 Pr<strong>of</strong>essionala publication <strong>of</strong> the society <strong>of</strong> corporate compliance <strong>and</strong> ethicscompliance insights fromTAMKO Building Products, Inc.Robert BradleyVice President <strong>and</strong>General Counsel22Recipe for a<strong>Compliance</strong> Dayin 2012Cynthia Scavelli28GRC focus: Keepyour employeesclose <strong>and</strong> yourauditors closerSteve McGrawArt WeissChief <strong>Compliance</strong><strong>and</strong> <strong>Ethics</strong> Officer32<strong>Compliance</strong> ina casino worldMichele AbelyDavid C. Humphreyspage 14President<strong>and</strong> CEO36DOJ review:FBI’s Integrity<strong>and</strong> <strong>Compliance</strong>ProgramEmil MoschellaPlease note the followingupcoming deadlines forarticle submissions:· May 15, 2012· July 15, 2012· September 15, 2012· November 15, 2012Earn CEUs!Please note that the CCB awards 2 CEUs to authors <strong>of</strong>articles published in <strong>Compliance</strong> & <strong>Ethics</strong> Pr<strong>of</strong>essional.Topics to consider include· Anticipated enforcement trends· Developments in compliance <strong>and</strong> ethics<strong>and</strong> program-related suggestions for riskmitigation· Fraud, bribery, <strong>and</strong> corruption· Securities <strong>and</strong> corporate governance· Labor <strong>and</strong> employment law· Healthcare fraud <strong>and</strong> abuse· Anti-money laundering· Government contracting· Global competition· Intellectual property· Records management <strong>and</strong> business ethics· Best practices· Information on new laws, regulations, <strong>and</strong>rules affecting international compliance<strong>and</strong> ethics governanceIf you are interested in submitting an article for publication in <strong>Compliance</strong> & <strong>Ethics</strong> Pr<strong>of</strong>essional,e-mail Liz Hergert at liz.hergert@corporatecompliance.org

SCCE NewsSCCE conference NewsNational conferences··<strong>Compliance</strong> & <strong>Ethics</strong> Institute,October 14–17, Las Vegas at Ariawww.complianceethicsinstitute.orgGeneral sessions will include:––Why Do We Root for the Good Guy Even IfHe’s Doing Bad? Jon Turteltaub, Director,National Treasure / Jay Kogen, Former Producer,The Simpsons / Chris Bohjalian, New York Timesbestselling author <strong>of</strong> Midwives––Strategies for Enhancing Your Effectiveness asa <strong>Compliance</strong> <strong>and</strong> <strong>Ethics</strong> Officer: Daniel Roach,Co-Chair, SCCE Advisory Board <strong>and</strong> VP <strong>Compliance</strong>& Audit, Dignity Health––<strong>Ethics</strong>, Leadership <strong>and</strong> Temptation in theWorkplace: James B. Stewart, Pulitzer Prize winner<strong>and</strong> columnist for The New York Times, author,Tangled Webs: How False Statements Are UnderminingAmerica: From Martha Stewart to Bernie Mad<strong>of</strong>f––Lessons We Don’t Learn: <strong>Corporate</strong> Sc<strong>and</strong>als,Why We Repeat Them, <strong>and</strong> How We CanLearn From Them: Donna C. Boehme, Principal,<strong>Compliance</strong> Strategists LLC / David J. Heller,Vice President <strong>and</strong> Chief <strong>Ethics</strong> <strong>and</strong> <strong>Compliance</strong>Officer, Edison International / Joseph E. Murphy,Of Counsel, <strong>Compliance</strong> Systems Legal Group··Higher Education <strong>Compliance</strong>Conference, June 3–6, Austin, Texaswww.highereducationcompliance.orgSessions will include:––Defining <strong>and</strong> Communicating the Role <strong>of</strong><strong>Compliance</strong> & <strong>Ethics</strong>: Adam Turteltaub, VicePresident <strong>of</strong> Membership Development, <strong>Society</strong><strong>of</strong> <strong>Corporate</strong> <strong>Compliance</strong> & <strong>Ethics</strong> (moderator) /Donna McNeely, University <strong>Ethics</strong> Officer, University<strong>of</strong> Illinois / Grace Fisher Renbarger, Former VicePresident <strong>and</strong> Chief <strong>Ethics</strong> & <strong>Compliance</strong> Officer forDell Inc. / Kimberly F. Turner, Chief Audit Executive,Texas Tech University System––Behavioral <strong>Ethics</strong>: Why Good People Do BadThings: Robert Prentice, Pr<strong>of</strong>essor <strong>of</strong> Business Law<strong>and</strong> Business <strong>Ethics</strong> in the Business, Government &<strong>Society</strong> Department, McCombs School <strong>of</strong> Business,University <strong>of</strong> TexasAcademieswww.corporatecompliance.org/academiesAcademies address methods for implementing<strong>and</strong> managing compliance programs basedon the Seven Element Approach. Courseswill address subject matter in each <strong>of</strong> theseareas <strong>and</strong> better prepare interested parties forthe CCEP ® exam. The Academy is designedfor participants with a general knowledge <strong>of</strong>compliance concepts <strong>and</strong> anyone working in acompliance function.Regional conferenceswww.corporatecompliance.org/regionalSCCE’s regional conferences are one-dayprograms designed to provide the hot topics<strong>and</strong> practical information that compliancepr<strong>of</strong>essionals need to create <strong>and</strong> maintaincompliance programs in a variety <strong>of</strong> industries.Upcoming 2012 regionals include:··New York, May 18··Anchorage, June 15··San Francisco, June 22··Atlanta, October 12··Houston, November 2Web conferenceswww.corporatecompliance.org/webconferencesSCCE members save $850 by purchasinga web conference subscription. Select 10individual sessions for only $900 (versus $1,750if purchased separately).Find the latest conference information online · www.corporatecompliance.org/events<strong>Compliance</strong> & <strong>Ethics</strong> Pr<strong>of</strong>essional May/June 2012+1 952 933 4977 or 888 277 4977 | www.corporatecompliance.org 9

