Wind Energy Feasibility Study - Town Of Orleans

Wind Energy Feasibility Study - Town Of Orleans

Wind Energy Feasibility Study - Town Of Orleans

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

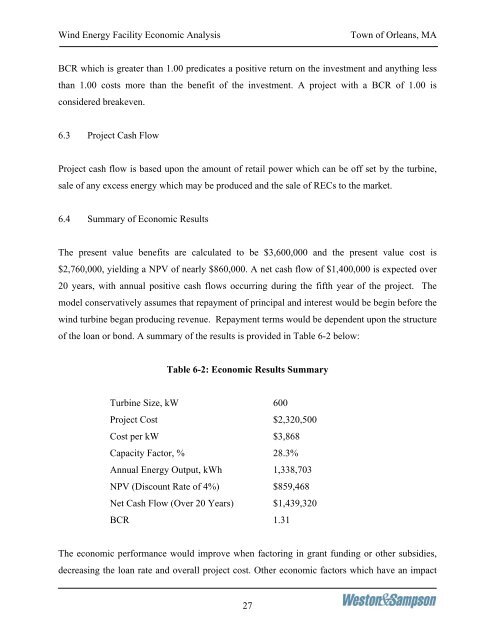

<strong>Wind</strong> <strong>Energy</strong> Facility Economic Analysis<strong>Town</strong> of <strong>Orleans</strong>, MABCR which is greater than 1.00 predicates a positive return on the investment and anything lessthan 1.00 costs more than the benefit of the investment. A project with a BCR of 1.00 isconsidered breakeven.6.3 Project Cash FlowProject cash flow is based upon the amount of retail power which can be off set by the turbine,sale of any excess energy which may be produced and the sale of RECs to the market.6.4 Summary of Economic ResultsThe present value benefits are calculated to be $3,600,000 and the present value cost is$2,760,000, yielding a NPV of nearly $860,000. A net cash flow of $1,400,000 is expected over20 years, with annual positive cash flows occurring during the fifth year of the project. Themodel conservatively assumes that repayment of principal and interest would be begin before thewind turbine began producing revenue. Repayment terms would be dependent upon the structureof the loan or bond. A summary of the results is provided in Table 6-2 below:Table 6-2: Economic Results SummaryTurbine Size, kW 600Project Cost $2,320,500Cost per kW $3,868Capacity Factor, % 28.3%Annual <strong>Energy</strong> Output, kWh 1,338,703NPV (Discount Rate of 4%) $859,468Net Cash Flow (Over 20 Years) $1,439,320BCR 1.31The economic performance would improve when factoring in grant funding or other subsidies,decreasing the loan rate and overall project cost. Other economic factors which have an impact27