DOOSAN HEAVY INDUSTRIES & CONSTRUCTION CO., LTD. AND ...

DOOSAN HEAVY INDUSTRIES & CONSTRUCTION CO., LTD. AND ...

DOOSAN HEAVY INDUSTRIES & CONSTRUCTION CO., LTD. AND ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

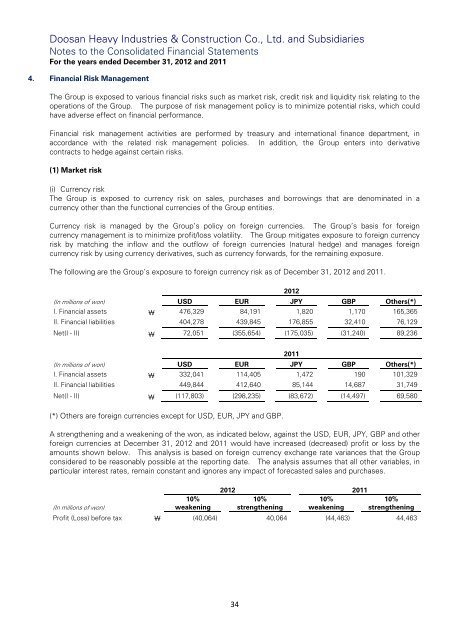

Doosan Heavy Industries & Construction Co., Ltd. and SubsidiariesNotes to the Consolidated Financial StatementsFor the years ended December 31, 2012 and 20114. Financial Risk ManagementThe Group is exposed to various financial risks such as market risk, credit risk and liquidity risk relating to theoperations of the Group. The purpose of risk management policy is to minimize potential risks, which couldhave adverse effect on financial performance.Financial risk management activities are performed by treasury and international finance department, inaccordance with the related risk management policies. In addition, the Group enters into derivativecontracts to hedge against certain risks.(1) Market risk(i) Currency riskThe Group is exposed to currency risk on sales, purchases and borrowings that are denominated in acurrency other than the functional currencies of the Group entities.Currency risk is managed by the Group’s policy on foreign currencies. The Group’s basis for foreigncurrency management is to minimize profit/loss volatility. The Group mitigates exposure to foreign currencyrisk by matching the inflow and the outflow of foreign currencies (natural hedge) and manages foreigncurrency risk by using currency derivatives, such as currency forwards, for the remaining exposure.The following are the Group’s exposure to foreign currency risk as of December 31, 2012 and 2011.2012(In millions of won)USD EUR JPY GBP Others(*)I. Financial assets ₩ 476,329 84,191 1,820 1,170 165,365II. Financial liabilities 404,278 439,845 176,855 32,410 76,129Net(I - II) ₩ 72,051 (355,654) (175,035) (31,240) 89,2362011(In millions of won)USD EUR JPY GBP Others(*)I. Financial assets ₩ 332,041 114,405 1,472 190 101,329II. Financial liabilities 449,844 412,640 85,144 14,687 31,749Net(I - II) ₩ (117,803) (298,235) (83,672) (14,497) 69,580(*) Others are foreign currencies except for USD, EUR, JPY and GBP.A strengthening and a weakening of the won, as indicated below, against the USD, EUR, JPY, GBP and otherforeign currencies at December 31, 2012 and 2011 would have increased (decreased) profit or loss by theamounts shown below. This analysis is based on foreign currency exchange rate variances that the Groupconsidered to be reasonably possible at the reporting date. The analysis assumes that all other variables, inparticular interest rates, remain constant and ignores any impact of forecasted sales and purchases.2012 2011(In millions of won)10%weakening10%strengthening10%weakening10%strengtheningProfit (Loss) before tax ₩ (40,064) 40,064 (44,463) 44,46334