SCCE NewsSCCE website NewsContact Tracey Page at +1 952 405 7936 or email her at tracey.page@corporatecompliance.org with any questions about SCCE’s website.SCCE website redesignOn May 16, you will notice the SCCE website has been redesigned.We still have all the same information listed online as before, but weorganized it so it’s easier to locate <strong>and</strong> use.A few <strong>of</strong> the major updates included in SCCE’s redesign are:··Improved navigation··Easier registration for events··Simpler product ordering··More efficient processing for memberships <strong>and</strong> renewals··Better CEU tracking··And much more!If you are having trouble finding anything in the coming weeks,please do not hesitate to call our <strong>of</strong>fice or email us to ask for something:helpteam @ corporatecompliance.org or +1 952 988 0141<strong>Compliance</strong> & <strong>Ethics</strong> Pr<strong>of</strong>essional May/June 2012Don’t forget to earn your CCB CEUs for this issueComplete the <strong>Compliance</strong> & <strong>Ethics</strong> Pr<strong>of</strong>essional CEUquiz for the articles below from this issue:··Overzealous I-9 compliance can result ina discrimination lawsuit, by Justin Estep(page 50)··<strong>Corporate</strong> codes <strong>of</strong> conduct in theUnited States, by Gilbert Geis, PhD <strong>and</strong>Henry N. Pontell, PhD (page 54)··Social media evidence: A new accountability,by Dawn Lomer (page 66)To complete the quiz:Visit www.corporatecompliance.org/quiz, thenselect a quiz, fill in your contact information, <strong>and</strong>answer the questions. The online quiz is self-scoring<strong>and</strong> you will see your results immediately.You may also fax or mail the completed quiz to CCB:Fax: +1 952 988 0146mail:Find the latest SCCE website updates online · www.corporatecompliance.org<strong>Compliance</strong> Certification Board6500 Barrie Road, Suite 250Minneapolis, MN 55435, United StatesQuestions? Call CCB at +1 952 933 4977 or888 277 4977.To receive one (1) CEU for successfully completingthe quiz, you must answer at least three questionscorrectly. Quizzes received after the expiration dateindicated on the quiz will not be accepted. Eachquiz is valid for 12 months, starting with the month<strong>of</strong> issue. Only the first attempt at each quiz will beaccepted.10 www.corporatecompliance.org +1 952 933 4977 or 888 277 4977

SCCE NewsNewsContact Eric Newman at +1 952 405 7938 or email him at eric.newman@corporatecompliance.org with any questions about SCCEnet.SCCEnet (www.corporatecompliance.org/SCCEnet) is the mostcomprehensive social network for compliance pr<strong>of</strong>essionals.Subscribe to dozens <strong>of</strong> discussion groups <strong>and</strong> get yourcompliance questions answered. Stay informed on the latestcorporate compliance news <strong>and</strong> information. Network with yourcolleagues <strong>and</strong> stay connected with our mobile app.Subscribe to the following SCCEnet compliancediscussion groups:··Go to www.corporatecompliance.org/groups <strong>and</strong>click “My Subscriptions” to subscribe todiscussion groups <strong>and</strong> participate.––2012 SCCE <strong>Compliance</strong> <strong>and</strong> <strong>Ethics</strong> Institute––Multi-Industry Auditing <strong>and</strong> Monitoring<strong>Compliance</strong> Network––Multi-Industry Chief <strong>Compliance</strong><strong>Ethics</strong> Officer Network––Multi-Industry Global <strong>Compliance</strong> <strong>and</strong><strong>Ethics</strong> Community––Multi-Industry <strong>Ethics</strong> Forum––Communication Training <strong>and</strong> Curriculum Development––Competition Law <strong>and</strong> Antitrust Network––<strong>Compliance</strong> Risk Management––European <strong>Compliance</strong> <strong>and</strong> <strong>Ethics</strong>––FCPA: Foreign Corrupt Practices Act Forum––Financial Institutions Network––Higher Education Forum––Investment Management Forum––SCCE <strong>Compliance</strong> Academies––Social Media <strong>Compliance</strong>––Social Responsibility Forum––Utilities <strong>and</strong> Energy NetworkPopular SCCEnet discussions··Multi-Industry Chief <strong>Compliance</strong> <strong>Ethics</strong>Officer Network––What’s a CLO? Book review for “The Cost <strong>of</strong><strong>Compliance</strong>” shows unfamiliarity with “<strong>Compliance</strong>Officer” title: http://bit.ly/whatsaclo––In praise <strong>of</strong> <strong>of</strong>fice politics:http://bit.ly/praise<strong>of</strong>ficepolitics––New EU privacy rules: http://bit.ly/euprivacy––Lawyer who spotted broker fraud rewarded with5-year SEC ordeal: http://bit.ly/sec5year··Multi-Industry Auditing <strong>and</strong> Monitoring<strong>Compliance</strong> Network––Companies should use metrics to defend themselvesfrom Dodd-Frank whistleblower claims, report says:http://bit.ly/doddfrankmetrics··Multi-Industry <strong>Ethics</strong> Forum:Ideals <strong>and</strong> <strong>Ethics</strong>––The next business edge? http://bit.ly/idealsethics––Giving back: http://bit.ly/givingbackethics··FCPA: Foreign Corrupt Practices Act Forum––FCPA Fines/Penalties: http://bit.ly/fcpafinesUpdate your SCCEnet pr<strong>of</strong>ile using LinkedIn ®··You can update your SCCEnet pr<strong>of</strong>ile withinformation from your LinkedIn ® pr<strong>of</strong>ile.Instructions at www.corporatecompliance.org/updatepr<strong>of</strong>ileWatch compliance videos on YouTube··Subscribe to SCCE’s YouTube channel:www.youtube.com/compliancevideosSCCE is now on Google+··Add SCCE to your circles:www.corporatecompliance.org/googleFind the latest SCCEnet updates online · www.corporatecompliance.org/sccenet<strong>Compliance</strong> & <strong>Ethics</strong> Pr<strong>of</strong>essional May/June 2012+1 952 933 4977 or 888 277 4977 | www.corporatecompliance.org 11

People on the Move<strong>Compliance</strong> & <strong>Ethics</strong> Pr<strong>of</strong>essional May/June 2012· Cynthia Scavelli, Esq.,CCEP, FIS <strong>Corporate</strong><strong>Compliance</strong> & <strong>Ethics</strong> Counsel,has been selected as one<strong>of</strong> The Jacksonville BusinessJournal’s “40 Under 40” for2012. Scavelli has also beenappointed as the new leader<strong>of</strong> the Northeast Florida<strong>Compliance</strong> <strong>and</strong> <strong>Ethics</strong> UserGroup for 2012 in Jacksonville,Florida. The group servesas a resource to companies,community organizations,<strong>and</strong> governmental agencies inNortheast Florida to promoteawareness <strong>and</strong> influence, educate,<strong>and</strong> support the value<strong>of</strong> compliance <strong>and</strong> ethicsprograms in business <strong>and</strong> ourcommunity.· On March 5, 2012, Lisa D.Pleasant was appointed the<strong>Compliance</strong> Manager for St.John’s Community Services <strong>of</strong>Washington DC, a nonpr<strong>of</strong>itorganization committed toadvancing community supportopportunities for peopleliving with disabilities. Shewas the Regulatory AffairsCoordinator for Aria Health,a hospital in Philadelphia,<strong>and</strong> she is the former <strong>Ethics</strong>Specialist <strong>and</strong> Alternate<strong>Ethics</strong> Liaison Officer for theUniversity <strong>of</strong> Medicine <strong>and</strong>Dentistry <strong>of</strong> New Jersey.Peopleon theMove· David Childers has beennamed Chief ExecutiveOfficer at Compli, a provider<strong>of</strong> on-dem<strong>and</strong>Human Resources, Safety,<strong>and</strong> <strong>Compliance</strong> managements<strong>of</strong>tware. Lon Leneve,President <strong>of</strong> Compli, says,“David is a pioneer in theGRC field <strong>and</strong> has a trackrecord for being one <strong>of</strong> themost dynamic <strong>and</strong> innovativeindividuals in the industry.”Prior to joining Compli,Childers was a founder <strong>and</strong>CEO <strong>of</strong> <strong>Ethics</strong>Point, one<strong>of</strong> the leading global riskawareness organizations.Childers sits on the Board <strong>of</strong>SCCE <strong>and</strong> is a member <strong>of</strong> the<strong>Ethics</strong> & <strong>Compliance</strong> OfficerAssociation (ECOA), theInternational Association <strong>of</strong>Privacy Pr<strong>of</strong>essionals (IAPP),<strong>and</strong> a charter member <strong>of</strong> theOpen <strong>Compliance</strong> <strong>Ethics</strong>Group, where he has been recognizedas an OCEG Fellow.· Newbridge SecuritiesCorporation (NSC) is excitedto announce the addition<strong>of</strong> Michael Bernadino toserve as Chief <strong>Compliance</strong>Officer, effective February13, 2012. Bernadino is athirty-five-year veteran <strong>of</strong> thesecurities industry <strong>and</strong> foundingpartner at IJL FinancialAdvisors, LLC in Charlotte,NC. Todd Newton, President<strong>and</strong> Co-CEO <strong>of</strong> Newbridge,says, “Mike brings a reputation<strong>of</strong> underst<strong>and</strong>ing thefinancial advisors needswhile maintaining soundrelationships with the variousregulatory agencies towhich we report.” NSC is aFINRA member broker-dealerthat engages in full servicesecurities brokerage, investmentbanking, <strong>and</strong> advisoryservices for individuals <strong>and</strong>institutional customers.Received a promotion? Have anew hire in your department? ·If you’ve received a promotion, award, or degree;accepted a new position; or added a new staffmember to your <strong>Compliance</strong> department, please letus know. It’s a great way to keep the compliancecommunity up-to-date. Send your updates toliz.hergert@corporatecompliance.org.12 www.corporatecompliance.org +1 952 933 4977 or 888 277 4977

