Compliance & Ethics Professional - Society of Corporate ...

Compliance & Ethics Professional - Society of Corporate ...

Compliance & Ethics Professional - Society of Corporate ...

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

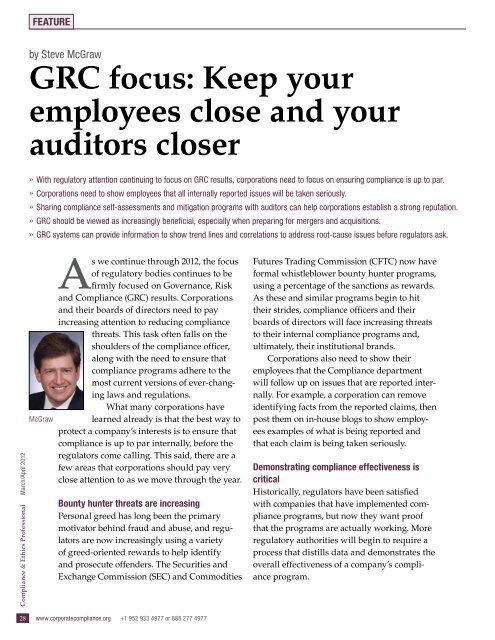

Featureby Steve McGrawGRC focus: Keep youremployees close and yourauditors closer»»With regulatory attention continuing to focus on GRC results, corporations need to focus on ensuring compliance is up to par.»»Corporations need to show employees that all internally reported issues will be taken seriously.»»Sharing compliance self-assessments and mitigation programs with auditors can help corporations establish a strong reputation.»»GRC should be viewed as increasingly beneficial, especially when preparing for mergers and acquisitions.»»GRC systems can provide information to show trend lines and correlations to address root-cause issues before regulators ask.<strong>Compliance</strong> & <strong>Ethics</strong> <strong>Pr<strong>of</strong>essional</strong> March/April 2012McGrawAs we continue through 2012, the focus<strong>of</strong> regulatory bodies continues to befirmly focused on Governance, Riskand <strong>Compliance</strong> (GRC) results. Corporationsand their boards <strong>of</strong> directors need to payincreasing attention to reducing compliancethreats. This task <strong>of</strong>ten falls on theshoulders <strong>of</strong> the compliance <strong>of</strong>ficer,along with the need to ensure thatcompliance programs adhere to themost current versions <strong>of</strong> ever-changinglaws and regulations.What many corporations havelearned already is that the best way toprotect a company’s interests is to ensure thatcompliance is up to par internally, before theregulators come calling. This said, there are afew areas that corporations should pay veryclose attention to as we move through the year.Bounty hunter threats are increasingPersonal greed has long been the primarymotivator behind fraud and abuse, and regulatorsare now increasingly using a variety<strong>of</strong> greed-oriented rewards to help identifyand prosecute <strong>of</strong>fenders. The Securities andExchange Commission (SEC) and CommoditiesFutures Trading Commission (CFTC) now haveformal whistleblower bounty hunter programs,using a percentage <strong>of</strong> the sanctions as rewards.As these and similar programs begin to hittheir strides, compliance <strong>of</strong>ficers and theirboards <strong>of</strong> directors will face increasing threatsto their internal compliance programs and,ultimately, their institutional brands.Corporations also need to show theiremployees that the <strong>Compliance</strong> departmentwill follow up on issues that are reported internally.For example, a corporation can removeidentifying facts from the reported claims, thenpost them on in-house blogs to show employeesexamples <strong>of</strong> what is being reported andthat each claim is being taken seriously.Demonstrating compliance effectiveness iscriticalHistorically, regulators have been satisfiedwith companies that have implemented complianceprograms, but now they want pro<strong>of</strong>that the programs are actually working. Moreregulatory authorities will begin to require aprocess that distills data and demonstrates theoverall effectiveness <strong>of</strong> a company’s complianceprogram.28 www.corporatecompliance.org +1 952 933 4977 or 888 277 4977