English - Siegfried

English - Siegfried

English - Siegfried

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

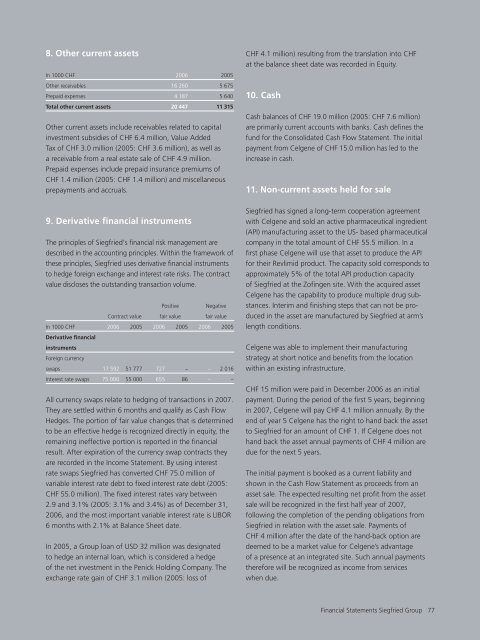

8. Other current assetsIn 1000 CHF 2006 2005Other receivables 16 260 5 675Prepaid expenses 4 187 5 640Total other current assets 20 447 11 315Other current assets include receivables related to capitalinvestment subsidies of CHF 6.4 million, Value AddedTax of CHF 3.0 million (2005: CHF 3.6 million), as well asa receivable from a real estate sale of CHF 4.9 million.Prepaid expenses include prepaid insurance premiums ofCHF 1.4 million (2005: CHF 1.4 million) and miscellaneousprepayments and accruals.9. Derivative financial instrumentsThe principles of <strong>Siegfried</strong>’s financial risk management aredescribed in the accounting principles. Within the framework ofthese principles, <strong>Siegfried</strong> uses derivative financial instrumentsto hedge foreign exchange and interest rate risks. The contractvalue discloses the outstanding transaction volume.Positive NegativeContract value fair value fair valueIn 1000 CHF 2006 2005 2006 2005 2006 2005Derivative financialinstrumentsForeign currencyswaps 17 592 51 777 727 – – 2 016Interest rate swaps 75 000 55 000 655 86 – –All currency swaps relate to hedging of transactions in 2007.They are settled within 6 months and qualify as Cash FlowHedges. The portion of fair value changes that is determinedto be an effective hedge is recognized directly in equity, theremaining ineffective portion is reported in the financialresult. After expiration of the currency swap contracts theyare recorded in the Income Statement. By using interestrate swaps <strong>Siegfried</strong> has converted CHF 75.0 million ofvariable interest rate debt to fixed interest rate debt (2005:CHF 55.0 million). The fixed interest rates vary between2.9 and 3.1% (2005: 3.1% and 3.4%) as of December 31,2006, and the most important variable interest rate is LIBOR6 months with 2.1% at Balance Sheet date.In 2005, a Group loan of USD 32 million was designatedto hedge an internal loan, which is considered a hedgeof the net investment in the Penick Holding Company. Theexchange rate gain of CHF 3.1 million (2005: loss ofCHF 4.1 million) resulting from the translation into CHFat the balance sheet date was recorded in Equity.10. CashCash balances of CHF 19.0 million (2005: CHF 7.6 million)are primarily current accounts with banks. Cash defines thefund for the Consolidated Cash Flow Statement. The initialpayment from Celgene of CHF 15.0 million has led to theincrease in cash.11. Non-current assets held for sale<strong>Siegfried</strong> has signed a long-term cooperation agreementwith Celgene and sold an active pharmaceutical ingredient(API) manufacturing asset to the US- based pharmaceuticalcompany in the total amount of CHF 55.5 million. In afirst phase Celgene will use that asset to produce the APIfor their Revlimid product. The capacity sold corresponds toapproximately 5% of the total API production capacityof <strong>Siegfried</strong> at the Zofingen site. With the acquired assetCelgene has the capability to produce multiple drug sub -stances. Interim and finishing steps that can not be pro -duced in the asset are manufactured by <strong>Siegfried</strong> at arm’slength conditions.Celgene was able to implement their manufacturingstrategy at short notice and benefits from the locationwithin an existing infrastructure.CHF 15 million were paid in December 2006 as an initialpayment. During the period of the first 5 years, beginningin 2007, Celgene will pay CHF 4.1 million annually. By theend of year 5 Celgene has the right to hand back the assetto <strong>Siegfried</strong> for an amount of CHF 1. If Celgene does nothand back the asset annual payments of CHF 4 million aredue for the next 5 years.The initial payment is booked as a current liability andshown in the Cash Flow Statement as proceeds from anasset sale. The expected resulting net profit from the assetsale will be recognized in the first half year of 2007,following the completion of the pending obligations from<strong>Siegfried</strong> in relation with the asset sale. Payments ofCHF 4 million after the date of the hand-back option aredeemed to be a market value for Celgene’s advantageof a presence at an integrated site. Such annual paymentstherefore will be recognized as income from serviceswhen due.Financial Statements <strong>Siegfried</strong> Group77