egypt telecom sector further tariff cuts are not welcome

egypt telecom sector further tariff cuts are not welcome

egypt telecom sector further tariff cuts are not welcome

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

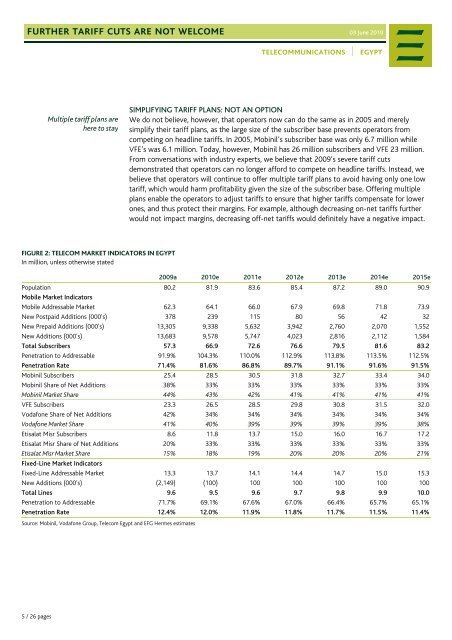

<strong>further</strong> <strong>tariff</strong> <strong>cuts</strong> <strong>are</strong> <strong>not</strong> <strong>welcome</strong> 03 June 2010<strong>telecom</strong>munications │ <strong>egypt</strong>Multiple <strong>tariff</strong> plans <strong>are</strong>here to staySIMPLIFYING TARIFF PLANS: NOT AN OPTIONWe do <strong>not</strong> believe, however, that operators now can do the same as in 2005 and merelysimplify their <strong>tariff</strong> plans, as the large size of the subscriber base prevents operators fromcompeting on headline <strong>tariff</strong>s. In 2005, Mobinil’s subscriber base was only 6.7 million whileVFE’s was 6.1 million. Today, however, Mobinil has 26 million subscribers and VFE 23 million.From conversations with industry experts, we believe that 2009’s severe <strong>tariff</strong> <strong>cuts</strong>demonstrated that operators can no longer afford to compete on headline <strong>tariff</strong>s. Instead, webelieve that operators will continue to offer multiple <strong>tariff</strong> plans to avoid having only one low<strong>tariff</strong>, which would harm profitability given the size of the subscriber base. Offering multipleplans enable the operators to adjust <strong>tariff</strong>s to ensure that higher <strong>tariff</strong>s compensate for lowerones, and thus protect their margins. For example, although decreasing on-net <strong>tariff</strong>s <strong>further</strong>would <strong>not</strong> impact margins, decreasing off-net <strong>tariff</strong>s would definitely have a negative impact.FIGURE 2: TELECOM MARKET INDICATORS IN EGYPTIn million, unless otherwise stated2009a 2010e 2011e 2012e 2013e 2014e 2015ePopulation 80.2 81.9 83.6 85.4 87.2 89.0 90.9Mobile Market IndicatorsMobile Addressable Market 62.3 64.1 66.0 67.9 69.8 71.8 73.9New Postpaid Additions (000's) 378 239 115 80 56 42 32New Prepaid Additions (000's) 13,305 9,338 5,632 3,942 2,760 2,070 1,552New Additions (000's) 13,683 9,578 5,747 4,023 2,816 2,112 1,584Total Subscribers 57.3 66.9 72.6 76.6 79.5 81.6 83.2Penetration to Addressable 91.9% 104.3% 110.0% 112.9% 113.8% 113.5% 112.5%Penetration Rate 71.4% 81.6% 86.8% 89.7% 91.1% 91.6% 91.5%Mobinil Subscribers 25.4 28.5 30.5 31.8 32.7 33.4 34.0Mobinil Sh<strong>are</strong> of Net Additions 38% 33% 33% 33% 33% 33% 33%Mobinil Market Sh<strong>are</strong> 44% 43% 42% 41% 41% 41% 41%VFE Subscribers 23.3 26.5 28.5 29.8 30.8 31.5 32.0Vodafone Sh<strong>are</strong> of Net Additions 42% 34% 34% 34% 34% 34% 34%Vodafone Market Sh<strong>are</strong> 41% 40% 39% 39% 39% 39% 38%Etisalat Misr Subscribers 8.6 11.8 13.7 15.0 16.0 16.7 17.2Etisalat Misr Sh<strong>are</strong> of Net Additions 20% 33% 33% 33% 33% 33% 33%Etisalat Misr Market Sh<strong>are</strong> 15% 18% 19% 20% 20% 20% 21%Fixed-Line Market IndicatorsFixed-Line Addressable Market 13.3 13.7 14.1 14.4 14.7 15.0 15.3New Additions (000's) (2,149) (100) 100 100 100 100 100Total Lines 9.6 9.5 9.6 9.7 9.8 9.9 10.0Penetration to Addressable 71.7% 69.1% 67.6% 67.0% 66.4% 65.7% 65.1%Penetration Rate 12.4% 12.0% 11.9% 11.8% 11.7% 11.5% 11.4%Source: Mobinil, Vodafone Group, Telecom Egypt and EFG Hermes estimates5 / 26 pages