DOOSAN HEAVY INDUSTRIES & CONSTRUCTION CO., LTD. AND ...

DOOSAN HEAVY INDUSTRIES & CONSTRUCTION CO., LTD. AND ...

DOOSAN HEAVY INDUSTRIES & CONSTRUCTION CO., LTD. AND ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

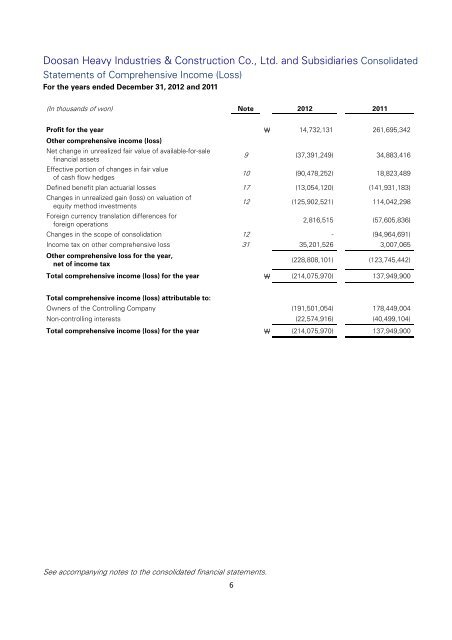

Doosan Heavy Industries & Construction Co., Ltd. and Subsidiaries ConsolidatedStatements of Comprehensive Income (Loss)For the years ended December 31, 2012 and 2011(In thousands of won) Note 2012 2011Profit for the year ₩ 14,732,131 261,695,342Other comprehensive income (loss)Net change in unrealized fair value of available-for-salefinancial assets9 (37,391,249) 34,883,416Effective portion of changes in fair valueof cash flow hedges10 (90,478,252) 18,823,489Defined benefit plan actuarial losses 17 (13,054,120) (141,931,183)Changes in unrealized gain (loss) on valuation ofequity method investments12 (125,902,521) 114,042,298Foreign currency translation differences forforeign operations2,816,515 (57,605,836)Changes in the scope of consolidation 12 - (94,964,691)Income tax on other comprehensive loss 31 35,201,526 3,007,065Other comprehensive loss for the year,net of income tax(228,808,101) (123,745,442)Total comprehensive income (loss) for the year ₩ (214,075,970) 137,949,900Total comprehensive income (loss) attributable to:Owners of the Controlling Company (191,501,054) 178,449,004Non-controlling interests (22,574,916) (40,499,104)Total comprehensive income (loss) for the year ₩ (214,075,970) 137,949,900See accompanying notes to the consolidated financial statements.6