Help Keep Your<strong>Compliance</strong> ProgramFully StaffedList Your Job OpeningsOnline with SCCEIt’s hard to have an effective compliance <strong>and</strong> ethicsprogram when you have openings on your team.Help fill those openings quickly—list your compliancejob opportunities with the <strong>Society</strong> <strong>of</strong> <strong>Corporate</strong><strong>Compliance</strong> <strong>and</strong> <strong>Ethics</strong>.Benefits include:• Listing is posted for 90 days to maximize exposure• Targeted audience• Your ad is also included in our monthly SCCE JobsNewsletter, which reaches more than 14,000 emailsDon’t leave your compliance positions open any longerthan necessary. Post your job listings with SCCE today.www.corporatecompliance.org/newjobsor call +1 952 933 4977 or 888 277 4977

FeatureFBI <strong>Corporate</strong> <strong>Compliance</strong> Officer Outreach EventOctober 25–26, 2011 • Washington, DC & Quantico, Virginiaby Adam TurteltaubTwo days with the FBI<strong>Compliance</strong> & <strong>Ethics</strong> Pr<strong>of</strong>essional May/June 2012When compliance <strong>and</strong> ethics pr<strong>of</strong>essionalshear “FBI,” the initialreaction is likely one <strong>of</strong> fear.There are few things that throw companiesinto more disarray than a dawn raid by theBureau.Yet, on October 25 <strong>and</strong> 26, 2011, the FBIturned expectations on their head <strong>and</strong> playedhost to the <strong>Ethics</strong> <strong>and</strong> <strong>Compliance</strong> pr<strong>of</strong>ession.In a fascinating two-day event, held atheadquarters in Washington DC <strong>and</strong> its trainingfacilities in Quantico, Virginia, the FBIhighlighted its internal compliance program<strong>and</strong> the effect it is having on both its agents<strong>and</strong> pr<strong>of</strong>essional staff. In cooperation with the<strong>Society</strong> <strong>of</strong> <strong>Corporate</strong> <strong>Compliance</strong> <strong>and</strong> <strong>Ethics</strong>,the FBI provided approximately 50 compliancepr<strong>of</strong>essionals with a rare look inside its program<strong>and</strong> the Bureau’s operations.The program was led by Patrick W.Kelley, an SCCE member <strong>and</strong> AssistantDirector <strong>of</strong> the FBI’s Office <strong>of</strong> Integrity <strong>and</strong><strong>Compliance</strong>, a position which reports toFBI Director Robert S. Mueller III throughDeputy Director Sean Joyce. The FBI is therare agency <strong>of</strong> the federal government thathas a compliance program.Like many private sector programs, theFBI’s was born out <strong>of</strong> actions that fell outside<strong>of</strong> the law. The misuse <strong>of</strong> National SecurityLetters (an investigative tool analogous to anadministrative subpoena) led to a comprehensiveexamination <strong>of</strong> how to prevent anyfuture abuses, including the development <strong>of</strong> acompliance program.As part <strong>of</strong> its research into how to build acompliance program, the FBI quickly realizedthat there was much that could be learnedfrom the private sector <strong>and</strong> began reaching outto the corporate compliance community. SCCEmet with the Bureau for a full day, as part <strong>of</strong>that process, <strong>and</strong> shared its expertise.The program on October 25 <strong>and</strong> 26 wasa “thank you” to the <strong>Compliance</strong> communityfor its support. It was also a reflection<strong>of</strong> the importance that FBI Director Robert14 www.corporatecompliance.org +1 952 933 4977 or 888 277 4977

