B-1 STATEMENT OF ADDITIONAL INFORMATION Dated May 1 ...

B-1 STATEMENT OF ADDITIONAL INFORMATION Dated May 1 ...

B-1 STATEMENT OF ADDITIONAL INFORMATION Dated May 1 ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

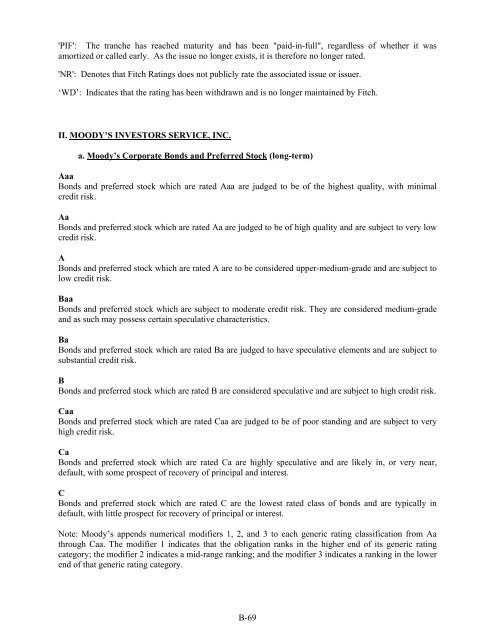

'PIF': The tranche has reached maturity and has been "paid-in-full", regardless of whether it wasamortized or called early. As the issue no longer exists, it is therefore no longer rated.'NR': Denotes that Fitch Ratings does not publicly rate the associated issue or issuer.‘WD’: Indicates that the rating has been withdrawn and is no longer maintained by Fitch.II. MOODY’S INVESTORS SERVICE, INC.a. Moody’s Corporate Bonds and Preferred Stock (long-term)AaaBonds and preferred stock which are rated Aaa are judged to be of the highest quality, with minimalcredit risk.AaBonds and preferred stock which are rated Aa are judged to be of high quality and are subject to very lowcredit risk.ABonds and preferred stock which are rated A are to be considered upper-medium-grade and are subject tolow credit risk.BaaBonds and preferred stock which are subject to moderate credit risk. They are considered medium-gradeand as such may possess certain speculative characteristics.BaBonds and preferred stock which are rated Ba are judged to have speculative elements and are subject tosubstantial credit risk.BBonds and preferred stock which are rated B are considered speculative and are subject to high credit risk.CaaBonds and preferred stock which are rated Caa are judged to be of poor standing and are subject to veryhigh credit risk.CaBonds and preferred stock which are rated Ca are highly speculative and are likely in, or very near,default, with some prospect of recovery of principal and interest.CBonds and preferred stock which are rated C are the lowest rated class of bonds and are typically indefault, with little prospect for recovery of principal or interest.Note: Moody’s appends numerical modifiers 1, 2, and 3 to each generic rating classification from Aathrough Caa. The modifier 1 indicates that the obligation ranks in the higher end of its generic ratingcategory; the modifier 2 indicates a mid-range ranking; and the modifier 3 indicates a ranking in the lowerend of that generic rating category.B-69