Pg 108 - Berjaya Corporation Berhad

Pg 108 - Berjaya Corporation Berhad

Pg 108 - Berjaya Corporation Berhad

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

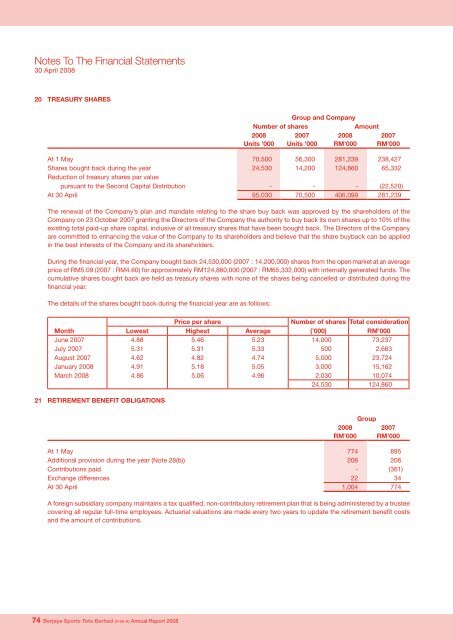

Notes To The Financial Statements30 April 200820 TREASURY SHARESGroup and CompanyNumber of sharesAmount2007 2008Units ’000 RM’0002008Units ’0002007RM’000At 1 May 70,500 56,300 281,239 238,427Shares bought back during the year 24,530 14,200 124,860 65,332Reduction of treasury shares par valuepursuant to the Second Capital Distribution - - - (22,520)At 30 April 95,030 70,500 406,099 281,239The renewal of the Company’s plan and mandate relating to the share buy back was approved by the shareholders of theCompany on 23 October 2007 granting the Directors of the Company the authority to buy back its own shares up to 10% of theexisting total paid-up share capital, inclusive of all treasury shares that have been bought back. The Directors of the Companyare committed to enhancing the value of the Company to its shareholders and believe that the share buyback can be appliedin the best interests of the Company and its shareholders.During the financial year, the Company bought back 24,530,000 (2007 : 14,200,000) shares from the open market at an averageprice of RM5.09 (2007 : RM4.60) for approximately RM124,860,000 (2007 : RM65,332,000) with internally generated funds. Thecumulative shares bought back are held as treasury shares with none of the shares being cancelled or distributed during thefinancial year.The details of the shares bought back during the financial year are as follows:Price per shareNumber of shares Total considerationMonthLowest Highest Average(’000)RM’000June 2007 4.88 5.46 5.23 14,000 73,237July 2007 5.31 5.31 5.33 500 2,663August 2007 4.62 4.82 4.74 5,000 23,724January 2008 4.91 5.18 5.05 3,000 15,162March 2008 4.86 5.06 4.96 2,030 10,07424,530 124,86021 RETIREMENT BENEFIT OBLIGATIONS2008RM’000Group2007RM’000At 1 May 774 895Additional provision during the year (Note 28(b)) 208 206Contributions paid - (361)Exchange differences 22 34At 30 April 1,004 774A foreign subsidiary company maintains a tax qualified, non-contributory retirement plan that is being administered by a trusteecovering all regular full-time employees. Actuarial valuations are made every two years to update the retirement benefit costsand the amount of contributions.74 <strong>Berjaya</strong> Sports Toto <strong>Berhad</strong> (9109-K) Annual Report 2008