English - Siegfried

English - Siegfried

English - Siegfried

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

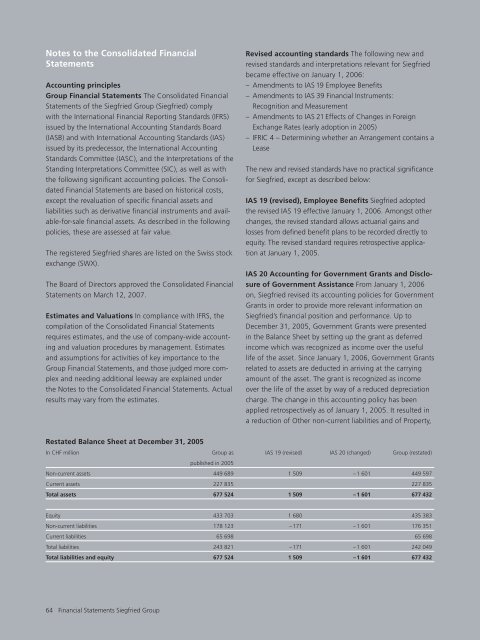

Notes to the Consolidated FinancialStatementsAccounting principlesGroup Financial Statements The Consolidated FinancialStatements of the <strong>Siegfried</strong> Group (<strong>Siegfried</strong>) complywith the International Financial Reporting Standards (IFRS)issued by the International Accounting Standards Board(IASB) and with International Accounting Standards (IAS)issued by its predecessor, the International AccountingStandards Committee (IASC), and the Interpretations of theStanding Interpretations Committee (SIC), as well as withthe following significant accounting policies. The ConsolidatedFinancial Statements are based on historical costs,except the revaluation of specific financial assets andliabilities such as derivative financial instruments and available-for-salefinancial assets. As described in the followingpolicies, these are assessed at fair value.The registered <strong>Siegfried</strong> shares are listed on the Swiss stockexchange (SWX).The Board of Directors approved the Consolidated FinancialStatements on March 12, 2007.Estimates and Valuations In compliance with IFRS, thecompilation of the Consolidated Financial Statementsrequires estimates, and the use of company-wide accountingand valuation procedures by management. Estimatesand assumptions for activities of key importance to theGroup Financial Statements, and those judged more complexand needing additional leeway are explained underthe Notes to the Consolidated Financial Statements. Actualresults may vary from the estimates.Revised accounting standards The following new andrevised standards and interpretations relevant for <strong>Siegfried</strong>became effective on January 1, 2006:– Amendments to IAS 19 Employee Benefits– Amendments to IAS 39 Financial Instruments:Recognition and Measurement– Amendments to IAS 21 Effects of Changes in ForeignExchange Rates (early adoption in 2005)– IFRIC 4 – Determining whether an Arrangement contains aLeaseThe new and revised standards have no practical significancefor <strong>Siegfried</strong>, except as described below:IAS 19 (revised), Employee Benefits <strong>Siegfried</strong> adoptedthe revised IAS 19 effective January 1, 2006. Amongst otherchanges, the revised standard allows actuarial gains andlosses from defined benefit plans to be recorded directly toequity. The revised standard requires retrospective applicationat January 1, 2005.IAS 20 Accounting for Government Grants and Disclosureof Government Assistance From January 1, 2006on, <strong>Siegfried</strong> revised its accounting policies for GovernmentGrants in order to provide more relevant information on<strong>Siegfried</strong>’s financial position and performance. Up toDecember 31, 2005, Government Grants were presentedin the Balance Sheet by setting up the grant as deferredincome which was recognized as income over the usefullife of the asset. Since January 1, 2006, Government Grantsrelated to assets are deducted in arriving at the carryingamount of the asset. The grant is recognized as incomeover the life of the asset by way of a reduced depreciationcharge. The change in this accounting policy has beenapplied retrospectively as of January 1, 2005. It resulted ina reduction of Other non-current liabilities and of Property,Restated Balance Sheet at December 31, 2005In CHF million Group as IAS 19 (revised) IAS 20 (changed) Group (restated)published in 2005Non-current assets 449 689 1 509 – 1 601 449 597Current assets 227 835 227 835Total assets 677 524 1 509 – 1 601 677 432Equity 433 703 1 680 435 383Non-current liabilities 178 123 – 171 – 1 601 176 351Current liabilities 65 698 65 698Total liabilities 243 821 – 171 – 1 601 242 049Total liabilities and equity 677 524 1 509 – 1 601 677 43264 Financial Statements <strong>Siegfried</strong> Group