FeatureMueller places on compliance programs. AsPatrick Kelley noted, “He recognizes you asthe first line <strong>of</strong> defense.” The program beganwith Kelley outlining the mission <strong>of</strong> the FBI,which places prevention <strong>of</strong> terrorism as itsfirst priority.He also shared the Bureau’s motto—Fidelity, Bravery, Integrity—noting thatintegrity is very much at the core <strong>of</strong> theBureau’s compliance program. It is even one<strong>of</strong> the organization’s core values, he explained.Director Mueller said, “In fact, integrity is thevalue that binds together the very fabric <strong>of</strong> ourinstitutional identity. It defines us <strong>and</strong> whatwe st<strong>and</strong> for; it is how we operate <strong>and</strong> how wemeasure our success. In short, integrity is thetouchstone for everything we do.”All new Special Agents <strong>of</strong> the FBI receiveeight hours <strong>of</strong> ethics training, versus thest<strong>and</strong>ard <strong>of</strong> just one hour for most federalemployees. In addition, immediately prior tobeing sworn in for their positions, every FBIemployee is shown a video that highlightsthe Bureau’s core values. The inspiring productionfeatures FBI employees who faceddifficult decisions in which they were guidedby the core values.“We thought that using real FBI personnelto tell real FBI stories to illustrate each <strong>of</strong>the core values would be the best way to reachboth experienced <strong>and</strong> new employees, <strong>and</strong> toshow that the values really are more than justwords,” said Kelley.The compliance <strong>and</strong> ethics programdoesn’t stop with the video, though. Thereis a permanent <strong>of</strong>fice with a total staff <strong>of</strong> 17people. In addition, compliance managementcommittees, organized along branch or functionallines, meet each quarter, <strong>and</strong> there is aformal meeting every four months with theFBI director <strong>and</strong> the top executives to reviewthe program <strong>and</strong> the risk areas.Attendees left favorably impressed by theFBI’s efforts. “I left with a deeper appreciation<strong>of</strong> the FBI organization. There were manyvaluable lessons to be taken from the program,but one that left a lasting impressionwas the FBI core values. The FBI valuesare ingrained throughout their businessorganization, <strong>and</strong> it is a message that is leveragedfrom the top down to all employees.Everyone is expected to be a leader!” saidTerri Lee, <strong>Corporate</strong> Responsibility Leader <strong>of</strong>the Electric Power Research Institute.The program for the meeting wasn’tsolely about the FBI’s compliance <strong>and</strong> ethicsprogram. It contained a number <strong>of</strong> sessionsdesigned to both enhance the <strong>Compliance</strong>community’s underst<strong>and</strong>ing <strong>of</strong> the FBI <strong>and</strong> <strong>of</strong>compliance risks that the private sector faces.Bryan Smith <strong>of</strong> the Economic Crimes Unitwarned the attendees <strong>of</strong> an uptick in securities<strong>and</strong> commodities fraud, particularly aroundinsider trading. He went on to explain thatthe FBI prioritizes these cases based on factorssuch as systemic risk to the US financialmarket <strong>and</strong> public confidence in the US financialsystem, as well as the number <strong>of</strong> victims.He also provided strong ammunition to thoseadvocating for self-reporting <strong>of</strong> incidents. Heassured the attendees that the companies thatself report <strong>and</strong> cooperate fare far better thanthose that do not.Madeline Payne, an Intelligence Analystwith the Economic Espionage Unit, followedBryan Smith’s presentation. Her focus, <strong>and</strong>that <strong>of</strong> her unit, is protecting trade secretsfrom misappropriation. It’s a significant problem,especially among engineers, because somany trade secrets reside in their heads.It’s also a problem with two fronts for companiesto consider. While most might focus onthe loss <strong>of</strong> a trade secret to a competitor, thereis another grave challenge: the transfer <strong>of</strong> proprietarydata to foreign governments. Thosecommitting this type <strong>of</strong> crime are also significantflight risks, because they are <strong>of</strong>ten nationals<strong>of</strong> the country that they are stealing data for.<strong>Compliance</strong> & <strong>Ethics</strong> Pr<strong>of</strong>essional May/June 2012+1 952 933 4977 or 888 277 4977 | www.corporatecompliance.org 15

FeatureCompanies also need to be alert to therisks <strong>of</strong> money laundering through gift <strong>and</strong>stored-value cards. Increasingly, explainedDouglas Leff, Supervisory Special Agent inthe Asset Forfeiture & Money LaunderingUnit, criminals are taking advantage <strong>of</strong>this virtually untraceable means <strong>of</strong> movingmoney. Companies, particularly retailers,need to be wary <strong>of</strong> unusually high volumes<strong>of</strong> transactions using these instruments.Businesses may also want to consider monitoringemployee expenses which reflectgift card purchases. These purchases maybe innocent, but they may be an indicator<strong>of</strong> a Foreign Corrupt Practices Act(FCPA) violation.every three months, making it difficult toprove who the sender <strong>of</strong> an email was.He also warned companies to be aware <strong>of</strong>the risks <strong>of</strong> cloud computing. The distributedstorage model makes it much more difficultfor law enforcement to identify a criminalafter an intrusion.The day ended with a heated discussion<strong>of</strong> the FCPA. It featured a panel consisting <strong>of</strong>Paula Ebersole, Supervisory Special Agent<strong>of</strong> the FBI’s Washington Field Office; ChrisFavro, a retired FBI agent <strong>and</strong> now SeniorCounsel, <strong>Compliance</strong> <strong>and</strong> Business Conductfor 3M; <strong>and</strong> Charles Duross, Assistant Chief <strong>of</strong>the US Department <strong>of</strong> Justice’s Fraud Section.The conversation included a discussion <strong>of</strong> thedesire <strong>of</strong> the <strong>Compliance</strong> community for theDepartment <strong>of</strong> Justice to provide more informationabout how companies can earn creditfor their compliance programs.Roy Snell, CEO <strong>of</strong> SCCE <strong>and</strong> the HealthCare <strong>Compliance</strong> Association, pointed out,“This is exactly the kind <strong>of</strong> data we need todemonstrate to CEOs <strong>and</strong> boards the valuethat compliance programs can bring to theirorganizations.”<strong>Compliance</strong> & <strong>Ethics</strong> Pr<strong>of</strong>essional May/June 2012Another emerging risk area is socialmedia. Michael Kolessar, Supervisory SpecialAgent in the Cyber Unit, reported an increasein incidents <strong>of</strong> extortion using social media.He recounted a case in which a disaffectedcustomer threatened to unleash a torrent <strong>of</strong>online complaints about a company unlessit agreed to his dem<strong>and</strong>s. Kolessar urgedcompanies to report these dem<strong>and</strong>s to lawenforcement promptly while the data is readilyaccessible. Contrary to the belief that digitalcommunications last forever, he explained thatmany Internet providers purge their recordsDay Two <strong>of</strong> the program took place at theFBI’s training facility in Quantico, Virginia.The tour included the Memorial Wall, whichhonors agents killed in the line <strong>of</strong> duty, <strong>and</strong>famed Hogan’s Alley, a few Hollywood-builtcity blocks designed to give agents the opportunityto train in “real life” settings.The training in enforcement for recruitsalso includes 40 hours <strong>of</strong> legal education,the group learned. Lisa Baker, Chief <strong>of</strong> theLegal Instruction Unit, shared a portion <strong>of</strong>the training on the protection <strong>of</strong> civil rights.This program helps recruits underst<strong>and</strong> thesource <strong>of</strong> their authority, as well as the limits<strong>of</strong> it, <strong>and</strong> the value <strong>of</strong> adhering to thoselimits. This portion <strong>of</strong> the training beginswith the U.S. Constitution <strong>and</strong> Bill <strong>of</strong> Rights,16 www.corporatecompliance.org +1 952 933 4977 or 888 277 4977

