- Page 2:

DIVISION ONEIncome-taxAct, 1961

- Page 7 and 8:

I-7 ARRANGEMENT OF SECTIONSSECTIONP

- Page 9 and 10:

I-9 ARRANGEMENT OF SECTIONSSECTIONP

- Page 11 and 12:

I-11 ARRANGEMENT OF SECTIONSSECTION

- Page 13 and 14:

I-13 ARRANGEMENT OF SECTIONSSECTION

- Page 15 and 16:

I-15 ARRANGEMENT OF SECTIONSSECTION

- Page 17 and 18:

I-17 ARRANGEMENT OF SECTIONSSECTION

- Page 19 and 20:

I-19 ARRANGEMENT OF SECTIONSSECTION

- Page 21 and 22:

I-21 ARRANGEMENT OF SECTIONSSECTION

- Page 23 and 24:

I-23 ARRANGEMENT OF SECTIONSSECTION

- Page 25 and 26:

I-25 ARRANGEMENT OF SECTIONSSECTION

- Page 27 and 28:

I-27 ARRANGEMENT OF SECTIONSSECTION

- Page 29 and 30:

I-29 ARRANGEMENT OF SECTIONSSECTION

- Page 31 and 32:

I-31 ARRANGEMENT OF SECTIONSSECTION

- Page 33 and 34:

INCOME-TAX ACT, 1961*[43 OF 1961][A

- Page 35 and 36:

1.3 CH. I - PRELIMINARY S. 2(1B)or

- Page 37 and 38:

1.5 CH. I - PRELIMINARY S. 2(11)(b)

- Page 39 and 40:

1.7 CH. I - PRELIMINARY S. 2(14)(c)

- Page 41 and 42:

1.9 CH. I - PRELIMINARY S. 2(18)(ii

- Page 43 and 44:

1.11 CH. I - PRELIMINARY S. 2(19AA)

- Page 45 and 46:

1.13 CH. I - PRELIMINARY S. 2(22)86

- Page 47 and 48:

1.15 CH. I - PRELIMINARY S. 2(23)th

- Page 49 and 50:

1.17 CH. I - PRELIMINARY S. 2(24)re

- Page 51 and 52:

1.19 CH. I - PRELIMINARY S. 2(26)33

- Page 53 and 54:

1.21 CH. I - PRELIMINARY S. 2(29BA)

- Page 55 and 56:

1.23 CH. I - PRELIMINARY S. 2(37A)(

- Page 57 and 58:

1.25 CH. I - PRELIMINARY S. 2(42A)u

- Page 59 and 60:

1.27 CH. I - PRELIMINARY S. 2(42A)d

- Page 61 and 62:

1.29 CH. I - PRELIMINARY S. 2(48)or

- Page 63 and 64:

1.31 CH. II - BASIS OF CHARGE S. 5p

- Page 65 and 66:

1.33 CH. II - BASIS OF CHARGE S. 65

- Page 67 and 68:

1.35 CH. II - BASIS OF CHARGE S. 9I

- Page 69 and 70:

1.37 CH. II - BASIS OF CHARGE S. 9(

- Page 71 and 72:

1.39 CH. II - BASIS OF CHARGE S. 98

- Page 73 and 74:

1.41 CH. III - INCOMES WHICH DO NOT

- Page 75 and 76:

1.43 CH. III - INCOMES WHICH DO NOT

- Page 77 and 78:

1.45 CH. III - INCOMES WHICH DO NOT

- Page 79 and 80:

1.47 CH. III - INCOMES WHICH DO NOT

- Page 81 and 82:

1.49 CH. III - INCOMES WHICH DO NOT

- Page 83 and 84:

1.51 CH. III - INCOMES WHICH DO NOT

- Page 85 and 86:

1.53 CH. III - INCOMES WHICH DO NOT

- Page 87 and 88:

1.55 CH. III - INCOMES WHICH DO NOT

- Page 89 and 90:

1.57 CH. III - INCOMES WHICH DO NOT

- Page 91 and 92:

1.59 CH. III - INCOMES WHICH DO NOT

- Page 93 and 94:

1.61 CH. III - INCOMES WHICH DO NOT

- Page 95 and 96:

1.63 CH. III - INCOMES WHICH DO NOT

- Page 97 and 98:

1.65 CH. III - INCOMES WHICH DO NOT

- Page 99 and 100:

1.67 CH. III - INCOMES WHICH DO NOT

- Page 101 and 102:

1.69 CH. III - INCOMES WHICH DO NOT

- Page 103 and 104:

1.71 CH. III - INCOMES WHICH DO NOT

- Page 105 and 106:

1.73 CH. III - INCOMES WHICH DO NOT

- Page 107 and 108:

1.75 CH. III - INCOMES WHICH DO NOT

- Page 109 and 110:

1.77 CH. III - INCOMES WHICH DO NOT

- Page 111 and 112:

1.79 CH. III - INCOMES WHICH DO NOT

- Page 113 and 114:

1.81 CH. III - INCOMES WHICH DO NOT

- Page 115 and 116:

1.83 CH. III - INCOMES WHICH DO NOT

- Page 117 and 118:

1.85 CH. III - INCOMES WHICH DO NOT

- Page 119 and 120:

1.87 CH. III - INCOMES WHICH DO NOT

- Page 121 and 122:

1.89 CH. III - INCOMES WHICH DO NOT

- Page 123 and 124:

1.91 CH. III - INCOMES WHICH DO NOT

- Page 125 and 126:

1.93 CH. III - INCOMES WHICH DO NOT

- Page 127 and 128:

1.95 CH. III - INCOMES WHICH DO NOT

- Page 129 and 130:

1.97 CH. III - INCOMES WHICH DO NOT

- Page 131 and 132:

1.99 CH. III - INCOMES WHICH DO NOT

- Page 133 and 134:

