Pg 108 - Berjaya Corporation Berhad

Pg 108 - Berjaya Corporation Berhad

Pg 108 - Berjaya Corporation Berhad

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

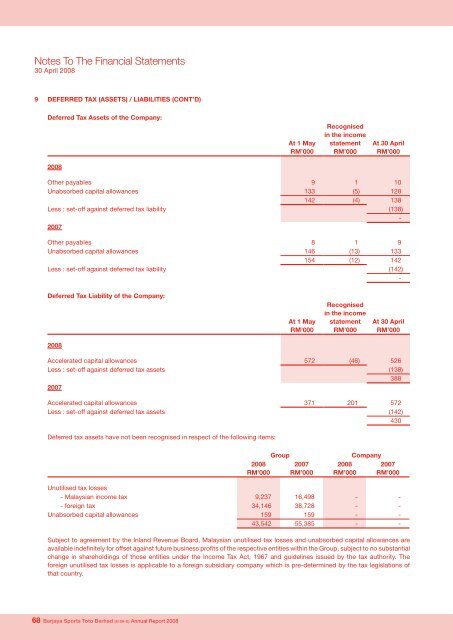

Notes To The Financial Statements30 April 20089 DEFERRED TAX (ASSETS) / LIABILITIES (CONT’D)Deferred Tax Assets of the Company:At 1 MayRM’000Recognisedin the incomestatementRM’000At 30 AprilRM’0002008Other payables 9 1 10Unabsorbed capital allowances 133 (5) 128142 (4) 138Less : set-off against deferred tax liability (138)-2007Other payables 8 1 9Unabsorbed capital allowances 146 (13) 133154 (12) 142Less : set-off against deferred tax liability (142)-Deferred Tax Liability of the Company:At 1 MayRM’000Recognisedin the incomestatementRM’000At 30 AprilRM’0002008Accelerated capital allowances 572 (46) 526Less : set-off against deferred tax assets (138)3882007Accelerated capital allowances 371 201 572Less : set-off against deferred tax assets (142)430Deferred tax assets have not been recognised in respect of the following items:2008RM’000Group2007RM’0002008RM’000Company2007RM’000Unutilised tax losses- Malaysian income tax 9,237 16,498 - -- foreign tax 34,146 38,728 - -Unabsorbed capital allowances 159 159 - -43,542 55,385 - -Subject to agreement by the Inland Revenue Board, Malaysian unutilised tax losses and unabsorbed capital allowances areavailable indefinitely for offset against future business profits of the respective entities within the Group, subject to no substantialchange in shareholdings of those entities under the Income Tax Act, 1967 and guidelines issued by the tax authority. Theforeign unutilised tax losses is applicable to a foreign subsidiary company which is pre-determined by the tax legislations ofthat country.68 <strong>Berjaya</strong> Sports Toto <strong>Berhad</strong> (9109-K) Annual Report 2008