Featurea copy <strong>of</strong> which is provided to each recruit.To drive the lessons home, the trainingincludes examples <strong>of</strong> the risks that can occurwhen those Constitutional boundaries arebreached.COINTELPRO, a program from severaldecades ago that monitored people the FBIhad deemed a potential threat to the nation,is one <strong>of</strong> the incidents studies. This programonce included a list <strong>of</strong> more than 26,000Americans to be “rounded up” in case <strong>of</strong>a national emergency. The investigation <strong>of</strong>COINTELPRO led to significant changeswithin the FBI, including a set <strong>of</strong> guidelinesfor the FBI that would form the basis <strong>of</strong> itscompliance program.Baker explained that the policy environmentfor domestic operations is now basedon the Constitution, federal statutes, <strong>and</strong>Executive Orders, plus the Attorney GeneralGuidelines, the FBI Domestic Investigation<strong>and</strong> Operational Guide, as well as BureauProgram Policy Implementation Guides.Together these are used to direct the FBI’soperations <strong>and</strong> ensure they comply with thelaw <strong>and</strong> the Bureau’s own st<strong>and</strong>ards.In addition, the FBI operates under aset <strong>of</strong> core values, Patrick Kelley explained.These are:··Rigorous obedience to the Constitution <strong>of</strong>the United States··Respect for the dignity <strong>of</strong> all thosewe protect··Compassion··Fairness··Uncompromising personal <strong>and</strong>institutional integrity··Accountability by accepting responsibilityfor our actions <strong>and</strong> decisions <strong>and</strong> theirconsequences··Leadership, by example, both personal<strong>and</strong> pr<strong>of</strong>essionalThese values help define how the FBIviews itself. For example, according to theFBI’s internal ethics manual: “It is our policyto comply fully with all laws, regulations,<strong>and</strong> rules governing our operations, programs<strong>and</strong> activities…Public service is apublic trust. Those <strong>of</strong> us lucky enough toserve the public in <strong>and</strong> through this greatorganization must adhere to that principle ineverything we do.”The day concluded with a fascinating <strong>and</strong>fun peek into how agents are trained to takethose values <strong>and</strong> the law, <strong>and</strong> apply themwhen facing a scenario in which deadly forcemay be used.<strong>Compliance</strong> & <strong>Ethics</strong> Pr<strong>of</strong>essional May/June 2012+1 952 933 4977 or 888 277 4977 | www.corporatecompliance.org 17

TMFeatureCarl Benoit, Supervisory Special Agent<strong>and</strong> instructor at Quantico, gave the attendeesa sample <strong>of</strong> a two-day training programin which scenes play out on a screen <strong>and</strong>participants (in the case <strong>of</strong> this program,three female <strong>and</strong> one male attendee) had todecide both whether to shoot <strong>and</strong> when. Theirresults were shown on the screen <strong>and</strong> dissectedby Benoit. This session illuminated theConstitutional requirements <strong>and</strong> SupremeCourt interpretations <strong>of</strong> when deadly forcemay be used, <strong>and</strong> how difficult it can be to dothe right thing in a fast-evolving situation inwhich the time between a simple confrontation<strong>and</strong> shots fired by a suspect could be lessthan two seconds.“The ‘Deadly Force’ exercise was particularlyamazing to me,” reported Jim Brigham,Vice President Internal Audit at Petco. “I didn’treally appreciate how quickly <strong>and</strong> decisivelyagents have to act until I went through thisexercise. Even though I knew the exercise washarmless, as the screen counted down to thescene I could feel my anticipation grow. Asthe suspect on the screen turned around, Icould see the gun at his waistline. He startedto run <strong>and</strong> pull his gun <strong>and</strong> I started to shoot.I was much too late <strong>and</strong>, in the excitement,far too inaccurate. This was an incredibleteaching tool which only reinforced my admiration<strong>of</strong> the men <strong>and</strong> women who serve us asFBI agents.”In sum, it was an insightful two days. Ithelped the compliance <strong>and</strong> ethics pr<strong>of</strong>essionalswho attended to better underst<strong>and</strong> the risksthat they face, the asset the FBI could be to theircompanies, as well as the particularly challengesfaced by FBI agents <strong>and</strong> staff as they liveup to their motto <strong>of</strong> Fidelity, Bravery, Integrity. ✵Adam Turteltaub is Vice President <strong>of</strong> Membership Developmentfor the SCCE in Minneapolis, MN. He may be reached atadam.turteltaub@corporatecompliance.org.the premier social networkfor compliance <strong>and</strong> ethics pr<strong>of</strong>essionals<strong>Compliance</strong> & <strong>Ethics</strong> Pr<strong>of</strong>essional May/June 2012Why should you log on to SCCEnet ?••Get your questions answered in the community discussion groups••Download compliance documents from our community libraries, or share your own••Stay informed on the latest compliance <strong>and</strong> ethics news <strong>and</strong> guidanceLog on at corporatecompliance.org/sccenetAlso visit SCCE on these popular social media sitesJoin our groupfollow us oncorporatecompliance.org/linkedin twitter.com/scce facebook.com/sccecorporatecompliance.org/googleyoutube.com/compliancevideos18 www.corporatecompliance.org +1 952 933 4977 or 888 277 4977

10th AnnualHigher Education<strong>Compliance</strong> ConferenceJune 3–6, 2012 | Austin, TexasAT&T Executive Education Conference CenterCome to Austin, Texas, for the primary networking event for compliance<strong>and</strong> ethics pr<strong>of</strong>essionals within higher education. Don’t miss theoppportunity to gather with your peers <strong>and</strong> discuss emerging issues, sharebest practices, <strong>and</strong> build valuable relationships.Join us in June to hear the following hot topics!• Program Integrity: Juggling <strong>and</strong> Jeopardy• Maximum Efficiency on a Shoestring Budget: Making the Most <strong>of</strong> WhatYou Have• Engaging the University Community in ERM• How to H<strong>and</strong>le Whistleblower Complaints in Higher Education:What Happens after the Whistle Blows• <strong>Compliance</strong> & <strong>Ethics</strong> Programming for Small Campuses: LeveragingResources through Effective Communication across Risk DisciplinesRegister today <strong>and</strong> enjoy the flexibility<strong>of</strong> two conferences for the price <strong>of</strong> one!Complimentary access to HCCA’s Research<strong>Compliance</strong> Conference is included with yourHigher Education <strong>Compliance</strong> Conferenceregistration. The parallel schedule gives youthe freedom to attend sessions at eitherconference—two for the price <strong>of</strong> one.VIEW THE FULL AGENDA & REGISTER ATwww.highereducationcompliance.org

Learn the essentials <strong>of</strong> managing an effective compliance program…Attend SCCE’s 2012BASIC COMPLIANCE & ETHICSACADEMIESin the UNITED STATES, SOUTH AMERICA, EUROPE, <strong>and</strong> ASIAMay 7–10SÃO PAULO, BRAZILJune 11–14SCOTTSDALE, AZJuly 9–12SHANGHAI, CHINAMay 21–24BRUSSELS, BELGIUMJune 25–28SAN DIEGO, CAAugust 13–16BOSTON, MASCCE’s Basic <strong>Compliance</strong> & <strong>Ethics</strong> Academies are three-<strong>and</strong>-ahalf-dayintensive training programs designed to provide youwith the essentials <strong>of</strong> managing an effective compliance <strong>and</strong>ethics program. You’ll be taught by a faculty made up <strong>of</strong> expertswith deep experience in the topics they teach. Be a part <strong>of</strong> theAcademy <strong>and</strong> gain comprehensive knowledge <strong>of</strong>:• St<strong>and</strong>ards, Policies, <strong>and</strong> Procedures• <strong>Compliance</strong> <strong>and</strong> <strong>Ethics</strong> Program Administration• Communications, Education, <strong>and</strong> Training• Monitoring, Auditing, <strong>and</strong> Internal Reporting Systems• Response <strong>and</strong> Investigation, Discipline <strong>and</strong> Incentives• Risk AssessmentAt the end <strong>of</strong> the Academy you can sit for the optional Certified<strong>Compliance</strong> & <strong>Ethics</strong> Pr<strong>of</strong>essional (CCEP) ® exam. The CCEP ®program promotes a st<strong>and</strong>ard <strong>of</strong> requisite knowledge forcompliance <strong>and</strong> ethics, encourages continued personal <strong>and</strong>pr<strong>of</strong>essional growth, <strong>and</strong> enhances the credibility <strong>of</strong> bothcertified pr<strong>of</strong>essionals <strong>and</strong> the compliance programs they staff.SCCE credits earned at the Academy will count towards thecredits required to sit for the certification exam.November 12–15ORLANDO, FLDecember 10–13SAN DIEGO, CA(NOTE: Academy <strong>and</strong> CCEP ® exam are conducted in English at this time.)To learn more about the Academy<strong>and</strong> certification — <strong>and</strong> how theycan help your compliance <strong>and</strong>ethics program, visit us online…www.corporatecompliance.org