1.101 CH. III - INCOMES WHICH DO NO

- Page 135 and 136: 1.103 CH. III - INCOMES WHICH DO NO

- Page 137 and 138: 1.105 CH. III - INCOMES WHICH DO NO

- Page 139 and 140: 1.107 CH. III - INCOMES WHICH DO NO

- Page 141 and 142: 1.109 CH. III - INCOMES WHICH DO NO

- Page 143 and 144: 1.111 CH. III - INCOMES WHICH DO NO

- Page 145 and 146: 1.113 CH. III - INCOMES WHICH DO NO

- Page 147 and 148: 1.115 CH. III - INCOMES WHICH DO NO

- Page 149 and 150: 1.117 CH. III - INCOMES WHICH DO NO

- Page 151 and 152: 1.119 CH. III - INCOMES WHICH DO NO

- Page 153 and 154: 1.121 CH. III - INCOMES WHICH DO NO

- Page 155 and 156: 1.123 CH. III - INCOMES WHICH DO NO

- Page 157 and 158: 1.125 CH. III - INCOMES WHICH DO NO

- Page 159 and 160: 1.127 CH. III - INCOMES WHICH DO NO

- Page 161 and 162: 1.129 CH. III - INCOMES WHICH DO NO

- Page 163 and 164: 1.131 CH. III - INCOMES WHICH DO NO

- Page 165 and 166: 1.133 CH. III - INCOMES WHICH DO NO

- Page 167 and 168: 1.135 CH. III - INCOMES WHICH DO NO

- Page 169 and 170: 1.137 CH. III - INCOMES WHICH DO NO

- Page 171 and 172: 1.139 CH. III - INCOMES WHICH DO NO

- Page 173 and 174: 1.141 CH. III - INCOMES WHICH DO NO

- Page 175 and 176: 1.143 CH. IV - COMPUTATION OF TOTAL

- Page 177 and 178: 1.145 CH. IV - COMPUTATION OF TOTAL

- Page 179 and 180: 1.147 CH. IV - COMPUTATION OF TOTAL

- Page 181 and 182: 1.149 CH. IV - COMPUTATION OF TOTAL

- Page 183 and 184: 1.151 CH. IV - COMPUTATION OF TOTAL

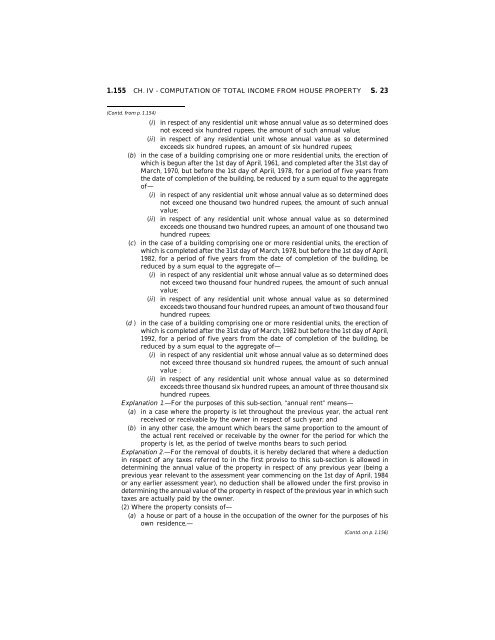

- Page 185: 1.153 CH. IV - COMPUTATION OF TOTAL

- Page 189 and 190: 1.157 CH. IV - COMPUTATION OF TOTAL

- Page 191 and 192: 1.159 CH. IV - COMPUTATION OF TOTAL

- Page 193 and 194: 1.161 CH. IV - COMPUTATION OF BUSIN

- Page 195 and 196: 1.163 CH. IV - COMPUTATION OF BUSIN

- Page 197 and 198: 1.165 CH. IV - COMPUTATION OF BUSIN

- Page 199 and 200: 1.167 CH. IV - COMPUTATION OF BUSIN

- Page 201 and 202: 1.169 CH. IV - COMPUTATION OF BUSIN

- Page 203 and 204: 1.171 CH. IV - COMPUTATION OF BUSIN

- Page 205 and 206: 1.173 CH. IV - COMPUTATION OF BUSIN

- Page 207 and 208: 1.175 CH. IV - COMPUTATION OF BUSIN

- Page 209 and 210: 1.177 CH. IV - COMPUTATION OF BUSIN

- Page 211 and 212: 1.179 CH. IV - COMPUTATION OF BUSIN

- Page 213 and 214: 1.181 CH. IV - COMPUTATION OF BUSIN

- Page 215 and 216: 1.183 CH. IV - COMPUTATION OF BUSIN

- Page 217 and 218: 1.185 CH. IV - COMPUTATION OF BUSIN

- Page 219 and 220: 1.187 CH. IV - COMPUTATION OF BUSIN

- Page 221 and 222: 1.189 CH. IV - COMPUTATION OF BUSIN

- Page 223 and 224: 1.191 CH. IV - COMPUTATION OF BUSIN

- Page 225 and 226: 1.193 CH. IV - COMPUTATION OF BUSIN

- Page 227 and 228: 1.195 CH. IV - COMPUTATION OF BUSIN

- Page 229 and 230: 1.197 CH. IV - COMPUTATION OF BUSIN

- Page 231 and 232: 1.199 CH. IV - COMPUTATION OF BUSIN

- Page 233 and 234: 1.201 CH. IV - COMPUTATION OF BUSIN

- Page 235 and 236: 1.203 CH. IV - COMPUTATION OF BUSIN

- Page 237 and 238:

1.205 CH. IV - COMPUTATION OF BUSIN

- Page 239 and 240:

1.207 CH. IV - COMPUTATION OF BUSIN

- Page 241 and 242:

1.209 CH. IV - COMPUTATION OF BUSIN

- Page 243 and 244:

1.211 CH. IV - COMPUTATION OF BUSIN

- Page 245 and 246:

1.213 CH. IV - COMPUTATION OF BUSIN

- Page 247 and 248:

1.215 CH. IV - COMPUTATION OF BUSIN

- Page 249 and 250:

1.217 CH. IV - COMPUTATION OF BUSIN

- Page 251 and 252:

1.219 CH. IV - COMPUTATION OF BUSIN

- Page 253 and 254:

1.221 CH. IV - COMPUTATION OF BUSIN

- Page 255 and 256:

1.223 CH. IV - COMPUTATION OF BUSIN

- Page 257 and 258:

1.225 CH. IV - COMPUTATION OF BUSIN

- Page 259 and 260:

1.227 CH. IV - COMPUTATION OF BUSIN

- Page 261 and 262:

1.229 CH. IV - COMPUTATION OF BUSIN

- Page 263 and 264:

1.231 CH. IV - COMPUTATION OF BUSIN

- Page 265 and 266:

1.233 CH. IV - COMPUTATION OF BUSIN

- Page 267 and 268:

1.235 CH. IV - COMPUTATION OF BUSIN

- Page 269 and 270:

1.237 CH. IV - COMPUTATION OF BUSIN

- Page 271 and 272:

1.239 CH. IV - COMPUTATION OF BUSIN

- Page 273 and 274:

