pdf (2MB) - McBride

pdf (2MB) - McBride

pdf (2MB) - McBride

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

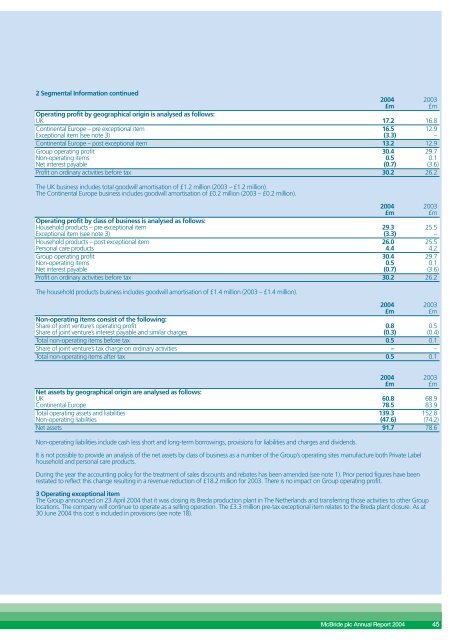

2 Segmental Information continued2004 2003£m £mOperating profit by geographical origin is analysed as follows:UK 17.2 16.8Continental Europe – pre exceptional itemExceptional item (see note 3)16.5(3.3)12.9–Continental Europe – post exceptional item 13.2 12.9Group operating profitNon-operating items30.40.529.70.1Net interest payable (0.7) (3.6)Profit on ordinary activities before tax 30.2 26.2The UK business includes total goodwill amortisation of £1.2 million (2003 – £1.2 million).The Continental Europe business includes goodwill amortisation of £0.2 million (2003 – £0.2 million).2004 2003£m £mOperating profit by class of business is analysed as follows:Household products – pre exceptional item 29.3 25.5Exceptional item (see note 3) (3.3) –Household products – post exceptional itemPersonal care products26.04.425.54.2Group operating profitNon-operating items30.40.529.70.1Net interest payable (0.7) (3.6)Profit on ordinary activities before tax 30.2 26.2The household products business includes goodwill amortisation of £1.4 million (2003 – £1.4 million).2004£m2003£mNon-operating items consist of the following:Share of joint venture’s operating profit 0.8 0.5Share of joint venture’s interest payable and similar charges (0.3) (0.4)Total non-operating items before tax 0.5 0.1Share of joint venture’s tax charge on ordinary activities – –Total non-operating items after tax 0.5 0.12004£m2003£mNet assets by geographical origin are analysed as follows:UK 60.8 68.9Continental Europe 78.5 83.9Total operating assets and liabilities 139.3 152.8Non-operating liabilities (47.6) (74.2)Net assets 91.7 78.6Non-operating liabilities include cash less short and long-term borrowings, provisions for liabilities and charges and dividends.It is not possible to provide an analysis of the net assets by class of business as a number of the Group’s operating sites manufacture both Private Labelhousehold and personal care products.During the year the accounting policy for the treatment of sales discounts and rebates has been amended (see note 1). Prior period figures have beenrestated to reflect this change resulting in a revenue reduction of £18.2 million for 2003. There is no impact on Group operating profit.3 Operating exceptional itemThe Group announced on 23 April 2004 that it was closing its Breda production plant in The Netherlands and transferring those activities to other Grouplocations. The company will continue to operate as a selling operation. The £3.3 million pre-tax exceptional item relates to the Breda plant closure. As at30 June 2004 this cost is included in provisions (see note 18).<strong>McBride</strong> plc Annual Report 2004 45