Boehme <strong>of</strong> Contentionby Donna BoehmeGoldman Sachs. Culture.Muppets. Talk amongstyourselves.BoehmeYou’ve got to feel pretty bad for theGoldman Sachs PR folks, who probablyspit out their sips <strong>of</strong> triple soyvanilla latte in unison as they turned ontheir iPads to former exec Greg Smith’sexplosive take-this-job-<strong>and</strong>-shove-it resignationin the form <strong>of</strong> a New York Timesop-ed. On the other h<strong>and</strong>, what aperfect made-for-TV movie for those<strong>of</strong> us in the compliance <strong>and</strong> ethicspeanut gallery. You really can’tmake this stuff up.If you haven’t read Smith’s scathingop-ed, “Why I Am LeavingGoldman Sachs,” publicly rebuking the firmfor its “toxic culture” <strong>and</strong> alleging that execsroutinely referred to their clients as “muppets”(British slang for “idiots”—where have youbeen?), here it is. Go ahead, we’ll wait: www.nytimes.com/2012/03/14/opinion/why-i-am-leaving-goldman-sachs.htmlAlthough Goldman, as expected, has vigorouslyrefuted the claims (again, PR peopleworking overtime), this comes at a time whenWall Street firms are under fire for theirgreedy, risk-taking culture that may or maynot have led to the financial meltdown, <strong>and</strong>plays right into the h<strong>and</strong>s <strong>of</strong> those who arguefor more—not less—regulation. For the purpose<strong>of</strong> our discussion here, I’m not votingeither way. For the moment, let’s just file theseobservations under the category <strong>of</strong> “TheThings We Think <strong>and</strong> Do Not Say.”Observation #1: Circle-the-wagons syndrome.Anyone following the speed <strong>of</strong> Wall Streetcircling the wagons could get a bad case <strong>of</strong>whiplash. Connect the dots to Bloomberg’sugly editorial excoriation <strong>of</strong> Smith himself thenext day. www.bloomberg.com/news/2012-03-14/yes-mr-smith-goldman-sachs-is-all-about-makingmoney-view.htmlObservation #2: <strong>Society</strong> still hates snitches.Forget firm culture; as a society, we stillrecoil when people get out <strong>of</strong> line <strong>and</strong> speakup. That’s why Satan created retaliation.Goldman’s counter-attack on Smith was swift<strong>and</strong> continues. In my networks, I’m watchingmany who are usually happy to talk about“tone at the top” <strong>and</strong> “transparency” backaway from this one.Observation #3: The CCO’s fairy tale rarelycomes true.The former CCO in me wants to believeGoldman will take Smith’s criticisms to heart<strong>and</strong> engage their employees in an open dialogueabout ethical culture. But I know thechances <strong>of</strong> that, to quote my all-time favoriteE*Trade talking-baby commercial, “are the sameas being mauled by a polar bear <strong>and</strong> a regularbear in the same day.” www.youtube.com/watch?v=HqVBKO_QM3oAnd that’s my two cents. Now, go <strong>and</strong> talkamongst yourselves! ✵Send comments to Donna Boehme at dboehme@compliancestrategists.com.<strong>Compliance</strong> & <strong>Ethics</strong> Pr<strong>of</strong>essional May/June 2012+1 952 933 4977 or 888 277 4977 | www.corporatecompliance.org 21

SCCE welcomes New Members<strong>Compliance</strong> & <strong>Ethics</strong> Pr<strong>of</strong>essional May/June 2012Arizona··Carmen J<strong>and</strong>acek, Arizona Public Service··Calvin Lickfelt, Strategy AssociatesInternational LLC··Sally Murphy, USAble Life··Stefani Rosenstein, Apollo Group, Inc··Jeremy Schudy, Saguaro SurgicalCalifornia··Michelle Alfi, CBRE··Anne Sullivan Daly, Sutter Health··Stefani Dawkins, Cisco Systems··Patrice Eitner, Corinthian Colleges··Samuel Florio, Santa Clara University··Pamela J. Garretson, The Boeing Company··Phil Grevin, Veterinary Pet InsuranceCompany··Temre L. Hanson, Johnson & Johnson··Kirsten Kempe, Johnson & Johnson··Ishrag Khababa, Satellite Healhcare··Sharon L. Masterson, The Boeing Company··Teresa Merry, Monterey Bay Aquarium··Michael A. Miller, Aerojet··John W. Prager, Jr. , Lusardi Construction Co··David Sterling, Adobe Systems Incorporated··Michael L. Whitcomb, UPRRColorado··Kathryn MarturanoConnecticut··Karen Allison··Ralph Archer, III, Goodrich Corp··Allison Ellis, Frontier Communications··Jonathan Ivec, Iona College··Ariel Zhang, Terex CorpFlorida··William H<strong>of</strong>fman, Satcom Direct, Inc··Pamela Kraska, Daytona College··Anita Mixon··Lisa Sullivan, NextEra Energy··Michael Yount, Wellcare Health PlansGeorgia··Amy K. Andrews-Bennett, UCB Inc··Charles Nugent, The Network··Kent Peters, R<strong>and</strong>stad··Robert R. Rentfrow, Georgia Syst OperationsCorp··Audrey Talley, Private Consultant··Suellyn Tornay, Global Payments IncIllinois··Courtney A. Bartlett, TreeHouse Foods, Inc··Thomas Caputo, Tribune Company··Susan Darow, LRN··Kimberly Dascoli, Walgreen Co··Mark Ewald, DeVry Inc··Bridget A. Glynn, GE··Anthony Jones, State Farm Insurance··Akbar Pasha, Baxter HeatlhcareIowa··Lisa A. Arechaveleta, EMC Insurance··Kayla Fl<strong>and</strong>ers, Pioneer Hi-Bred InternationalKansas··Lynne Valdivia, KFMC, IncKentucky··Michael ONeill, Southern Baptist TheologicalSeminary··Tracey Pender-Link, University <strong>of</strong> LouisvilleLouisiana··Kim Chatelain, Jefferson ParishMaine··Beth HansonMassachusetts··Nick Piccirillo, Abt Associates Inc··Lisa Shea, DePuy Co./Johnson & JohnsonMichigan··Barbara Arleth, Hagerty··Jonathan P. Bricker, SAI Global··Michael Womersley, WalgreensMinnesota··Michael Ayotte, ITC Holdings··Miggie E. Cramblit, Midwest ReliabilityOrganization··Brent Eilefson, Upsher-Smith Laboratories,Inc··Joel Green, Upsher-Smith Laboratories, Inc··Kristina Irvin··Saamahn Mahjouri··Robert Overman, Upsher-Smith Laboratories,Inc··Nancy Van Gieson, Upsher-SmithLaboratories, Inc··Robin Wolpert, 3MMissouri··Joy C. Arview, The Boeing Company··Anthony D. Cross, Technolas Perfect Vision··William F. Giese, III, The Boeing Company··Brett Holl<strong>and</strong>, KCP&L··Denise R. Jester, Molina Healthcare··Dean Larson, KCP&L··Chris Parr, KCP&L··Elizabeth A. Scott, Molina Health Care <strong>of</strong>MissouriNebraska··Melanie Scheaffer, Cabela’sNew Jersey··Edward L. Benson, Johnson & Johnson··Brett S. Bissey, UMDNJ··Tamara Brintzingh<strong>of</strong>fer, Johnson & Johnson··Michael R. Clarke, Actavis Inc··Maria Coppinger-Peters, Kearny FederalSavings Bank··Cynthia Coronel, Saint Clare’s Health System··S<strong>and</strong>hya Drinkwater, Johnson & Johnson··Michael Ferrone, Solix, Inc··Patrik Florencio, S<strong>and</strong>oz··Dina Given, Johnson & Johnson··Jane A. Kelly, ZT Systems··Alice A. Leg<strong>and</strong>er, Lockheed Martin··Louis Maus, Koch Modular Process Systems,LLC··Philip Munkacsy, Watson Pharmaceuticals··Elizabeth Rhoades, Novartis/S<strong>and</strong>oz Inc··Roberto Roche, Medco Health Solutions, Inc··Kevin Schatzle, Provide Security LLC··Lori Tasca, Solix Inc··Kathy Tench, Optimer Pharmaceuticals, Inc··Trenor TurnerNew York··Nancy Cohen, The Estee Lauder Companies··Laura Kalick, NYC District Council <strong>of</strong>Carpenters Benefit Funds··Jeffrey Kwastel, New York State Office <strong>of</strong> theAttorney General··Dyana Lee, Thacher Associates··Lynne Plavnick, Volunteers <strong>of</strong> America··Lauren Shy, PepsiCo, IncNorth Carolina··Genevieve M. Black, United Therapeutics··Kirk Crowder, ArchimicaNOrth Dakota··Duane A. Peterson, Green Iron Equipment22 www.corporatecompliance.org +1 952 933 4977 or 888 277 4977