1.241 CH. IV - COMPUTATION OF BUSIN

- Page 275 and 276:

1.243 CH. IV - COMPUTATION OF BUSIN

- Page 277 and 278:

1.245 CH. IV - COMPUTATION OF BUSIN

- Page 279 and 280:

1.247 CH. IV - COMPUTATION OF BUSIN

- Page 281 and 282:

1.249 CH. IV - COMPUTATION OF BUSIN

- Page 283 and 284:

1.251 CH. IV - COMPUTATION OF BUSIN

- Page 285 and 286:

1.253 CH. IV - COMPUTATION OF BUSIN

- Page 287 and 288:

1.255 CH. IV - COMPUTATION OF BUSIN

- Page 289 and 290:

1.257 CH. IV - COMPUTATION OF BUSIN

- Page 291 and 292:

1.259 CH. IV - COMPUTATION OF BUSIN

- Page 293 and 294:

1.261 CH. IV - COMPUTATION OF BUSIN

- Page 295 and 296:

1.263 CH. IV - COMPUTATION OF BUSIN

- Page 297 and 298:

1.265 CH. IV - COMPUTATION OF BUSIN

- Page 299 and 300:

1.267 CH. IV - COMPUTATION OF BUSIN

- Page 301 and 302:

1.269 CH. IV - COMPUTATION OF BUSIN

- Page 303 and 304:

1.271 CH. IV - COMPUTATION OF BUSIN

- Page 305 and 306:

1.273 CH. IV - COMPUTATION OF BUSIN

- Page 307 and 308:

1.275 CH. IV - COMPUTATION OF BUSIN

- Page 309 and 310:

1.277 CH. IV - COMPUTATION OF BUSIN

- Page 311 and 312:

1.279 CH. IV - COMPUTATION OF BUSIN

- Page 313 and 314:

1.281 CH. IV - COMPUTATION OF BUSIN

- Page 315 and 316:

1.283 CH. IV - COMPUTATION OF BUSIN

- Page 317 and 318:

1.285 CH. IV - COMPUTATION OF BUSIN

- Page 319 and 320:

1.287 CH. IV - COMPUTATION OF BUSIN

- Page 321 and 322:

1.289 CH. IV - COMPUTATION OF BUSIN

- Page 323 and 324:

1.291 CH. IV - COMPUTATION OF BUSIN

- Page 325 and 326:

1.293 CH. IV - COMPUTATION OF BUSIN

- Page 327 and 328:

1.295 CH. IV - COMPUTATION OF BUSIN

- Page 329 and 330:

1.297 CH. IV - COMPUTATION OF BUSIN

- Page 331 and 332:

1.299 CH. IV - COMPUTATION OF BUSIN

- Page 333 and 334:

1.301 CH. IV - COMPUTATION OF INCOM

- Page 335 and 336:

1.303 CH. IV - COMPUTATION OF INCOM

- Page 337 and 338:

1.305 CH. IV - COMPUTATION OF INCOM

- Page 339 and 340:

1.307 CH. IV - COMPUTATION OF INCOM

- Page 341 and 342:

1.309 CH. IV - COMPUTATION OF INCOM

- Page 343 and 344:

1.311 CH. IV - COMPUTATION OF INCOM

- Page 345 and 346:

1.313 CH. IV - COMPUTATION OF INCOM

- Page 347 and 348:

1.315 CH. IV - COMPUTATION OF INCOM

- Page 349 and 350:

1.317 CH. IV - COMPUTATION OF INCOM

- Page 351 and 352:

1.319 CH. IV - COMPUTATION OF INCOM

- Page 353 and 354:

1.321 CH. IV - COMPUTATION OF INCOM

- Page 355 and 356:

1.323 CH. IV - COMPUTATION OF INCOM

- Page 357 and 358:

1.325 CH. IV - COMPUTATION OF INCOM

- Page 359 and 360:

1.327 CH. IV - COMPUTATION OF INCOM

- Page 361 and 362:

1.329 CH. IV - COMPUTATION OF INCOM

- Page 363 and 364:

1.331 CH. IV - COMPUTATION OF INCOM

- Page 365 and 366:

1.333 CH. IV - COMPUTATION OF INCOM

- Page 367 and 368:

1.335 CH. IV - COMPUTATION OF INCOM

- Page 369 and 370:

1.337 CH. IV - COMPUTATION OF INCOM

- Page 371 and 372:

1.339 CH. IV - COMPUTATION OF INCOM

- Page 373 and 374:

1.341 CH. IV - COMPUTATION OF INCOM

- Page 375 and 376:

1.343 CH. IV - COMPUTATION OF INCOM

- Page 377 and 378:

1.345 CH. IV - COMPUTATION OF INCOM

- Page 379 and 380:

1.347 CH. IV - COMPUTATION OF INCOM

- Page 381 and 382:

1.349 CH. IV - COMPUTATION OF INCOM

- Page 383 and 384:

1.351 CH. IV - COMPUTATION OF INCOM

- Page 385 and 386:

1.353 CH. IV - COMPUTATION OF INCOM

- Page 387 and 388:

1.355 CH. V - INCOME OF OTHER PERSO

- Page 389 and 390:

1.357 CH. V - INCOME OF OTHER PERSO

- Page 391 and 392:

1.359 CH. V - INCOME OF OTHER PERSO

- Page 393 and 394:

1.361 CH. VI - AGGREGATION OF INCOM

- Page 395 and 396:

1.363 CH. VI - AGGREGATION OF INCOM

- Page 397 and 398:

1.365 CH. VI - AGGREGATION OF INCOM

- Page 399 and 400:

1.367 CH. VI - AGGREGATION OF INCOM

- Page 401 and 402:

1.369 CH. VI - AGGREGATION OF INCOM

- Page 403 and 404:

1.371 CH. VI - AGGREGATION OF INCOM

- Page 405 and 406:

1.373 CH. VI - AGGREGATION OF INCOM

- Page 407 and 408:

1.375 CH. VI - AGGREGATION OF INCOM

- Page 409 and 410:

1.377 CH. VI - AGGREGATION OF INCOM

- Page 411 and 412:

1.379 CH. VI-A - DEDUCTIONS - GENER

- Page 413 and 414:

1.381 CH. VI-A - DEDUCTIONS - GENER

- Page 415 and 416:

1.383 CH. VI-A - DEDUCTIONS IN RESP

- Page 417 and 418:

1.385 CH. VI-A - DEDUCTIONS IN RESP

- Page 419 and 420:

1.387 CH. VI-A - DEDUCTIONS IN RESP

- Page 421 and 422:

1.389 CH. VI-A - DEDUCTIONS IN RESP

- Page 423 and 424:

1.391 CH. VI-A - DEDUCTIONS IN RESP

- Page 425 and 426:

1.393 CH. VI-A - DEDUCTIONS IN RESP

- Page 427 and 428:

1.395 CH. VI-A - DEDUCTIONS IN RESP

- Page 429 and 430:

1.397 CH. VI-A - DEDUCTIONS IN RESP

- Page 431 and 432:

1.399 CH. VI-A - DEDUCTIONS IN RESP

- Page 433 and 434:

1.401 CH. VI-A - DEDUCTIONS IN RESP

- Page 435 and 436:

1.403 CH. VI-A - DEDUCTIONS IN RESP

- Page 438 and 439:

S. 80G I.T. ACT, 1961 1.40630[(iiih

- Page 440 and 441:

S. 80G I.T. ACT, 1961 1.408(i) the

- Page 442 and 443:

S. 80G I.T. ACT, 1961 1.410purposes

- Page 444 and 445:

S. 80GGA I.T. ACT, 1961 1.41281[Ded

- Page 446 and 447:

S. 80GGA I.T. ACT, 1961 1.414Provid

- Page 448 and 449:

S. 80HH I.T. ACT, 1961 1.416(ii) it

- Page 450 and 451:

S. 80HHA I.T. ACT, 1961 1.41813[(9A

- Page 452 and 453:

S. 80HHB I.T. ACT, 1961 1.420notifi

- Page 454 and 455:

S. 80HHB I.T. ACT, 1961 1.422(ii) a

- Page 456 and 457:

S. 80HHBA I.T. ACT, 1961 1.424below

- Page 458 and 459:

S. 80HHC I.T. ACT, 1961 1.42654[(1B

- Page 460 and 461:

S. 80HHC I.T. ACT, 1961 1.428(ii) i

- Page 462 and 463:

S. 80HHC I.T. ACT, 1961 1.430House

- Page 464 and 465:

S. 80HHD I.T. ACT, 1961 1.43295[(ba

- Page 466 and 467:

S. 80HHD I.T. ACT, 1961 1.434(d) fo

- Page 468 and 469:

S. 80HHD I.T. ACT, 1961 1.436(5) Wh

- Page 470 and 471:

S. 80HHE I.T. ACT, 1961 1.43834[Ded

- Page 472 and 473:

S. 80HHE I.T. ACT, 1961 1.440softwa

- Page 474 and 475:

S. 80HHF I.T. ACT, 1961 1.442music

- Page 476 and 477:

S. 80-I I.T. ACT, 1961 1.444rights,

- Page 478 and 479:

S. 80-I I.T. ACT, 1961 1.446Explana

- Page 480 and 481:

S. 80-I I.T. ACT, 1961 1.448of the

- Page 482 and 483:

S. 80-IA I.T. ACT, 1961 1.450(Contd

- Page 484 and 485:

S. 80-IA I.T. ACT, 1961 1.452(Contd

- Page 486 and 487:

S. 80-IA I.T. ACT, 1961 1.454(Contd

- Page 488 and 489:

S. 80-IA I.T. ACT, 1961 1.456(Contd

- Page 490 and 491:

S. 80-IA I.T. ACT, 1961 1.458(i) it

- Page 492 and 493:

S. 80-IA I.T. ACT, 1961 1.460(b) a

- Page 494 and 495:

S. 80-IA I.T. ACT, 1961 1.462nies f

- Page 496 and 497:

S. 80-IA I.T. ACT, 1961 1.464(9) Wh

- Page 498 and 499:

S. 80-IB I.T. ACT, 1961 1.466Explan

- Page 500 and 501:

S. 80-IB I.T. ACT, 1961 1.468a co-o

- Page 502 and 503:

S. 80-IB I.T. ACT, 1961 1.470Delhi

- Page 504 and 505:

S. 80-IB I.T. ACT, 1961 1.472(b) ha

- Page 506 and 507:

S. 80-IB I.T. ACT, 1961 1.474Explan

- Page 508 and 509:

S. 80-IB I.T. ACT, 1961 1.476(iii)

- Page 510 and 511:

S. 80-IB I.T. ACT, 1961 1.478year i

- Page 512 and 513:

S. 80-IC I.T. ACT, 1961 1.480(i) on

- Page 514 and 515:

S. 80-ID I.T. ACT, 1961 1.482(v)

- Page 516 and 517:

S. 80-IE I.T. ACT, 1961 1.4841[(e)

- Page 518 and 519:

S. 80J I.T. ACT, 1961 1.486plant an

- Page 520 and 521:

S. 80L I.T. ACT, 1961 1.488Explanat

- Page 522 and 523:

S. 80LA I.T. ACT, 1961 1.49013[Dedu

- Page 524 and 525:

S. 80M I.T. ACT, 1961 1.492(c) from

- Page 526 and 527:

S. 80-O I.T. ACT, 1961 1.494a forei

- Page 528 and 529:

S. 80P I.T. ACT, 1961 1.496(2) The

- Page 530 and 531:

S. 80P I.T. ACT, 1961 1.498Explanat

- Page 532 and 533:

S. 80QQB I.T. ACT, 1961 1.50088[Ded

- Page 534 and 535:

S. 80R I.T. ACT, 1961 1.502(c) “c

- Page 536 and 537:

S. 80RRA I.T. ACT, 1961 1.504as is

- Page 538 and 539:

S. 80RRB I.T. ACT, 1961 1.506(vi) a

- Page 540 and 541:

S. 80U I.T. ACT, 1961 1.508(h) “t

- Page 542 and 543:

S. 80V I.T. ACT, 1961 1.5102 of the

- Page 544 and 545:

S. 88 I.T. ACT, 1961 1.512Deduction

- Page 546 and 547:

S. 88 I.T. ACT, 1961 1.514Provided

- Page 548 and 549:

S. 88 I.T. ACT, 1961 1.516(b) any a

- Page 550 and 551:

S. 88 I.T. ACT, 1961 1.518(i) “el

- Page 552 and 553:

S. 88 I.T. ACT, 1961 1.520Provided

- Page 554 and 555:

S. 88C I.T. ACT, 1961 1.522of premi

- Page 556 and 557:

S. 89A I.T. ACT, 1961 1.5249[(3) No

- Page 558 and 559:

S. 90A I.T. ACT, 1961 1.526(ii) inc

- Page 560 and 561:

S. 91 I.T. ACT, 1961 1.528Countries

- Page 562 and 563:

S. 92A I.T. ACT, 1961 1.530expense

- Page 564 and 565:

S. 92C I.T. ACT, 1961 1.532of assoc

- Page 566 and 567:

S. 92D I.T. ACT, 1961 1.534order of

- Page 568 and 569:

S. 93 I.T. ACT, 1961 1.53637[(iv)

- Page 570 and 571:

S. 94 I.T. ACT, 1961 1.538(4) (a)

- Page 572 and 573:

S. 104 I.T. ACT, 1961 1.540(c) such

- Page 574 and 575:

S. 112 I.T. ACT, 1961 1.542(2) Wher

- Page 576 and 577:

S. 112A I.T. ACT, 1961 1.544Explana

- Page 578 and 579:

S. 115A I.T. ACT, 1961 1.546the inc

- Page 580 and 581:

S. 115AB I.T. ACT, 1961 1.54893[Exp

- Page 582 and 583:

S. 115AC I.T. ACT, 1961 1.550(f)

- Page 584 and 585:

S. 115AC I.T. ACT, 1961 1.552(ii) t

- Page 586 and 587:

S. 115ACA I.T. ACT, 1961 1.554(ii)

- Page 588 and 589:

S. 115B I.T. ACT, 1961 1.556(2) Whe

- Page 590 and 591:

S. 115BBC I.T. ACT, 1961 1.558the i

- Page 592 and 593:

S. 115D I.T. ACT, 1961 1.560(c) “

- Page 594 and 595:

S. 115-I I.T. ACT, 1961 1.562(ii)

- Page 596 and 597:

S. 115J I.T. ACT, 1961 1.56458[(g)

- Page 598 and 599:

S. 115JA I.T. ACT, 1961 1.566(f) th

- Page 600 and 601:

S. 115JAA I.T. ACT, 1961 1.56880[(2

- Page 602 and 603:

S. 115JB I.T. ACT, 1961 1.570Provid

- Page 604 and 605:

S. 115JB I.T. ACT, 1961 1.572Explan

- Page 606 and 607:

S. 115-O I.T. ACT, 1961 1.57413[CHA

- Page 608 and 609:

S. 115R I.T. ACT, 1961 1.576When co

- Page 610 and 611:

S. 115T I.T. ACT, 1961 1.578(4) No

- Page 612 and 613:

S. 115VA I.T. ACT, 1961 1.580Defini

- Page 614 and 615:

S. 115VG I.T. ACT, 1961 1.582(v) ha

- Page 616 and 617:

S. 115V-I I.T. ACT, 1961 1.584Provi

- Page 618 and 619:

S. 115VK I.T. ACT, 1961 1.586(2) Th

- Page 620 and 621:

S. 115VP I.T. ACT, 1961 1.588Charge

- Page 622 and 623:

S. 115VT I.T. ACT, 1961 1.590D.—C

- Page 624 and 625:

S. 115VW I.T. ACT, 1961 1.592(2) Th

- Page 626 and 627:

S. 115VZB I.T. ACT, 1961 1.594amalg

- Page 628 and 629:

S. 115WB I.T. ACT, 1961 1.59654[Pro

- Page 630 and 631:

S. 115WB I.T. ACT, 1961 1.598(v) be

- Page 632 and 633:

S. 115WC I.T. ACT, 1961 1.600amount

- Page 634 and 635:

S. 115WE I.T. ACT, 1961 1.602(2) In

- Page 636 and 637:

S. 115WF I.T. ACT, 1961 1.604Provid

- Page 638 and 639:

S. 115WJ I.T. ACT, 1961 1.606benefi

- Page 640 and 641:

S. 115WKB I.T. ACT, 1961 1.608Inter

- Page 642 and 643:

S. 119 I.T. ACT, 1961 1.61090[Appoi

- Page 644 and 645:

S. 120 I.T. ACT, 1961 1.612(3) 10 [

- Page 646 and 647:

S. 124 I.T. ACT, 1961 1.614Jurisdic

- Page 648 and 649:

S. 129 I.T. ACT, 1961 1.616(a) wher

- Page 650 and 651:

S. 132 I.T. ACT, 1961 1.618to be co

- Page 652 and 653:

S. 132 I.T. ACT, 1961 1.620(A) the

- Page 654 and 655:

S. 132 I.T. ACT, 1961 1.622the 1st

- Page 656 and 657:

S. 132 I.T. ACT, 1961 1.624(6) 4 [*

- Page 658 and 659:

S. 132 I.T. ACT, 1961 1.626or Direc

- Page 660 and 661:

S. 132B I.T. ACT, 1961 1.628the Ind

- Page 662 and 663:

S. 132B I.T. ACT, 1961 1.630tion wi

- Page 664 and 665:

S. 133A I.T. ACT, 1961 1.632(5) req

- Page 666 and 667:

S. 133A I.T. ACT, 1961 1.634Commiss

- Page 668 and 669:

S. 137 I.T. ACT, 1961 1.63673[Asses

- Page 670 and 671:

S. 139 I.T. ACT, 1961 1.638in the O

- Page 672 and 673:

S. 139 I.T. ACT, 1961 1.640Provided

- Page 674 and 675:

S. 139 I.T. ACT, 1961 1.642Explanat

- Page 676 and 677:

S. 139 I.T. ACT, 1961 1.644he may f

- Page 678 and 679:

S. 139 I.T. ACT, 1961 1.646Provided

- Page 680 and 681:

S. 139 I.T. ACT, 1961 1.64856[(c) T

- Page 682 and 683:

S. 139A I.T. ACT, 1961 1.65067[***]

- Page 684 and 685:

S. 139A I.T. ACT, 1961 1.652(d) int

- Page 686 and 687:

S. 139B I.T. ACT, 1961 1.65495[(d)

- Page 688 and 689:

S. 140 I.T. ACT, 1961 1.656(c) the

- Page 690 and 691:

S. 140A I.T. ACT, 1961 1.658(iii) a

- Page 692 and 693:

S. 142 I.T. ACT, 1961 1.660Provisio

- Page 694 and 695:

S. 142 I.T. ACT, 1961 1.66254[Provi

- Page 696 and 697:

S. 143 I.T. ACT, 1961 1.664(a) the

- Page 698 and 699:

S. 143 I.T. ACT, 1961 1.666serve on

- Page 700 and 701:

S. 144 I.T. ACT, 1961 1.668(a) any

- Page 702 and 703:

S. 144C I.T. ACT, 1961 1.67097[Refe

- Page 704 and 705:

S. 145A I.T. ACT, 1961 1.672(2) The

- Page 706 and 707:

S. 148 I.T. ACT, 1961 1.674Explanat

- Page 708 and 709:

S. 150 I.T. ACT, 1961 1.676(b) if f

- Page 710 and 711:

S. 153 I.T. ACT, 1961 1.678Provided

- Page 712 and 713:

S. 153 I.T. ACT, 1961 1.680and any

- Page 714 and 715:

S. 153 I.T. ACT, 1961 1.682(iv) 60

- Page 716 and 717:

S. 153B I.T. ACT, 1961 1.68473[(2)

- Page 718 and 719:

S. 153C I.T. ACT, 1961 1.686(iii) t

- Page 720 and 721:

S. 154 I.T. ACT, 1961 1.688Rectific

- Page 722 and 723:

S. 155 I.T. ACT, 1961 1.690(b) on a

- Page 724 and 725:

S. 155 I.T. ACT, 1961 1.692(b) at a

- Page 726 and 727:

S. 155 I.T. ACT, 1961 1.694(c) for

- Page 728 and 729:

S. 155 I.T. ACT, 1961 1.696(10) 42

- Page 730 and 731:

S. 155 I.T. ACT, 1961 1.698and subs

- Page 732 and 733:

S. 158 I.T. ACT, 1961 1.700Notice o

- Page 734 and 735:

S. 158B I.T. ACT, 1961 1.702(4) Whe

- Page 736 and 737:

S. 158BB I.T. ACT, 1961 1.704under

- Page 738 and 739:

S. 158BC I.T. ACT, 1961 1.706the as

- Page 740 and 741:

S. 158BE I.T. ACT, 1961 1.7082[Expl

- Page 742 and 743:

S. 158BFA I.T. ACT, 1961 1.710(3) N

- Page 744 and 745:

S. 160 I.T. ACT, 1961 1.712(b) any

- Page 746 and 747:

S. 163 I.T. ACT, 1961 1.71421[***](

- Page 748 and 749:

S. 164 I.T. ACT, 1961 1.716(ii) the

- Page 750 and 751:

S. 164 I.T. ACT, 1961 1.718(iii) th

- Page 752 and 753:

S. 167C I.T. ACT, 1961 1.72061[Char

- Page 754 and 755:

S. 171 I.T. ACT, 1961 1.722succeede

- Page 756 and 757:

S. 172 I.T. ACT, 1961 1.7241978, am

- Page 758 and 759:

S. 174 I.T. ACT, 1961 1.726(6) A po

- Page 760 and 761:

S. 176 I.T. ACT, 1961 1.728juridica

- Page 762 and 763:

S. 178 I.T. ACT, 1961 1.730referred

- Page 764 and 765:

S. 180A I.T. ACT, 1961 1.732N.—Sp

- Page 766 and 767:

S. 187 I.T. ACT, 1961 1.734(4) Wher

- Page 768 and 769:

S. 190 I.T. ACT, 1961 1.736proceedi

- Page 770 and 771:

S. 192 I.T. ACT, 1961 1.73850[***]

- Page 772 and 773:

S. 193 I.T. ACT, 1961 1.740(4) The

- Page 774 and 775:

S. 193 I.T. ACT, 1961 1.74288[(v) a

- Page 776 and 777:

S. 194A I.T. ACT, 1961 1.744Provide

- Page 778 and 779:

S. 194A I.T. ACT, 1961 1.746(b) ten

- Page 780 and 781:

S. 194B I.T. ACT, 1961 1.748Profits

- Page 782 and 783:

S. 194C I.T. ACT, 1961 1.750(Contd.

- Page 784 and 785:

S. 194C I.T. ACT, 1961 1.752(ii) tw

- Page 786 and 787:

S. 194F I.T. ACT, 1961 1.754for sol

- Page 788 and 789:

S. 194H I.T. ACT, 1961 1.756issue o

- Page 790 and 791:

S. 194J I.T. ACT, 1961 1.758Explana

- Page 792 and 793:

S. 194K I.T. ACT, 1961 1.760or inte

- Page 794 and 795:

S. 195 I.T. ACT, 1961 1.762of payme

- Page 796 and 797:

S. 196 I.T. ACT, 1961 1.764section

- Page 798 and 799:

S. 196D I.T. ACT, 1961 1.766be deem

- Page 800 and 801:

S. 197A I.T. ACT, 1961 1.76853[(2A)

- Page 802 and 803:

S. 199 I.T. ACT, 1961 1.770declarat

- Page 804 and 805:

S. 200A I.T. ACT, 1961 1.77287[(2)

- Page 806 and 807:

S. 202 I.T. ACT, 1961 1.774(i) at o

- Page 808 and 809:

S. 203A I.T. ACT, 1961 1.776(3) 12-

- Page 810 and 811:

S. 206 I.T. ACT, 1961 1.778maintain

- Page 812 and 813:

S. 206A I.T. ACT, 1961 1.780tax und

- Page 814 and 815:

S. 206C I.T. ACT, 1961 1.782Person

- Page 816 and 817:

S. 206C I.T. ACT, 1961 1.784the acc

- Page 818 and 819:

S. 206C I.T. ACT, 1961 1.78678[(5A)

- Page 820 and 821:

S. 206C I.T. ACT, 1961 1.788section

- Page 822 and 823:

S. 209 I.T. ACT, 1961 1.7909[Condit

- Page 824 and 825:

S. 210 I.T. ACT, 1961 1.792section

- Page 826 and 827:

S. 211 I.T. ACT, 1961 1.794Due date

- Page 828 and 829:

S. 215 I.T. ACT, 1961 1.796prescrib

- Page 830 and 831:

S. 217 I.T. ACT, 1961 1.79855Intere

- Page 832 and 833:

S. 220 I.T. ACT, 1961 1.800payment

- Page 834 and 835:

S. 221 I.T. ACT, 1961 1.802time fix

- Page 836 and 837:

S. 223 I.T. ACT, 1961 1.804persons

- Page 838 and 839:

S. 226 I.T. ACT, 1961 1.806comply w

- Page 840 and 841:

S. 229 I.T. ACT, 1961 1.808Recovery

- Page 842 and 843:

S. 230 I.T. ACT, 1961 1.810(1A) Sub

- Page 844 and 845:

S. 234A I.T. ACT, 1961 1.81253[F.

- Page 846 and 847:

S. 234B I.T. ACT, 1961 1.814(ii) in

- Page 848 and 849:

S. 234C I.T. ACT, 1961 1.816Explana

- Page 850 and 851:

S. 234C I.T. ACT, 1961 1.818been a

- Page 852 and 853:

S. 236 I.T. ACT, 1961 1.820payment

- Page 854 and 855:

S. 239 I.T. ACT, 1961 1.822any asse

- Page 856 and 857:

S. 244 I.T. ACT, 1961 1.824the Cent

- Page 858 and 859:

S. 244A I.T. ACT, 1961 1.826calcula

- Page 860 and 861:

S. 245A I.T. ACT, 1961 1.828Provide

- Page 862 and 863:

S. 245BC I.T. ACT, 1961 1.830(4) No

- Page 864 and 865:

S. 245C I.T. ACT, 1961 1.832and suc

- Page 866 and 867:

S. 245D I.T. ACT, 1961 1.834applica

- Page 868 and 869:

S. 245D I.T. ACT, 1961 1.836may cal

- Page 870 and 871:

S. 245E I.T. ACT, 1961 1.83896[Powe

- Page 872 and 873:

S. 245H I.T. ACT, 1961 1.840in all

- Page 874 and 875:

S. 245J I.T. ACT, 1961 1.842(3) For

- Page 876 and 877:

S. 245N I.T. ACT, 1961 1.844Definit

- Page 878 and 879:

S. 245S I.T. ACT, 1961 1.84624[Prov

- Page 880 and 881:

S. 246 I.T. ACT, 1961 1.848Commissi

- Page 882 and 883:

S. 246 I.T. ACT, 1961 1.850(d) an o

- Page 884 and 885:

S. 246A I.T. ACT, 1961 1.852the ass

- Page 886 and 887:

S. 249 I.T. ACT, 1961 1.854irrespec

- Page 888 and 889:

S. 251 I.T. ACT, 1961 1.856(4) The

- Page 890 and 891:

S. 253 I.T. ACT, 1961 1.858cate or

- Page 892 and 893:

S. 253 I.T. ACT, 1961 1.860(3) Ever

- Page 894 and 895:

S. 255 I.T. ACT, 1961 1.862Provided

- Page 896 and 897:

S. 259 I.T. ACT, 1961 1.864containe

- Page 898 and 899:

S. 260B I.T. ACT, 1961 1.866(2) 66

- Page 900 and 901:

S. 264 I.T. ACT, 1961 1.868(i) an o

- Page 902 and 903:

S. 268 I.T. ACT, 1961 1.870(7) Notw

- Page 904 and 905:

S. 269A I.T. ACT, 1961 1.872(v) in

- Page 906 and 907:

S. 269A I.T. ACT, 1961 1.874(c) “

- Page 908 and 909:

S. 269B I.T. ACT, 1961 1.87622(2) E

- Page 910 and 911:

S. 269D I.T. ACT, 1961 1.87830Preli

- Page 912 and 913:

S. 269G I.T. ACT, 1961 1.880(a) the

- Page 914 and 915:

S. 269-I I.T. ACT, 1961 1.882Provid

- Page 916 and 917:

S. 269J I.T. ACT, 1961 1.884(2) Not

- Page 918 and 919:

S. 269L I.T. ACT, 1961 1.886Provide

- Page 920 and 921:

S. 269S I.T. ACT, 1961 1.88848[Prov

- Page 922 and 923:

S. 269T I.T. ACT, 1961 1.890Explana

- Page 924 and 925:

S. 269UA I.T. ACT, 1961 1.892(ii) i

- Page 926 and 927:

S. 269UB I.T. ACT, 1961 1.894(f)

- Page 928 and 929:

S. 269UD I.T. ACT, 1961 1.896Order

- Page 930 and 931:

S. 269UG I.T. ACT, 1961 1.898sectio

- Page 932 and 933:

S. 269UK I.T. ACT, 1961 1.900Provid

- Page 934 and 935:

S. 271 I.T. ACT, 1961 1.902Chapter

- Page 936 and 937:

S. 271 I.T. ACT, 1961 1.904(B) such

- Page 938 and 939:

S. 271 I.T. ACT, 1961 1.906deemed t

- Page 940 and 941:

S. 271 I.T. ACT, 1961 1.908order co

- Page 942 and 943:

S. 271AAA I.T. ACT, 1961 1.910compu

- Page 944 and 945:

S. 271E I.T. ACT, 1961 1.912(b) pay

- Page 946 and 947:

S. 272A I.T. ACT, 1961 1.91484[Pena

- Page 948 and 949:

S. 272B I.T. ACT, 1961 1.916(4) No

- Page 950 and 951:

S. 273 I.T. ACT, 1961 1.918(b) has

- Page 952 and 953:

S. 273A I.T. ACT, 1961 1.920(b) whe

- Page 954 and 955:

S. 273A I.T. ACT, 1961 1.922no orde

- Page 956 and 957:

S. 274 I.T. ACT, 1961 1.92468[Penal

- Page 958 and 959:

S. 275 I.T. ACT, 1961 1.926of the m

- Page 960 and 961:

S. 276BB I.T. ACT, 1961 1.928Failur

- Page 962 and 963:

S. 276D I.T. ACT, 1961 1.930section

- Page 964 and 965:

S. 278AB I.T. ACT, 1961 1.93227[Abe

- Page 966 and 967:

S. 278D I.T. ACT, 1961 1.934referre

- Page 968 and 969:

S. 280 I.T. ACT, 1961 1.93649[(3) W

- Page 970 and 971:

S. 281B I.T. ACT, 1961 1.938Tax cre

- Page 972 and 973:

S. 282B I.T. ACT, 1961 1.940“comm

- Page 974 and 975:

S. 285BA I.T. ACT, 1961 1.942and de

- Page 976 and 977:

S. 288 I.T. ACT, 1961 1.944Informat

- Page 978 and 979:

S. 288 I.T. ACT, 1961 1.946sub-sect

- Page 980 and 981:

S. 292B I.T. ACT, 1961 1.948evidenc

- Page 982 and 983:

S. 293A I.T. ACT, 1961 1.950Bar of

- Page 984 and 985:

S. 295 I.T. ACT, 1961 1.952Power to

- Page 986 and 987:

