Pg 108 - Berjaya Corporation Berhad

Pg 108 - Berjaya Corporation Berhad

Pg 108 - Berjaya Corporation Berhad

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

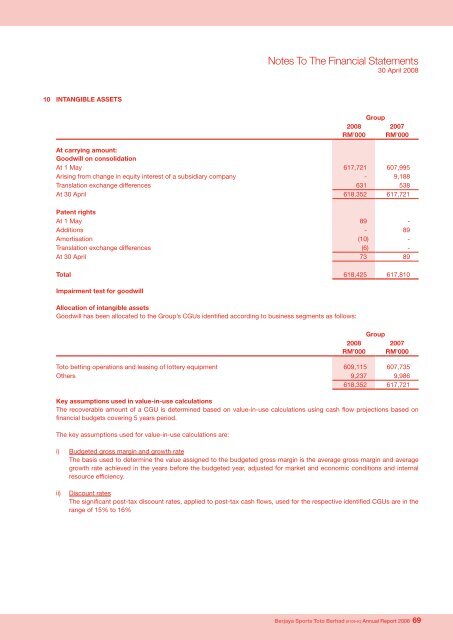

Notes To The Financial Statements30 April 200810 INTANGIBLE ASSETS2008RM’000Group2007RM’000At carrying amount:Goodwill on consolidationAt 1 May 617,721 607,995Arising from change in equity interest of a subsidiary company - 9,188Translation exchange differences 631 538At 30 April 618,352 617,721Patent rightsAt 1 May 89 -Additions - 89Amortisation (10) -Translation exchange differences (6) -At 30 April 73 89Total 618,425 617,810Impairment test for goodwillAllocation of intangible assetsGoodwill has been allocated to the Group’s CGUs identified according to business segments as follows:2008RM’000Group2007RM’000Toto betting operations and leasing of lottery equipment 609,115 607,735Others 9,237 9,986618,352 617,721Key assumptions used in value-in-use calculationsThe recoverable amount of a CGU is determined based on value-in-use calculations using cash flow projections based onfinancial budgets covering 5 years period.The key assumptions used for value-in-use calculations are:i) Budgeted gross margin and growth rateThe basis used to determine the value assigned to the budgeted gross margin is the average gross margin and averagegrowth rate achieved in the years before the budgeted year, adjusted for market and economic conditions and internalresource efficiency.ii)Discount ratesThe significant post-tax discount rates, applied to post-tax cash flows, used for the respective identified CGUs are in therange of 15% to 16%<strong>Berjaya</strong> Sports Toto <strong>Berhad</strong> (9109-K) Annual Report 2008 69