download the PDF - JP Morgan Asset Management

download the PDF - JP Morgan Asset Management

download the PDF - JP Morgan Asset Management

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

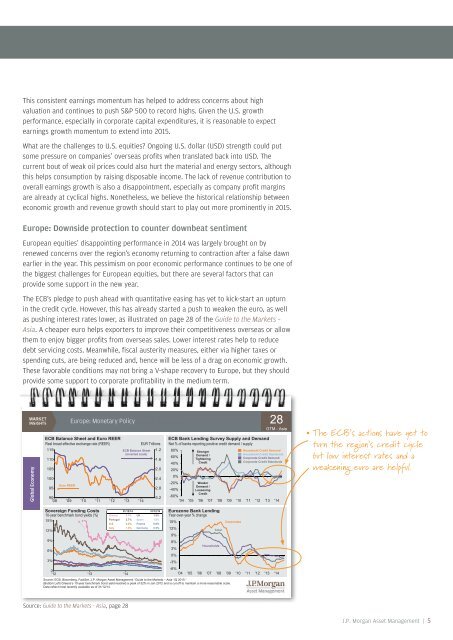

This consistent earnings momentum has helped to address concerns about highvaluation and continues to push S&P 500 to record highs. Given <strong>the</strong> U.S. growthperformance, especially in corporate capital expenditures, it is reasonable to expectearnings growth momentum to extend into 2015.What are <strong>the</strong> challenges to U.S. equities? Ongoing U.S. dollar (USD) strength could putsome pressure on companies’ overseas profits when translated back into USD. Thecurrent bout of weak oil prices could also hurt <strong>the</strong> material and energy sectors, althoughthis helps consumption by raising disposable income. The lack of revenue contribution tooverall earnings growth is also a disappointment, especially as company profit marginsare already at cyclical highs. None<strong>the</strong>less, we believe <strong>the</strong> historical relationship betweeneconomic growth and revenue growth should start to play out more prominently in 2015.Europe: Downside protection to counter downbeat sentimentEuropean equities’ disappointing performance in 2014 was largely brought on byrenewed concerns over <strong>the</strong> region’s economy returning to contraction after a false dawnearlier in <strong>the</strong> year. This pessimism on poor economic performance continues to be one of<strong>the</strong> biggest challenges for European equities, but <strong>the</strong>re are several factors that canprovide some support in <strong>the</strong> new year.The ECB’s pledge to push ahead with quantitative easing has yet to kick-start an upturnin <strong>the</strong> credit cycle. However, this has already started a push to weaken <strong>the</strong> euro, as wellas pushing interest rates lower, as illustrated on page 28 of <strong>the</strong> Guide to <strong>the</strong> Markets –Asia. A cheaper euro helps exporters to improve <strong>the</strong>ir competitiveness overseas or allow<strong>the</strong>m to enjoy bigger profits from overseas sales. Lower interest rates help to reducedebt servicing costs. Meanwhile, fiscal austerity measures, ei<strong>the</strong>r via higher taxes orspending cuts, are being reduced and, hence will be less of a drag on economic growth.These favorable conditions may not bring a V-shape recovery to Europe, but <strong>the</strong>y shouldprovide some support to corporate profitability in <strong>the</strong> medium term.conomyGlobal EcEurope: Monetary PolicyECB Balance Sheet and Euro REERReal broad effective exchange rate (REER)EUR Trillions115 ECB Balance Sheet 1.2(inverted scale)110 1.61052.0100Euro REER95 2.890'08 '09 '10 '11 '12 '13 '142.43.2ECB Bank Lending Survey ClickSupply and DemandNet % of banks reporting positive credit demand / supply28GTM - Asia80%StrongerHousehold Credit DemandDemand /Household Credit Standards60%TighteningCorporate Credit DemandCorporate Credit Standards40%Credit20%0%-20%WeakerDemand /-40%LooseningCredit-60%'04 '05 '06 '07 '08 '09 '10 '11 '12 '13 '14The ECB’s actions have yet toturn <strong>the</strong> region’s credit cyclebut low interest rates and aweakening euro are helpful.Sovereign Funding Costs10-year benchmark bond yields (%)15%12%9%6%3%0'12 '13 '1431/12/14 31/12/14Greece 9.4% UK 1.8%Portugal 2.7% Spain 1.6%U.S. 2.2% France 0.8%Italy 1.9% Germany 0.5%Eurozone Bank LendingYear-over-year % change15% Corporates12%9%6%3%0%-3%TotalHouseholds-6%'04 '05 '06 '07 '08 '09 '10 '11 '12 '13 '14Source: ECB, Bloomberg, FactSet, J.P. <strong>Morgan</strong> <strong>Asset</strong> <strong>Management</strong> “Guide to <strong>the</strong> Markets – Asia 1Q 2015.”(Bottom Left) Greece’s 10-year benchmark bond yield reached a peak of 32% in Jan 2012 and is cut off to maintain a more reasonable scale.Data reflect most recently available as of 31/12/14.Source: Guide to <strong>the</strong> Markets - Asia, page 28J.P. <strong>Morgan</strong> <strong>Asset</strong> <strong>Management</strong> | 5