Ohio··Tim Butler, Teradata Corp··Todd B. Carver, Teradata Corp··Karl Dahlquist, Johnson & Johnson··Hal Greig, ATSG Inc··Adam S. Poe, Mettler-Toledo International Inc··Jeanette Ponds, Teradata Corp··Molly Treese, Teradata Corp··Gary D. Huneryager, OG&EPennsylvania··Deborah Cameron, Synthes Inc··Am<strong>and</strong>a C<strong>of</strong>fey, Messiah College··Noah Davis, Rite Aid Corp··Larry Gibson, De Lage L<strong>and</strong>en··Kim Gunter Upshaw, TridentUSA HealthServices··Jennifer Heller, Comcast Corp··M<strong>and</strong>y Morgan, Erie Insurance Group··Andrew Palmer, Rite Aid Corp··Monika G. Rector, Johnson & Johnson··Christina Serra, Harsco··Hector T. Torres, Carlow UniversitySouth Carolina··Perceffenessee Cantey, AllSouth FCU··Katie Walter, Michelin North America, IncTennessee··Leigh Cheek, University <strong>of</strong> Tennessee··Melissa F. Kell, Walden SecurityTexas··Shirley Allen, Hewlett Packard (HP)··Lincoln Arneal, The University <strong>of</strong> TexasIntercollegiate Athletics··Andrew Baird, GE Oil & Gas··Corey S. Bradford, Prairie View A&MUniversity··Jeff Brockmann, NRG Energy··John Bui, Green Mountain Energy Company··Michelle Renee Dunaway, Scientific DrillingInternational, Inc··Angie D. Gallardo, ConocoPhillips··Steven Gyeszly, Weatherford··Brenda E. Hart, Baylor College <strong>of</strong> Medicine··Stephanie G John, Newfield ExplorationCompany··Reba Leonard, Homel<strong>and</strong> HealthCare, Inc··Esteban Majlat, ConocoPhillips Company··Donna Reed, GE Oil & Gas··Graham Vanhegan, ConocoPhillips··Melissa Wilson, WillbrosVirginia··Donna Abernathy, W.F. Magann Corp··Bill Anderson, DuPont Sustainable Solutions··Joan Andrew, CGI Federal··Douglas A. Hardman, TerreStar Networks Inc··Brian Jenkins, ALON, Inc··Ellen Miles, Zeiders Enterprises, Inc··Melissa Novak, HP··Christopher Sp<strong>of</strong>ford, MicroAire SurgicalInstruments LLC··Katharine Warren, Northrop GrummanWashington··James L. Baggs, Seattle City Light··Lyn Cameron, Micros<strong>of</strong>t Corp··Marie M. Rice, Ambassadors Group, Inc··Charles Ruthford, Intensional Connection,LLC··Nancy Thomas-MooreWisconsin··Val Lehner, ATC (American TransmissionCompany)Washington, DC··Jackie Richardson, FTI ConsultingVirgin Isl<strong>and</strong>s··John F. Lewis, Lewis ConsultingAustralia··Lloyd Kinzett, Harsco CorpBelgium··Gunnar WieboldtBrazil··Renata Oliveira, Machado Meyer Sendacz EOpice Ltda··Rogeria Carla Pergia Assis, Prudential DoBrasil Seguros De Vida SA··Francisco Niclos Negrao, Maganery Nery EDias··Bruno Ferreira Ferraz Camargo, Philips DoBrasil Ltda··Rogeria P.B.R. Gieremek, Serasa Experian··Marcia Muniz, Hyundai Motor Brasil··Maria Claudia Murr, Hewlett Packard··Marcela Pascoareli, Machado MeyerSendacz E Opice Advogados··Mauro Theobald, Grupo MaristaCanada··Richard Khambatta, Integrated PharmaServices IncChina··Xiang Han, MercerEngl<strong>and</strong>··Dan Aharon, DSPS GlobalGermany··Jannica Houben, Tech Data Europe GmbHPakistan··Sultan Ali, RiskDiscovered(BackgroundCheck Private Limited)··Saima Qaiser, RiskDiscovered(BackgroundCheck Private Limited)··Danish Thanvi, RiskDiscovered(BackgroundCheck Private Limited)··Khurram Zahid, RiskDiscovered(BackgroundCheck Private Limited)Romania··Dumitru Uta, Eli Lilly <strong>and</strong> CompanySwitzerl<strong>and</strong>··David Huegin, Clariant International LTD··S<strong>of</strong>ie Melis, Eli Lilly Export S.AUAE··Hind Abdulla Al Shehi, MubadalaDevelopment Company··Kurt L Drake, Mubadala DevelopmentCompanyUK··Lin Forbes Brown, BP International··Tuula Nieminen<strong>Compliance</strong> & <strong>Ethics</strong> Pr<strong>of</strong>essional May/June 2012+1 952 933 4977 or 888 277 4977 | www.corporatecompliance.org 23

