DOOSAN HEAVY INDUSTRIES & CONSTRUCTION CO., LTD. AND ...

DOOSAN HEAVY INDUSTRIES & CONSTRUCTION CO., LTD. AND ...

DOOSAN HEAVY INDUSTRIES & CONSTRUCTION CO., LTD. AND ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

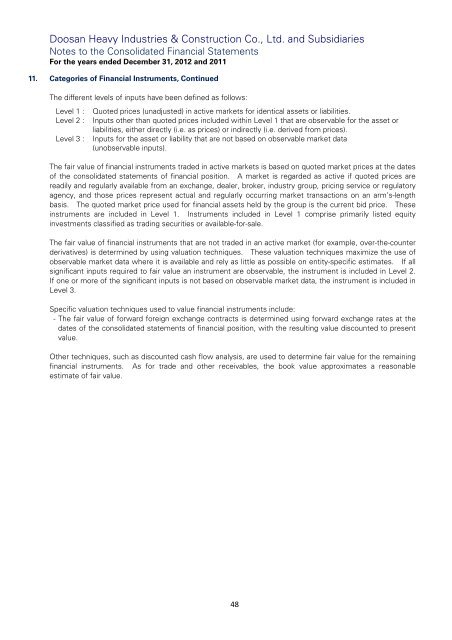

Doosan Heavy Industries & Construction Co., Ltd. and SubsidiariesNotes to the Consolidated Financial StatementsFor the years ended December 31, 2012 and 201111. Categories of Financial Instruments, ContinuedThe different levels of inputs have been defined as follows:Level 1 : Quoted prices (unadjusted) in active markets for identical assets or liabilities.Level 2 : Inputs other than quoted prices included within Level 1 that are observable for the asset orliabilities, either directly (i.e. as prices) or indirectly (i.e. derived from prices).Level 3 : Inputs for the asset or liability that are not based on observable market data(unobservable inputs).The fair value of financial instruments traded in active markets is based on quoted market prices at the datesof the consolidated statements of financial position. A market is regarded as active if quoted prices arereadily and regularly available from an exchange, dealer, broker, industry group, pricing service or regulatoryagency, and those prices represent actual and regularly occurring market transactions on an arm’s-lengthbasis. The quoted market price used for financial assets held by the group is the current bid price. Theseinstruments are included in Level 1. Instruments included in Level 1 comprise primarily listed equityinvestments classified as trading securities or available-for-sale.The fair value of financial instruments that are not traded in an active market (for example, over-the-counterderivatives) is determined by using valuation techniques. These valuation techniques maximize the use ofobservable market data where it is available and rely as little as possible on entity-specific estimates. If allsignificant inputs required to fair value an instrument are observable, the instrument is included in Level 2.If one or more of the significant inputs is not based on observable market data, the instrument is included inLevel 3.Specific valuation techniques used to value financial instruments include:- The fair value of forward foreign exchange contracts is determined using forward exchange rates at thedates of the consolidated statements of financial position, with the resulting value discounted to presentvalue.Other techniques, such as discounted cash flow analysis, are used to determine fair value for the remainingfinancial instruments. As for trade and other receivables, the book value approximates a reasonableestimate of fair value.48