download the PDF - JP Morgan Asset Management

download the PDF - JP Morgan Asset Management

download the PDF - JP Morgan Asset Management

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

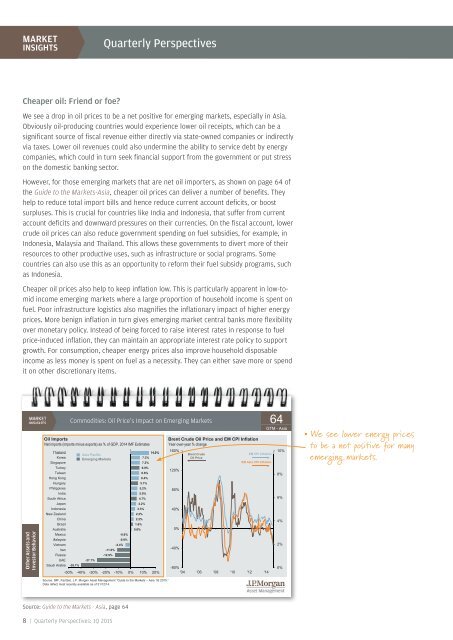

MARKETINSIGHTSQuarterly PerspectivesCheaper oil: Friend or foe?We see a drop in oil prices to be a net positive for emerging markets, especially in Asia.Obviously oil-producing countries would experience lower oil receipts, which can be asignificant source of fiscal revenue ei<strong>the</strong>r directly via state-owned companies or indirectlyvia taxes. Lower oil revenues could also undermine <strong>the</strong> ability to service debt by energycompanies, which could in turn seek financial support from <strong>the</strong> government or put stresson <strong>the</strong> domestic banking sector.However, for those emerging markets that are net oil importers, as shown on page 64 of<strong>the</strong> Guide to <strong>the</strong> Markets-Asia, cheaper oil prices can deliver a number of benefits. Theyhelp to reduce total import bills and hence reduce current account deficits, or boostsurpluses. This is crucial for countries like India and Indonesia, that suffer from currentaccount deficits and downward pressures on <strong>the</strong>ir currencies. On <strong>the</strong> fiscal account, lowercrude oil prices can also reduce government spending on fuel subsidies, for example, inIndonesia, Malaysia and Thailand. This allows <strong>the</strong>se governments to divert more of <strong>the</strong>irresources to o<strong>the</strong>r productive uses, such as infrastructure or social programs. Somecountries can also use this as an opportunity to reform <strong>the</strong>ir fuel subsidy programs, suchas Indonesia.Cheaper oil prices also help to keep inflation low. This is particularly apparent in low-tomidincome emerging markets where a large proportion of household income is spent onfuel. Poor infrastructure logistics also magnifies <strong>the</strong> inflationary impact of higher energyprices. More benign inflation in turn gives emerging market central banks more flexibilityover monetary policy. Instead of being forced to raise interest rates in response to fuelprice-induced inflation, <strong>the</strong>y can maintain an appropriate interest rate policy to supportgrowth. For consumption, cheaper energy prices also improve household disposableincome as less money is spent on fuel as a necessity. They can ei<strong>the</strong>r save more or spendit on o<strong>the</strong>r discretionary items.O<strong>the</strong>r <strong>Asset</strong>s andnvestor Beha viorCommodities: Oil Price’s Impact on Emerging MarketsOil ImportsNet imports (imports minus exports) as % of GDP, 2014 IMF EstimatesThailandKoreaSingaporeTurkeyTaiwanHong KongHungaryPhilippinesIndiaSouth AfricaJapanIndonesiaNew ZealandChinaBrazilAustraliaMexicoMalaysiaVietnamIranRussiaUAEAsia PacificEmerging Markets-27.1%-11.0%-12.9%-4.4%-0.6%-0.9% 09%14.0%7.3%7.2%6.9%6.6%6.4%57% 5.7%5.2%5.0%4.7%4.2%3.3%2.2%2.2%1.6%0.6%Brent Crude Oil Price and ClickEM CPI InflationYear-over-year % change160%120%80%40%0%Brent CrudeOil PriceEM CPI InflationEM Asia CPI Inflation64GTM - AsiaSaudi Arabia -39.7%I0%-80%-50% -40% -30% -20% -10% 0% 10% 20%'04 '06 '08 '10 '12 '14-40%10%8%6%4%2%We see lower energy pricesto be a net positive for manyemerging markets.Source: IMF, FactSet, J.P. <strong>Morgan</strong> <strong>Asset</strong> <strong>Management</strong> “Guide to <strong>the</strong> Markets – Asia 1Q 2015.”Data reflect most recently available as of 31/12/14.Source: Guide to <strong>the</strong> Markets - Asia, page 648 | Quarterly Perspectives: 1Q 2015