Featureby Robert BondUnderst<strong>and</strong>ing the proposedEU data protection regulation»»The EU is in the process <strong>of</strong> revising its data privacy regime to harmonise data protection across its member states.»»The propsed Data Protection Framework will implement greater enforcement powers that apply to both data controllers<strong>and</strong> data processors.»»The Framework will focus on consent, breaches, data transfers, accountability, <strong>and</strong> liability.»»Individuals will have greater control <strong>of</strong> their personal data, <strong>and</strong> special protections for the data <strong>of</strong> children are included.»»Foreign businesses that target EU citizens will incur significant compliance obligations.<strong>Compliance</strong> & <strong>Ethics</strong> Pr<strong>of</strong>essional May/June 2012BondOver the past few years, the EuropeanUnion (EU) has been consultingwith key stakeholders on the need tooverhaul the EU data privacy regime <strong>and</strong> toproduce a harmonized general data protectionframework.On the November 29, 2011, theEuropean Commission “leaked”an updated version <strong>of</strong> its draftGeneral Data Protection Regulation(Regulation) intended to producea harmonized Data ProtectionFramework for the EU, which amongother things will repeal the DataProtection Directive (95/46/EC). The proposedRegulation was finally announced on January25, 2012.The intention <strong>of</strong> the Regulation is “tobuild a stronger <strong>and</strong> more coherent DataProtection Framework in the EU, backed bystrong enforcement that will allow the digitaleconomy to develop across the internal market,put individuals in control <strong>of</strong> their own data,<strong>and</strong> reinforce legal <strong>and</strong> practical certaintyfor economic operators <strong>and</strong> public authorities.”However, the Regulation in its currentform imposes significant changes to the wayin which businesses will have to comply withdata protection laws <strong>and</strong> regulations in the EU.The European Commission considers thata Regulationwill be the most appropriate legal instrumentto define the framework for theprotection <strong>of</strong> personal data in the EU, sincethe direct applicability <strong>of</strong> the Regulationwill reduce legal fragmentation <strong>and</strong> providegreater legal certainty by introducinga harmonized set <strong>of</strong> core rules, improvingthe protection <strong>of</strong> fundamental rights <strong>of</strong>individuals, <strong>and</strong> contributing to the functionality<strong>of</strong> the internal market.The key principles <strong>of</strong> the Data ProtectionDirective <strong>and</strong> the majority <strong>of</strong> the definitionstherein remain the same. However, thereare significant changes to some definitions,clarification over some <strong>of</strong> the principles (inparticular, consent), <strong>and</strong> reinforcement <strong>of</strong>current solutions for data transfers. Mostimportantly, there are new obligations for boththe data controller <strong>and</strong> the data processor withrespect to the role <strong>of</strong> the data protection <strong>of</strong>ficer,as well as obligations involving m<strong>and</strong>atoryreporting <strong>of</strong> data breaches, dramatic increasesto enforcement powers <strong>and</strong> fines, <strong>and</strong> specificresponsibilities with regard to the personaldata <strong>of</strong> children.24 www.corporatecompliance.org +1 952 933 4977 or 888 277 4977

FeatureBased on the wording <strong>of</strong> the proposedRegulation, businesses with entities in Europethat process personal data, use equipment inthe EU for processing personal data, or are notin the EU but process personal data <strong>of</strong> EU datasubjects or monitor their behavior, will incursignificant compliance obligations.As the Regulation applies to both data controllers<strong>and</strong> data processors, <strong>and</strong> dramaticallyextends the enforcement powers <strong>of</strong> the regulators<strong>and</strong> the fines for non-compliance (i.e., 2%<strong>of</strong> worldwide revenue for negligent or recklessbreach), businesses will need to prepare forinvestment in EU data protection compliance.The current Regulation runs to 116 pages,but our summary <strong>of</strong> the key provisions is asfollows:··The Regulation will be binding on all EUmember states from the date that it comesinto force. That date will be the 20 th dayfollowing the date <strong>of</strong> publication <strong>of</strong> theRegulation in the <strong>of</strong>ficial journal <strong>of</strong> theEuropean Union, <strong>and</strong> the application <strong>of</strong>the Regulation may be two years from theaforementioned date. Our underst<strong>and</strong>ingis that it will take at least a year to debatethe Regulation <strong>and</strong> for it to be approved bythe EU, which means that we can expectthe Regulation to be published in its finalform <strong>and</strong> enter into force in the secondhalf <strong>of</strong> 2013, giving a two-year period forbusinesses to come into compliance by2015, although it is possible that it may beexpedited so as to come in to force by 2014.··The Regulation applies both to data controllers<strong>and</strong> data processors that have eitherlegal entities in the EU, or process personaldata <strong>of</strong> EU data subjects, irrespective <strong>of</strong> thelocation <strong>of</strong> the controller or processor; butthe Regulation does not apply where theprocessing is by an individual purely forpersonal or household activities.··Most <strong>of</strong> the current definitions <strong>of</strong> datasubject, personal data, <strong>and</strong> the like, remainthe same, except that sensitive personaldata now includes genetic <strong>and</strong> biometricinformation, <strong>and</strong> consent is defined as“any freely given specific, informed <strong>and</strong>specific indication <strong>of</strong>” the data subject’ssignification for the purposes <strong>of</strong> processing.Also, “personal data breach” is nowdefined with respect to breach <strong>of</strong> securityfor which new obligations arise.··The data protection principles broadlyremain the same, although it should benoted that consent <strong>and</strong> the mechanismsfor gaining consent are provided in detailin the Regulation. Among other things,the Regulation states that consent cannotbe automatically implied with respect tothe processing <strong>of</strong> employee data, nor withrespect to the processing <strong>of</strong> the data <strong>of</strong> achild, where the child is under the age <strong>of</strong> 13<strong>and</strong> parental consent has not been given.··Fair processing statements or privacynotices will have to be in plain <strong>and</strong> intelligiblelanguage, <strong>and</strong> drafted with certaindata subjects in mind, “in particular forany information addressed specifically toa child” (where a child here is defined asunder the age <strong>of</strong> 18).··In a privacy statement or privacy notice,Article 12 indicates that there needs to bespecific information given to a data subjectwith respect to the nature <strong>and</strong> purposes<strong>of</strong> the processing <strong>of</strong> their data <strong>and</strong> <strong>of</strong> theirrights. There are also detailed requirementsin relation to pr<strong>of</strong>iling <strong>and</strong> the collection <strong>of</strong>data via social network services.· · Although subject access requests are stillpermitted, Article 17 additionally providesthe “right to be forgotten” <strong>and</strong> to have<strong>Compliance</strong> & <strong>Ethics</strong> Pr<strong>of</strong>essional May/June 2012+1 952 933 4977 or 888 277 4977 | www.corporatecompliance.org 25