A Practical Guide to SR&ED in 2011 - CCH Canadian

A Practical Guide to SR&ED in 2011 - CCH Canadian

A Practical Guide to SR&ED in 2011 - CCH Canadian

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

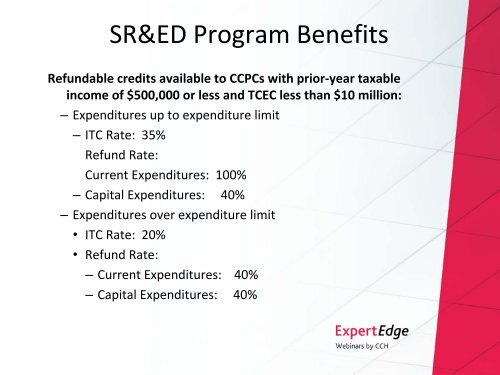

SR&<strong>ED</strong> Program BenefitsRefundable credits available <strong>to</strong> CCPCs with prior‐year taxable<strong>in</strong>come of $500,000 or less and TCEC less than $10 million:– Expenditures up <strong>to</strong> expenditure limit– ITC Rate: 35%Refund Rate:Current Expenditures: 100%– Capital Expenditures: 40%– Expenditures over expenditure limit• ITC Rate: 20%• Refund Rate:– Current Expenditures: 40%– Capital Expenditures: 40%