DOOSAN HEAVY INDUSTRIES & CONSTRUCTION CO., LTD. AND ...

DOOSAN HEAVY INDUSTRIES & CONSTRUCTION CO., LTD. AND ...

DOOSAN HEAVY INDUSTRIES & CONSTRUCTION CO., LTD. AND ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

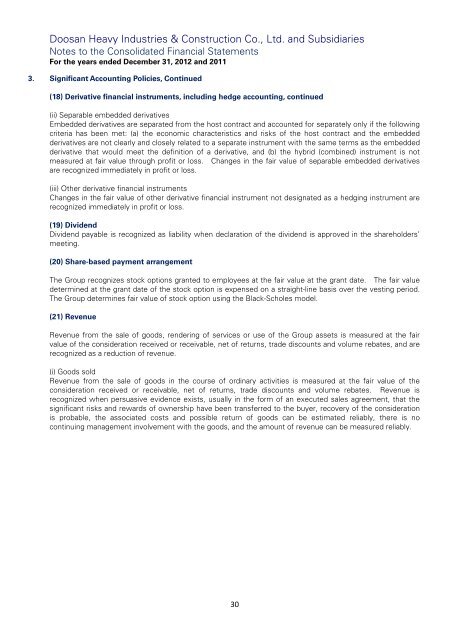

Doosan Heavy Industries & Construction Co., Ltd. and SubsidiariesNotes to the Consolidated Financial StatementsFor the years ended December 31, 2012 and 20113. Significant Accounting Policies, Continued(18) Derivative financial instruments, including hedge accounting, continued(ii) Separable embedded derivativesEmbedded derivatives are separated from the host contract and accounted for separately only if the followingcriteria has been met: (a) the economic characteristics and risks of the host contract and the embeddedderivatives are not clearly and closely related to a separate instrument with the same terms as the embeddedderivative that would meet the definition of a derivative, and (b) the hybrid (combined) instrument is notmeasured at fair value through profit or loss. Changes in the fair value of separable embedded derivativesare recognized immediately in profit or loss.(iii) Other derivative financial instrumentsChanges in the fair value of other derivative financial instrument not designated as a hedging instrument arerecognized immediately in profit or loss.(19) DividendDividend payable is recognized as liability when declaration of the dividend is approved in the shareholders’meeting.(20) Share-based payment arrangementThe Group recognizes stock options granted to employees at the fair value at the grant date. The fair valuedetermined at the grant date of the stock option is expensed on a straight-line basis over the vesting period.The Group determines fair value of stock option using the Black-Scholes model.(21) RevenueRevenue from the sale of goods, rendering of services or use of the Group assets is measured at the fairvalue of the consideration received or receivable, net of returns, trade discounts and volume rebates, and arerecognized as a reduction of revenue.(i) Goods soldRevenue from the sale of goods in the course of ordinary activities is measured at the fair value of theconsideration received or receivable, net of returns, trade discounts and volume rebates. Revenue isrecognized when persuasive evidence exists, usually in the form of an executed sales agreement, that thesignificant risks and rewards of ownership have been transferred to the buyer, recovery of the considerationis probable, the associated costs and possible return of goods can be estimated reliably, there is nocontinuing management involvement with the goods, and the amount of revenue can be measured reliably.30