English - Siegfried

English - Siegfried

English - Siegfried

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

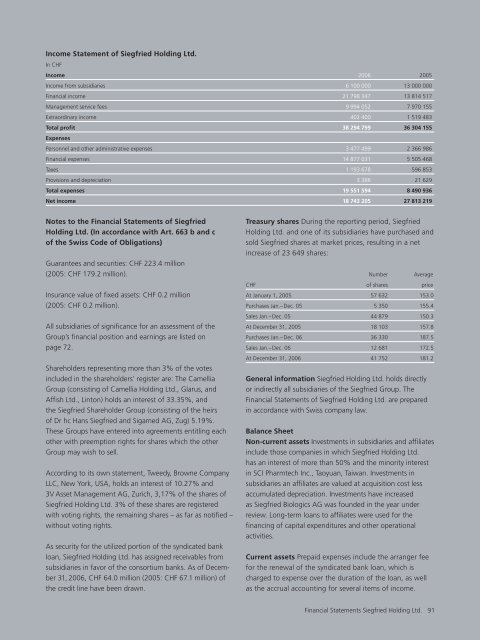

Income Statement of <strong>Siegfried</strong> Holding Ltd.In CHFIncome 2006 2005Income from subsidiaries 6 100 000 13 000 000Financial income 21 798 347 13 814 517Management service fees 9 994 052 7 970 155Extraordinary income 402 400 1 519 483Total profit 38 294 799 36 304 155ExpensesPersonnel and other administrative expenses 3 477 499 2 366 986Financial expenses 14 877 031 5 505 468Taxes 1 193 678 596 853Provisions and depreciation 3 386 21 629Total expenses 19 551 594 8 490 936Net income 18 743 205 27 813 219Notes to the Financial Statements of <strong>Siegfried</strong>Holding Ltd. (In accordance with Art. 663 b and cof the Swiss Code of Obligations)Guarantees and securities: CHF 223.4 million(2005: CHF 179.2 million).Insurance value of fixed assets: CHF 0.2 million(2005: CHF 0.2 million).All subsidiaries of significance for an assessment of theGroup’s financial position and earnings are listed onpage 72.Shareholders representing more than 3% of the votesincluded in the shareholders’ register are: The CamelliaGroup (consisting of Camellia Holding Ltd., Glarus, andAffish Ltd., Linton) holds an interest of 33.35%, andthe <strong>Siegfried</strong> Shareholder Group (consisting of the heirsof Dr hc Hans <strong>Siegfried</strong> and Sigamed AG, Zug) 5.19%.These Groups have entered into agreements entitling eachother with preemption rights for shares which the otherGroup may wish to sell.According to its own statement, Tweedy, Browne CompanyLLC, New York, USA, holds an interest of 10.27% and3V Asset Management AG, Zurich, 3,17% of the shares of<strong>Siegfried</strong> Holding Ltd. 3% of these shares are registeredwith voting rights, the remaining shares – as far as notified –without voting rights.As security for the utilized portion of the syndicated bankloan, <strong>Siegfried</strong> Holding Ltd. has assigned receivables fromsubsidiaries in favor of the consortium banks. As of December31, 2006, CHF 64.0 million (2005: CHF 67.1 million) ofthe credit line have been drawn.Treasury shares During the reporting period, <strong>Siegfried</strong>Holding Ltd. and one of its subsidiaries have purchased andsold <strong>Siegfried</strong> shares at market prices, resulting in a netincrease of 23 649 shares:NumberAverageCHF of shares priceAt January 1, 2005 57 632 153.0Purchases Jan.– Dec. 05 5 350 155.4Sales Jan.– Dec. 05 44 879 150.3At December 31, 2005 18 103 157.8Purchases Jan.– Dec. 06 36 330 187.5Sales Jan.– Dec. 06 12 681 172.5At December 31, 2006 41 752 181.2General information <strong>Siegfried</strong> Holding Ltd. holds directlyor indirectly all subsidiaries of the <strong>Siegfried</strong> Group. TheFinancial Statements of <strong>Siegfried</strong> Holding Ltd. are preparedin accordance with Swiss company law.Balance SheetNon-current assets Investments in subsidiaries and affiliatesinclude those companies in which <strong>Siegfried</strong> Holding Ltd.has an interest of more than 50% and the minority interestin SCI Pharmtech Inc., Taoyuan, Taiwan. Investments insubsidiaries an affiliates are valued at acquisition cost lessaccumulated depreciation. Investments have increasedas <strong>Siegfried</strong> Biologics AG was founded in the year underreview. Long-term loans to affiliates were used for thefinancing of capital expenditures and other operationalactivities.Current assets Prepaid expenses include the arranger feefor the renewal of the syndicated bank loan, which ischarged to expense over the duration of the loan, as wellas the accrual accounting for several items of income.Financial Statements <strong>Siegfried</strong> Holding Ltd.91