pdf (2MB) - McBride

pdf (2MB) - McBride

pdf (2MB) - McBride

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

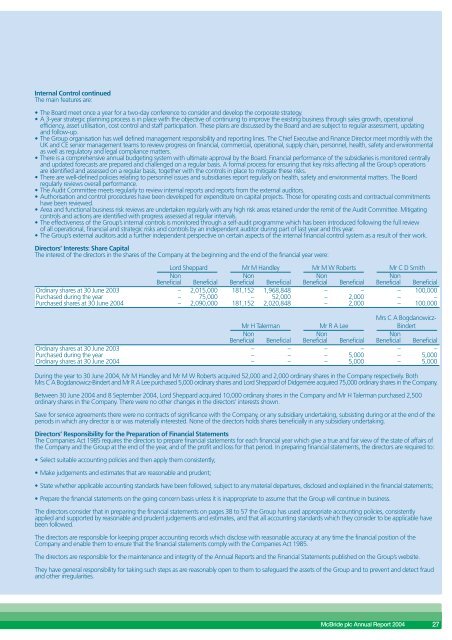

Internal Control continuedThe main features are:• The Board meet once a year for a two-day conference to consider and develop the corporate strategy.• A 3-year strategic planning process is in place with the objective of continuing to improve the existing business through sales growth, operationalefficiency, asset utilisation, cost control and staff participation. These plans are discussed by the Board and are subject to regular assessment, updatingand follow-up.• The Group organisation has well defined management responsibility and reporting lines. The Chief Executive and Finance Director meet monthly with theUK and CE senior management teams to review progress on financial, commercial, operational, supply chain, personnel, health, safety and environmentalas well as regulatory and legal compliance matters.• There is a comprehensive annual budgeting system with ultimate approval by the Board. Financial performance of the subsidiaries is monitored centrallyand updated forecasts are prepared and challenged on a regular basis. A formal process for ensuring that key risks affecting all the Group’s operationsare identified and assessed on a regular basis, together with the controls in place to mitigate these risks.• There are well-defined policies relating to personnel issues and subsidiaries report regularly on health, safety and environmental matters. The Boardregularly reviews overall performance.• The Audit Committee meets regularly to review internal reports and reports from the external auditors.• Authorisation and control procedures have been developed for expenditure on capital projects. Those for operating costs and contractual commitmentshave been reviewed.• Area and functional business risk reviews are undertaken regularly with any high risk areas retained under the remit of the Audit Committee. Mitigatingcontrols and actions are identified with progress assessed at regular intervals.• The effectiveness of the Group’s internal controls is monitored through a self-audit programme which has been introduced following the full reviewof all operational, financial and strategic risks and controls by an independent auditor during part of last year and this year.• The Group’s external auditors add a further independent perspective on certain aspects of the internal financial control system as a result of their work.Directors’ Interests: Share CapitalThe interest of the directors in the shares of the Company at the beginning and the end of the financial year were:Lord Sheppard Mr M Handley Mr M W Roberts Mr C D SmithNon Non Non NonBeneficial Beneficial Beneficial Beneficial Beneficial Beneficial Beneficial BeneficialOrdinary shares at 30 June 2003Purchased during the year––2,015,00075,000181,152–1,968,84852,000–––2,000––100,000–Purchased shares at 30 June 2004 – 2,090,000 181,152 2,020,848 – 2,000 – 100,000Mrs C A Bogdanowicz-Mr H Talerman Mr R A Lee BindertNon Non NonBeneficial Beneficial Beneficial Beneficial Beneficial BeneficialOrdinary shares at 30 June 2003Purchased during the year–––––––5,000–––5,000Ordinary shares at 30 June 2004 – – – 5,000 – 5,000During the year to 30 June 2004, Mr M Handley and Mr M W Roberts acquired 52,000 and 2,000 ordinary shares in the Company respectively. BothMrs C A Bogdanowicz-Bindert and Mr R A Lee purchased 5,000 ordinary shares and Lord Sheppard of Didgemere acquired 75,000 ordinary shares in the Company.Between 30 June 2004 and 8 September 2004, Lord Sheppard acquired 10,000 ordinary shares in the Company and Mr H Talerman purchased 2,500ordinary shares in the Company. There were no other changes in the directors’ interests shown.Save for service agreements there were no contracts of significance with the Company, or any subsidiary undertaking, subsisting during or at the end of theperiods in which any director is or was materially interested. None of the directors holds shares beneficially in any subsidiary undertaking.Directors’ Responsibility for the Preparation of Financial StatementsThe Companies Act 1985 requires the directors to prepare financial statements for each financial year which give a true and fair view of the state of affairs ofthe Company and the Group at the end of the year, and of the profit and loss for that period. In preparing financial statements, the directors are required to:• Select suitable accounting policies and then apply them consistently;• Make judgements and estimates that are reasonable and prudent;• State whether applicable accounting standards have been followed, subject to any material departures, disclosed and explained in the financial statements;• Prepare the financial statements on the going concern basis unless it is inappropriate to assume that the Group will continue in business.The directors consider that in preparing the financial statements on pages 38 to 57 the Group has used appropriate accounting policies, consistentlyapplied and supported by reasonable and prudent judgements and estimates, and that all accounting standards which they consider to be applicable havebeen followed.The directors are responsible for keeping proper accounting records which disclose with reasonable accuracy at any time the financial position of theCompany and enable them to ensure that the financial statements comply with the Companies Act 1985.The directors are responsible for the maintenance and integrity of the Annual Reports and the Financial Statements published on the Group’s website.They have general responsibility for taking such steps as are reasonably open to them to safeguard the assets of the Group and to prevent and detect fraudand other irregularities.<strong>McBride</strong> plc Annual Report 2004 27