Pg 108 - Berjaya Corporation Berhad

Pg 108 - Berjaya Corporation Berhad

Pg 108 - Berjaya Corporation Berhad

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

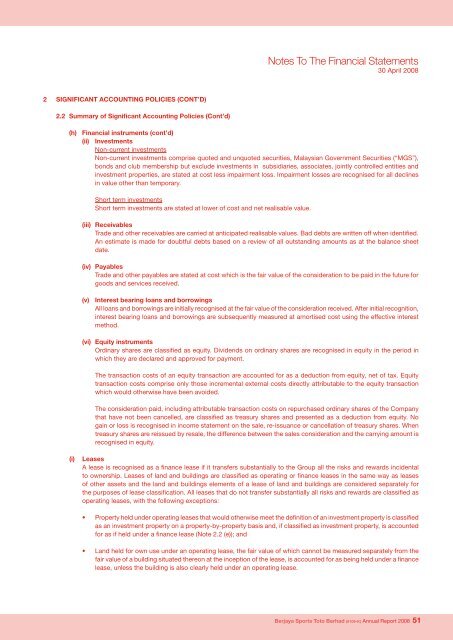

Notes To The Financial Statements30 April 20082 SIGNIFICANT ACCOUNTING POLICIES (CONT’D)2.2 Summary of Significant Accounting Policies (Cont’d)(h) Financial instruments (cont’d)(ii) InvestmentsNon-current investmentsNon-current investments comprise quoted and unquoted securities, Malaysian Government Securities (“MGS”),bonds and club membership but exclude investments in subsidiaries, associates, jointly controlled entities andinvestment properties, are stated at cost less impairment loss. Impairment losses are recognised for all declinesin value other than temporary.Short term investmentsShort term investments are stated at lower of cost and net realisable value.(iii) ReceivablesTrade and other receivables are carried at anticipated realisable values. Bad debts are written off when identified.An estimate is made for doubtful debts based on a review of all outstanding amounts as at the balance sheetdate.(iv) PayablesTrade and other payables are stated at cost which is the fair value of the consideration to be paid in the future forgoods and services received.(v) Interest bearing loans and borrowingsAll loans and borrowings are initially recognised at the fair value of the consideration received. After initial recognition,interest bearing loans and borrowings are subsequently measured at amortised cost using the effective interestmethod.(vi) Equity instrumentsOrdinary shares are classified as equity. Dividends on ordinary shares are recognised in equity in the period inwhich they are declared and approved for payment.The transaction costs of an equity transaction are accounted for as a deduction from equity, net of tax. Equitytransaction costs comprise only those incremental external costs directly attributable to the equity transactionwhich would otherwise have been avoided.The consideration paid, including attributable transaction costs on repurchased ordinary shares of the Companythat have not been cancelled, are classified as treasury shares and presented as a deduction from equity. Nogain or loss is recognised in income statement on the sale, re-issuance or cancellation of treasury shares. Whentreasury shares are reissued by resale, the difference between the sales consideration and the carrying amount isrecognised in equity.(i)LeasesA lease is recognised as a finance lease if it transfers substantially to the Group all the risks and rewards incidentalto ownership. Leases of land and buildings are classified as operating or finance leases in the same way as leasesof other assets and the land and buildings elements of a lease of land and buildings are considered separately forthe purposes of lease classification. All leases that do not transfer substantially all risks and rewards are classified asoperating leases, with the following exceptions:• Property held under operating leases that would otherwise meet the definition of an investment property is classifiedas an investment property on a property-by-property basis and, if classified as investment property, is accountedfor as if held under a finance lease (Note 2.2 (e)); and• Land held for own use under an operating lease, the fair value of which cannot be measured separately from thefair value of a building situated thereon at the inception of the lease, is accounted for as being held under a financelease, unless the building is also clearly held under an operating lease.<strong>Berjaya</strong> Sports Toto <strong>Berhad</strong> (9109-K) Annual Report 2008 51