DOOSAN HEAVY INDUSTRIES & CONSTRUCTION CO., LTD. AND ...

DOOSAN HEAVY INDUSTRIES & CONSTRUCTION CO., LTD. AND ...

DOOSAN HEAVY INDUSTRIES & CONSTRUCTION CO., LTD. AND ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

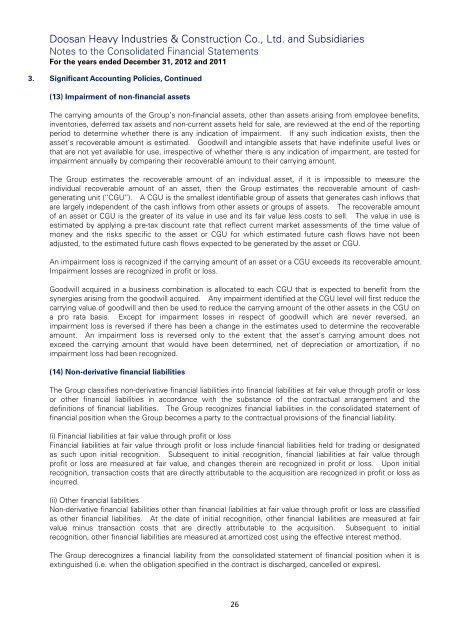

Doosan Heavy Industries & Construction Co., Ltd. and SubsidiariesNotes to the Consolidated Financial StatementsFor the years ended December 31, 2012 and 20113. Significant Accounting Policies, Continued(13) Impairment of non-financial assetsThe carrying amounts of the Group’s non-financial assets, other than assets arising from employee benefits,inventories, deferred tax assets and non-current assets held for sale, are reviewed at the end of the reportingperiod to determine whether there is any indication of impairment. If any such indication exists, then theasset’s recoverable amount is estimated. Goodwill and intangible assets that have indefinite useful lives orthat are not yet available for use, irrespective of whether there is any indication of impairment, are tested forimpairment annually by comparing their recoverable amount to their carrying amount.The Group estimates the recoverable amount of an individual asset, if it is impossible to measure theindividual recoverable amount of an asset, then the Group estimates the recoverable amount of cashgeneratingunit (‘‘CGU’’). A CGU is the smallest identifiable group of assets that generates cash inflows thatare largely independent of the cash inflows from other assets or groups of assets. The recoverable amountof an asset or CGU is the greater of its value in use and its fair value less costs to sell. The value in use isestimated by applying a pre-tax discount rate that reflect current market assessments of the time value ofmoney and the risks specific to the asset or CGU for which estimated future cash flows have not beenadjusted, to the estimated future cash flows expected to be generated by the asset or CGU.An impairment loss is recognized if the carrying amount of an asset or a CGU exceeds its recoverable amount.Impairment losses are recognized in profit or loss.Goodwill acquired in a business combination is allocated to each CGU that is expected to benefit from thesynergies arising from the goodwill acquired. Any impairment identified at the CGU level will first reduce thecarrying value of goodwill and then be used to reduce the carrying amount of the other assets in the CGU ona pro rata basis. Except for impairment losses in respect of goodwill which are never reversed, animpairment loss is reversed if there has been a change in the estimates used to determine the recoverableamount. An impairment loss is reversed only to the extent that the asset’s carrying amount does notexceed the carrying amount that would have been determined, net of depreciation or amortization, if noimpairment loss had been recognized.(14) Non-derivative financial liabilitiesThe Group classifies non-derivative financial liabilities into financial liabilities at fair value through profit or lossor other financial liabilities in accordance with the substance of the contractual arrangement and thedefinitions of financial liabilities. The Group recognizes financial liabilities in the consolidated statement offinancial position when the Group becomes a party to the contractual provisions of the financial liability.(i) Financial liabilities at fair value through profit or lossFinancial liabilities at fair value through profit or loss include financial liabilities held for trading or designatedas such upon initial recognition. Subsequent to initial recognition, financial liabilities at fair value throughprofit or loss are measured at fair value, and changes therein are recognized in profit or loss. Upon initialrecognition, transaction costs that are directly attributable to the acquisition are recognized in profit or loss asincurred.(ii) Other financial liabilitiesNon-derivative financial liabilities other than financial liabilities at fair value through profit or loss are classifiedas other financial liabilities. At the date of initial recognition, other financial liabilities are measured at fairvalue minus transaction costs that are directly attributable to the acquisition. Subsequent to initialrecognition, other financial liabilities are measured at amortized cost using the effective interest method.The Group derecognizes a financial liability from the consolidated statement of financial position when it isextinguished (i.e. when the obligation specified in the contract is discharged, cancelled or expires).26