DOOSAN HEAVY INDUSTRIES & CONSTRUCTION CO., LTD. AND ...

DOOSAN HEAVY INDUSTRIES & CONSTRUCTION CO., LTD. AND ...

DOOSAN HEAVY INDUSTRIES & CONSTRUCTION CO., LTD. AND ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

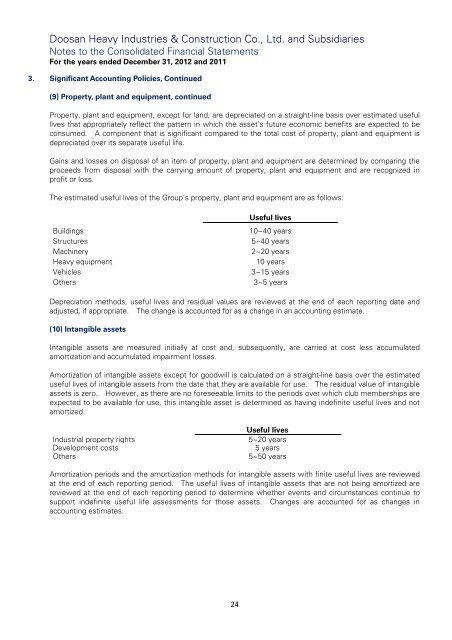

Doosan Heavy Industries & Construction Co., Ltd. and SubsidiariesNotes to the Consolidated Financial StatementsFor the years ended December 31, 2012 and 20113. Significant Accounting Policies, Continued(9) Property, plant and equipment, continuedProperty, plant and equipment, except for land, are depreciated on a straight-line basis over estimated usefullives that appropriately reflect the pattern in which the asset’s future economic benefits are expected to beconsumed. A component that is significant compared to the total cost of property, plant and equipment isdepreciated over its separate useful life.Gains and losses on disposal of an item of property, plant and equipment are determined by comparing theproceeds from disposal with the carrying amount of property, plant and equipment and are recognized inprofit or loss.The estimated useful lives of the Group’s property, plant and equipment are as follows:BuildingsStructuresMachineryHeavy equipmentVehiclesOthersUseful lives10~40 years5~40 years2~20 years10 years3~15 years3~5 yearsDepreciation methods, useful lives and residual values are reviewed at the end of each reporting date andadjusted, if appropriate. The change is accounted for as a change in an accounting estimate.(10) Intangible assetsIntangible assets are measured initially at cost and, subsequently, are carried at cost less accumulatedamortization and accumulated impairment losses.Amortization of intangible assets except for goodwill is calculated on a straight-line basis over the estimateduseful lives of intangible assets from the date that they are available for use. The residual value of intangibleassets is zero. However, as there are no foreseeable limits to the periods over which club memberships areexpected to be available for use, this intangible asset is determined as having indefinite useful lives and notamortized.Industrial property rightsDevelopment costsOthersUseful lives5~20 years5 years5~50 yearsAmortization periods and the amortization methods for intangible assets with finite useful lives are reviewedat the end of each reporting period. The useful lives of intangible assets that are not being amortized arereviewed at the end of each reporting period to determine whether events and circumstances continue tosupport indefinite useful life assessments for those assets. Changes are accounted for as changes inaccounting estimates.24