pdf (2MB) - McBride

pdf (2MB) - McBride

pdf (2MB) - McBride

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

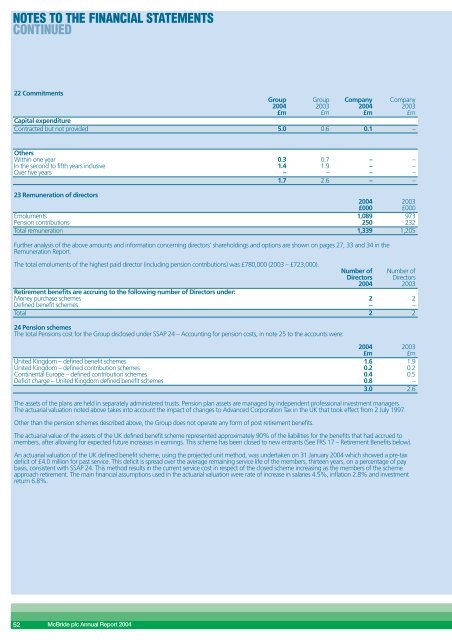

NOTES TO THE FINANCIAL STATEMENTSCONTINUED22 CommitmentsGroup2004Group2003Company2004Company2003£m £m £m £mCapital expenditureContracted but not provided 5.0 0.6 0.1 –OthersWithin one yearIn the second to fifth years inclusive0.31.40.71.9––––Over five years – – – –1.7 2.6 – –23 Remuneration of directors2004 2003£000 £000Emoluments 1,089 973Pension contributions 250 232Total remuneration 1,339 1,205Further analysis of the above amounts and information concerning directors’ shareholdings and options are shown on pages 27, 33 and 34 in theRemuneration Report.The total emoluments of the highest paid director (including pension contributions) was £780,000 (2003 – £723,000).Number ofDirectorsNumber ofDirectors2004 2003Retirement benefits are accruing to the following number of Directors under:Money purchase schemes 2 2Defined benefit schemes – –Total 2 224 Pension schemesThe total Pensions cost for the Group disclosed under SSAP 24 – Accounting for pension costs, in note 25 to the accounts were:2004 2003£m £mUnited Kingdom – defined benefit schemes 1.6 1.9United Kingdom – defined contribution schemes 0.2 0.2Continental Europe – defined contribution schemes 0.4 0.5Deficit charge – United Kingdom defined benefit schemes 0.8 –3.0 2.6The assets of the plans are held in separately administered trusts. Pension plan assets are managed by independent professional investment managers.The actuarial valuation noted above takes into account the impact of changes to Advanced Corporation Tax in the UK that took effect from 2 July 1997.Other than the pension schemes described above, the Group does not operate any form of post retirement benefits.The actuarial value of the assets of the UK defined benefit scheme represented approximately 90% of the liabilities for the benefits that had accrued tomembers, after allowing for expected future increases in earnings. This scheme has been closed to new entrants (See FRS 17 – Retirement Benefits below).An actuarial valuation of the UK defined benefit scheme, using the projected unit method, was undertaken on 31 January 2004 which showed a pre-taxdeficit of £4.0 million for past service. This deficit is spread over the average remaining service life of the members, thirteen years, on a percentage of paybasis, consistent with SSAP 24. This method results in the current service cost in respect of the closed scheme increasing as the members of the schemeapproach retirement. The main financial assumptions used in the actuarial valuation were rate of increase in salaries 4.5%, inflation 2.8% and investmentreturn 6.8%.52<strong>McBride</strong> plc Annual Report 2004