Annual Report 2000 - Skanska

Annual Report 2000 - Skanska

Annual Report 2000 - Skanska

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

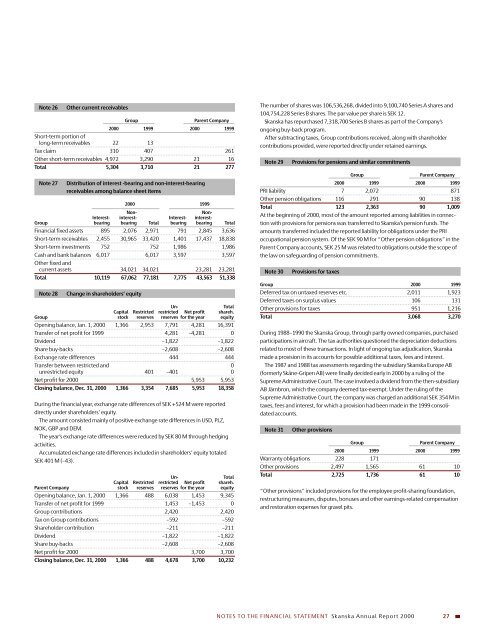

Note 26Other current receivablesGroupParent Company<strong>2000</strong> 1999 <strong>2000</strong> 1999Short-term portion oflong-term receivables 22 13Tax claim 310 407 261Other short-term receivables 4,972 3,290 21 16Total 5,304 3,710 21 277Note 27Distribution of interest -bearing and non-interest-bearingreceivables among balance sheet items<strong>2000</strong> 1999Non-Non-Interest- interest- Interest- interest-Group bearing bearing Total bearing bearing TotalFinancial fixed assets 895 2,076 2,971 791 2,845 3,636Short-term receivables 2,455 30,965 33,420 1,401 17,437 18,838Short-term investments 752 752 1,986 1,986Cash and bank balances 6,017 6,017 3,597 3,597Other fixed andcurrent assets 34,021 34,021 23,281 23,281Total 10,119 67,062 77,181 7,775 43,563 51,338Note 28Change in shareholders’ equityUn-TotalCapital Restricted restricted Net profit shareh.Group stock reserves reserves for the year equityOpening balance, Jan. 1, <strong>2000</strong> 1,366 2,953 7,791 4,281 16,391Transfer of net profit for 1999 4,281 –4,281 0Dividend –1,822 –1,822Share buy-backs –2,608 –2,608Exchange rate differences 444 444Transfer between restricted and 0unrestricted equity 401 –401 0Net profit for <strong>2000</strong> 5,953 5,953Closing balance, Dec. 31, <strong>2000</strong> 1,366 3,354 7,685 5,953 18,358During the financial year, exchange rate differences of SEK +524 M were reporteddirectly under shareholders’ equity.The amount consisted mainly of positive exchange rate differences in USD, PLZ,NOK, GBP and DEM.The year’s exchange rate differences were reduced by SEK 80 M through hedgingactivities.Accumulated exchange rate differences included in shareholders’ equity totaledSEK 401 M (–43).Un-TotalCapital Restricted restricted Net profit shareh.Parent Company stock reserves reserves for the year equityOpening balance, Jan. 1, <strong>2000</strong> 1,366 488 6,038 1,453 9,345Transfer of net profit for 1999 1,453 –1,453 0Group contributions 2,420 2,420Tax on Group contributions –592 –592Shareholder contribution –211 –211Dividend –1,822 –1,822Share buy-backs –2,608 –2,608Net profit for <strong>2000</strong> 3,700 3,700Closing balance, Dec. 31, <strong>2000</strong> 1,366 488 4,678 3,700 10,232The number of shares was 106,536,268, divided into 9,100,740 Series A shares and104,754,228 Series B shares. The par value per share is SEK 12.<strong>Skanska</strong> has repurchased 7,318,700 Series B shares as part of the Company’songoing buy-back program.After subtracting taxes, Group contributions received, along with shareholdercontributions provided, were reported directly under retained earnings.Note 29Provisions for pensions and similar commitmentsGroupParent Company<strong>2000</strong> 1999 <strong>2000</strong> 1999PRI liability 7 2,072 871Other pension obligations 116 291 90 138Total 123 2,363 90 1,009At the beginning of <strong>2000</strong>, most of the amount reported among liabilities in connectionwith provisions for pensions was transferred to <strong>Skanska</strong>’s pension funds. Theamounts transferred included the reported liability for obligations under the PRIoccupational pension system. Of the SEK 90 M for “Other pension obligations” in theParent Company accounts, SEK 25 M was related to obligations outside the scope ofthe law on safeguarding of pension commitments.Note 30Provisions for taxesGroup <strong>2000</strong> 1999Deferred tax on untaxed reserves etc. 2,011 1,923Deferred taxes on surplus values 106 131Other provisions for taxes 951 1,216Total 3,068 3,270During 1988–1990 the <strong>Skanska</strong> Group, through partly owned companies, purchasedparticipations in aircraft. The tax authorities questioned the depreciation deductionsrelated to most of these transactions. In light of ongoing tax adjudication, <strong>Skanska</strong>made a provision in its accounts for possible additional taxes, fees and interest.The 1987 and 1988 tax assessments regarding the subsidiary <strong>Skanska</strong> Europe AB(formerly Skåne-Gripen AB) were finally decided early in <strong>2000</strong> by a ruling of theSupreme Administrative Court. The case involved a dividend from the then-subsidiaryAB Järnbron, which the company deemed tax-exempt. Under the ruling of theSupreme Administrative Court, the company was charged an additional SEK 354 M intaxes, fees and interest, for which a provision had been made in the 1999 consolidatedaccounts.Note 31Other provisionsGroupParent Company<strong>2000</strong> 1999 <strong>2000</strong> 1999Warranty obligations 228 171Other provisions 2,497 1,565 61 10Total 2,725 1,736 61 10“Other provisions” included provisions for the employee profit-sharing foundation,restructuring measures, disputes, bonuses and other earnings-related compensationand restoration expenses for gravel pits.NOTES TO THE FINANCIAL STATEMENT <strong>Skanska</strong> <strong>Annual</strong> <strong>Report</strong> <strong>2000</strong> 27