Annual Report 2000 - Skanska

Annual Report 2000 - Skanska

Annual Report 2000 - Skanska

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

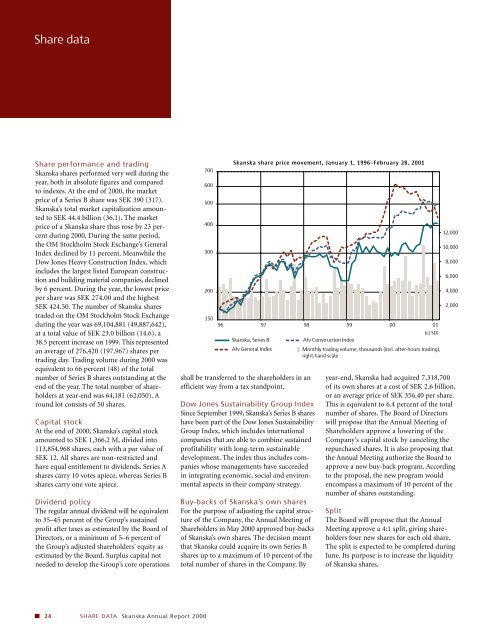

Share dataShare performance and trading<strong>Skanska</strong> shares performed very well during theyear, both in absolute figures and comparedto indexes. At the end of <strong>2000</strong>, the marketprice of a Series B share was SEK 390 (317).<strong>Skanska</strong>’s total market capitalization amountedto SEK 44.4 billion (36.1). The marketprice of a <strong>Skanska</strong> share thus rose by 23 percentduring <strong>2000</strong>. During the same period,the OM Stockholm Stock Exchange’s GeneralIndex declined by 11 percent. Meanwhile theDow Jones Heavy Construction Index, whichincludes the largest listed European constructionand building material companies, declinedby 6 percent. During the year, the lowest priceper share was SEK 274.00 and the highestSEK 424.50. The number of <strong>Skanska</strong> sharestraded on the OM Stockholm Stock Exchangeduring the year was 69,104,881 (49,887,642),at a total value of SEK 23.0 billion (14.6), a38.5 percent increase on 1999. This representedan average of 276,420 (197,967) shares pertrading day. Trading volume during <strong>2000</strong> wasequivalent to 66 percent (48) of the totalnumber of Series B shares outstanding at theend of the year. The total number of shareholdersat year-end was 64,181 (62,050). Around lot consists of 50 shares.Capital stockAt the end of <strong>2000</strong>, <strong>Skanska</strong>’s capital stockamounted to SEK 1,366.2 M, divided into113,854,968 shares, each with a par value ofSEK 12. All shares are non-restricted andhave equal entitlement to dividends. Series Ashares carry 10 votes apiece, whereas Series Bshares carry one vote apiece.Dividend policyThe regular annual dividend will be equivalentto 35–45 percent of the Group’s sustainedprofit after taxes as estimated by the Board ofDirectors, or a minimum of 5–6 percent ofthe Group’s adjusted shareholders’ equity asestimated by the Board. Surplus capital notneeded to develop the Group’s core operations700600500400300200<strong>Skanska</strong> share price movement, January 1, 1996–February 28, 200115096 97 98 99 00 01(c) SIX<strong>Skanska</strong>, Series BAfv Construction IndexAfv General Indexshall be transferred to the shareholders in anefficient way from a tax standpoint.Dow Jones Sustainability Group IndexSince September 1999, <strong>Skanska</strong>’s Series B shareshave been part of the Dow Jones SustainabilityGroup Index, which includes internationalcompanies that are able to combine sustainedprofitability with long-term sustainabledevelopment. The index thus includes companieswhose managements have succeededin integrating economic, social and environmentalaspects in their company strategy.Buy-backs of <strong>Skanska</strong>’s own sharesFor the purpose of adjusting the capital structureof the Company, the <strong>Annual</strong> Meeting ofShareholders in May <strong>2000</strong> approved buy-backsof <strong>Skanska</strong>’s own shares. The decision meantthat <strong>Skanska</strong> could acquire its own Series Bshares up to a maximum of 10 percent of thetotal number of shares in the Company. ByMonthly trading volume, thousands (incl. after-hours trading),right-hand scale12,00010,0008,0006,0004,0002,000year-end, <strong>Skanska</strong> had acquired 7,318,700of its own shares at a cost of SEK 2.6 billion,or an average price of SEK 356.40 per share.This is equivalent to 6.4 percent of the totalnumber of shares. The Board of Directorswill propose that the <strong>Annual</strong> Meeting ofShareholders approve a lowering of theCompany’s capital stock by canceling therepurchased shares. It is also proposing thatthe <strong>Annual</strong> Meeting authorize the Board toapprove a new buy-back program. Accordingto the proposal, the new program wouldencompass a maximum of 10 percent of thenumber of shares outstanding.SplitThe Board will propose that the <strong>Annual</strong>Meeting approve a 4:1 split, giving shareholdersfour new shares for each old share.The split is expected to be completed duringJune. Its purpose is to increase the liquidityof <strong>Skanska</strong> shares.24 SHARE DATA <strong>Skanska</strong> <strong>Annual</strong> <strong>Report</strong> <strong>2000</strong>