Pg 108 - Berjaya Corporation Berhad

Pg 108 - Berjaya Corporation Berhad

Pg 108 - Berjaya Corporation Berhad

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

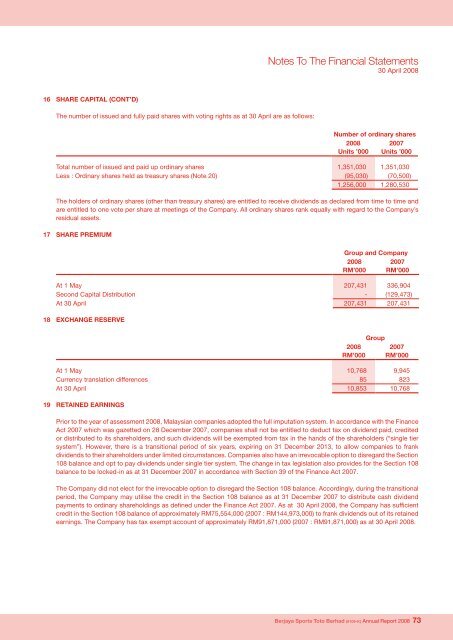

Notes To The Financial Statements30 April 200816 SHARE CAPITAL (CONT’D)The number of issued and fully paid shares with voting rights as at 30 April are as follows:Number of ordinary shares2008 2007Units ’000 Units ’000Total number of issued and paid up ordinary shares 1,351,030 1,351,030Less : Ordinary shares held as treasury shares (Note 20) (95,030) (70,500)1,256,000 1,280,530The holders of ordinary shares (other than treasury shares) are entitled to receive dividends as declared from time to time andare entitled to one vote per share at meetings of the Company. All ordinary shares rank equally with regard to the Company’sresidual assets.17 SHARE PREMIUMGroup and Company2008 2007RM’000 RM’000At 1 May 207,431 336,904Second Capital Distribution - (129,473)At 30 April 207,431 207,43118 EXCHANGE RESERVE2008RM’000Group2007RM’000At 1 May 10,768 9,945Currency translation differences 85 823At 30 April 10,853 10,76819 RETAINED EARNINGSPrior to the year of assessment 2008, Malaysian companies adopted the full imputation system. In accordance with the FinanceAct 2007 which was gazetted on 28 December 2007, companies shall not be entitled to deduct tax on dividend paid, creditedor distributed to its shareholders, and such dividends will be exempted from tax in the hands of the shareholders (“single tiersystem”). However, there is a transitional period of six years, expiring on 31 December 2013, to allow companies to frankdividends to their shareholders under limited circumstances. Companies also have an irrevocable option to disregard the Section<strong>108</strong> balance and opt to pay dividends under single tier system. The change in tax legislation also provides for the Section <strong>108</strong>balance to be locked-in as at 31 December 2007 in accordance with Section 39 of the Finance Act 2007.The Company did not elect for the irrevocable option to disregard the Section <strong>108</strong> balance. Accordingly, during the transitionalperiod, the Company may utilise the credit in the Section <strong>108</strong> balance as at 31 December 2007 to distribute cash dividendpayments to ordinary shareholdings as defined under the Finance Act 2007. As at 30 April 2008, the Company has sufficientcredit in the Section <strong>108</strong> balance of approximately RM75,554,000 (2007 : RM144,973,000) to frank dividends out of its retainedearnings. The Company has tax exempt account of approximately RM91,871,000 (2007 : RM91,871,000) as at 30 April 2008.<strong>Berjaya</strong> Sports Toto <strong>Berhad</strong> (9109-K) Annual Report 2008 73