download the PDF - JP Morgan Asset Management

download the PDF - JP Morgan Asset Management

download the PDF - JP Morgan Asset Management

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

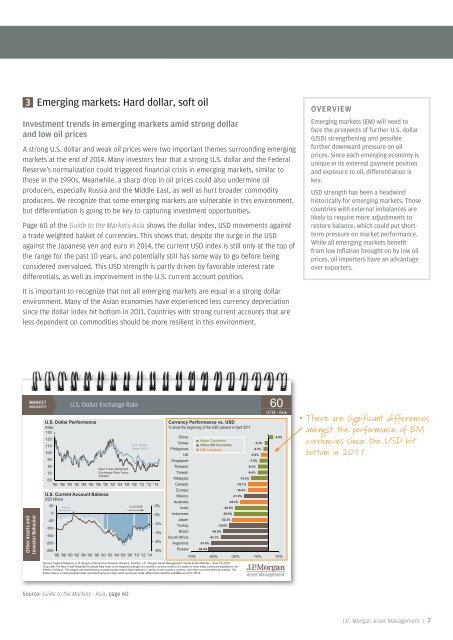

3 Emerging markets: Hard dollar, soft oilInvestment trends in emerging markets amid strong dollarand low oil pricesA strong U.S. dollar and weak oil prices were two important <strong>the</strong>mes surrounding emergingmarkets at <strong>the</strong> end of 2014. Many investors fear that a strong U.S. dollar and <strong>the</strong> FederalReserve’s normalization could triggered financial crisis in emerging markets, similar tothose in <strong>the</strong> 1990s. Meanwhile, a sharp drop in oil prices could also undermine oilproducers, especially Russia and <strong>the</strong> Middle East, as well as hurt broader commodityproducers. We recognize that some emerging markets are vulnerable in this environment,but differentiation is going to be key to capturing investment opportunities.Page 60 of <strong>the</strong> Guide to <strong>the</strong> Markets-Asia shows <strong>the</strong> dollar index, USD movements againsta trade weighted basket of currencies. This shows that, despite <strong>the</strong> surge in <strong>the</strong> USDagainst <strong>the</strong> Japanese yen and euro in 2014, <strong>the</strong> current USD index is still only at <strong>the</strong> top of<strong>the</strong> range for <strong>the</strong> past 10 years, and potentially still has some way to go before beingconsidered overvalued. This USD strength is partly driven by favorable interest ratedifferentials, as well as improvement in <strong>the</strong> U.S. current account position.It is important to recognize that not all emerging markets are equal in a strong dollarenvironment. Many of <strong>the</strong> Asian economies have experienced less currency depreciationsince <strong>the</strong> dollar index hit bottom in 2011. Countries with strong current accounts that areless dependent on commodities should be more resilient in this environment.OVERVIEWEmerging markets (EM) will need toface <strong>the</strong> prospects of fur<strong>the</strong>r U.S. dollar(USD) streng<strong>the</strong>ning and possiblefur<strong>the</strong>r downward pressure on oilprices. Since each emerging economy isunique in its external payment positionand exposure to oil, differentiation iskey.USD strength has been a headwindhistorically for emerging markets. Thosecountries with external imbalances arelikely to require more adjustments torestore balance, which could put shorttermpressure on market performance.While all emerging markets benefitfrom low inflation brought on by low oilprices, oil importers have an advantageover exporters.O<strong>the</strong>r <strong>Asset</strong>s andnvestor Beha viorIU.S. Dollar Exchange RateU.S. Dollar PerformanceIndex130120110U.S. DollarIndex (DXY)1009080Real Trade Weighted70Exchange Rate Index(REER)60'86 '88 '90 '92 '94 '96 '98 '00 '02 '04 '06 '08 '10 '12 '14U.S. Current Account BalanceUSD billions50 Value % of GDP 2%00%-50-2%-100-4%-150-200-6%-250-8%'86 '88 '90 '92 '94 '96 '98 '00 '02 '04 '06 '08 '10 '12 '14ChinaKoreaPhilippinesUKSingaporeThailandTaiwanMalaysiaCanadaEuropeMexicoAustraliaIndiaIndonesiaJapanClickCurrency Performance vs. USD% since <strong>the</strong> beginning of <strong>the</strong> USD uptrend in April 2011TurkeyBrazilSouth AfricaArgentinaRussiaAsian CountriesO<strong>the</strong>r EM CountriesDM Countries-51.8%-54.4%-40.8%-43.1%-30.0%-30.9%-32.3%-35.0%-25.2%-6.5%-7.8%-9.3% 93%-9.4%-15.3%-18.1%-18.4%-21.8%-3.2%-4.3%60GTM - Asia46% 4.6%-70% -50% -30% -10% 10%There are significant differencesamongst <strong>the</strong> performance of EMcurrencies since <strong>the</strong> USD hitbottom in 2011.Source: Federal Reserve, U.S. Bureau of Economic Analysis, Reuters, FactSet, J.P. <strong>Morgan</strong> <strong>Asset</strong> <strong>Management</strong> “Guide to <strong>the</strong> Markets – Asia 1Q 2015.”(Top Left) The Real Trade Weighted Exchange Rate Index is <strong>the</strong> weighted average of a country’s currency relative to a basket of o<strong>the</strong>r major currencies adjusted for <strong>the</strong>effects of inflation. The weights are determined by comparing <strong>the</strong> relative trade balances, in terms of one country’s currency, with o<strong>the</strong>r countries within <strong>the</strong> basket. TheDollar Index is a trade-weighted index calculated using six major world currencies. Data reflect most recently available as of 31/12/14.Source: Guide to <strong>the</strong> Markets - Asia, page 60J.P. <strong>Morgan</strong> <strong>Asset</strong> <strong>Management</strong> | 7