S. 296 I.T. ACT, 1961 1.95445[(mm)

- Page 988 and 989:

S. 297 I.T. ACT, 1961 1.956are pend

- Page 990 and 991:

R. 5 I.T. ACT, 1961 1.958THE FIRST

- Page 992 and 993:

R. 1 I.T. ACT, 1961 1.960Interpreta

- Page 994 and 995:

R. 8 I.T. ACT, 1961 1.962(c) by arr

- Page 996 and 997:

R. 14 I.T. ACT, 1961 1.964(a) (in t

- Page 998 and 999:

R. 24 I.T. ACT, 1961 1.966to the of

- Page 1000 and 1001:

R. 29 I.T. ACT, 1961 1.968(i) in th

- Page 1002 and 1003:

R. 41 I.T. ACT, 1961 1.970Seizure b

- Page 1004 and 1005:

R. 51 I.T. ACT, 1961 1.972Irregular

- Page 1006 and 1007:

R. 59 I.T. ACT, 1961 1.974of sale h

- Page 1008 and 1009:

R. 66 I.T. ACT, 1961 1.976(b) an ap

- Page 1010 and 1011:

R. 69 I.T. ACT, 1961 1.9789[Time li

- Page 1012 and 1013:

R. 76 I.T. ACT, 1961 1.980or some s

- Page 1014 and 1015:

R. 83 I.T. ACT, 1961 1.982(2) Where

- Page 1016 and 1017:

R. 92 I.T. ACT, 1961 1.984Penalties

- Page 1018 and 1019:

R. 2 I.T. ACT, 1961 1.986THE FOURTH

- Page 1020 and 1021:

R. 4 I.T. ACT, 1961 1.988(b) the co

- Page 1022 and 1023:

R. 8 I.T. ACT, 1961 1.990(b) so as

- Page 1024 and 1025:

R. 11 I.T. ACT, 1961 1.992to employ

- Page 1026 and 1027:

R. 2 I.T. ACT, 1961 1.994Government

- Page 1028 and 1029:

R. 9 I.T. ACT, 1961 1.996Officer me

- Page 1030 and 1031:

R. 3 I.T. ACT, 1961 1.998(2) All ru

- Page 1032 and 1033:

R. 9 I.T. ACT, 1961 1.1000withdrawi

- Page 1034 and 1035:

Item 33 I.T. ACT, 1961 1.1002(16) P

- Page 1036 and 1037:

Item 13 I.T. ACT, 1961 1.10042. Iro

- Page 1038 and 1039:

I.T. ACT, 1961 1.10067. Gramophones

- Page 1040 and 1041:

Item 17 I.T. ACT, 1961 1.1008PART B

- Page 1042 and 1043:

Item 19 I.T. ACT, 1961 1.1010S. No.

- Page 1044 and 1045:

Item 13 I.T. ACT, 1961 1.1012(ii) A

- Page 1046 and 1047:

Item 10 I.T. ACT, 1961 1.1014PART C

- Page 1048 and 1049:

APPENDIXTEXT OF REMAINING PROVISION

- Page 1050 and 1051:

1.1019 APPENDIXscheme) in the banki

- Page 1052 and 1053:

1.1021 APPENDIX(14) The provisions

- Page 1054 and 1055:

1.1023 APPENDIXin force, and may, b

- Page 1056 and 1057:

1.1025 APPENDIXequity shares, exerc

- Page 1058 and 1059:

1.1027 APPENDIXregistered under the

- Page 1060 and 1061:

1.1029 APPENDIX(9) Upon the revocat

- Page 1062 and 1063:

1.1031 APPENDIX(9) Where a company

- Page 1064 and 1065:

1.1033 APPENDIXconducted in such ma

- Page 1066 and 1067:

1.1035 APPENDIX(i) where such publi

- Page 1068 and 1069:

1.1037 APPENDIX(3) Where a notice g

- Page 1070 and 1071:

1.1039 APPENDIX(ii) directs that th

- Page 1072 and 1073:

1.1041 APPENDIX64. The Madras Chrom

- Page 1074 and 1075:

1.1043 APPENDIX153. Shri Navrathana

- Page 1076 and 1077:

1.1045 APPENDIX225. Sri Annamalai B

- Page 1078 and 1079:

1.1047 APPENDIX277. Vaitheeswaranko

- Page 1080 and 1081:

1.1049 APPENDIX327. Veer Mutual Ben

- Page 1082 and 1083:

1.1051 APPENDIX(i) (a) The turnover

- Page 1084 and 1085:

1.1053 APPENDIX(xi)(xii)(xiii)shown

- Page 1086 and 1087:

1.1055 APPENDIXparts and components

- Page 1088 and 1089:

1.1057 APPENDIXprofits of which, he

- Page 1090 and 1091:

1.1059 APPENDIXSECTION 360 OF CODE

- Page 1092 and 1093:

1.1061 APPENDIXSECTION 1 OF EMPLOYE

- Page 1094 and 1095:

1.1063 APPENDIXsuch conditions as t

- Page 1096 and 1097:

1.1065 APPENDIXFifth - Every juryma

- Page 1098 and 1099:

1.1067 APPENDIX(2) The factors refe

- Page 1100 and 1101:

1.1069 APPENDIXSECTION 43 OF LIFE I

- Page 1102 and 1103:

1.1071 APPENDIX(h) “multiple disa

- Page 1104 and 1105:

1.1073 APPENDIX(r) “mental retard

- Page 1106 and 1107:

1.1075 APPENDIX(h) “securities”

- Page 1108 and 1109:

1.1077 APPENDIX(ii) any other compa

- Page 1110 and 1111:

1.1079 APPENDIXperson in favour of

- Page 1112 and 1113:

1.1081 APPENDIXMedical facilities f

- Page 1114 and 1115:

I.T. ACT, 1961 1.1084- interest for

- Page 1116 and 1117:

I.T. ACT, 1961 1.1086Audit, compuls

- Page 1118 and 1119:

I.T. ACT, 1961 1.1088Business expen

- Page 1120 and 1121:

I.T. ACT, 1961 1.1090Certificate pr

- Page 1122 and 1123:

I.T. ACT, 1961 1.1092Contractors/Su

- Page 1124 and 1125:

I.T. ACT, 1961 1.1094- corporation

- Page 1126 and 1127:

I.T. ACT, 1961 1.1096- royalty, etc

- Page 1128 and 1129:

I.T. ACT, 1961 1.1098Expenditure in

- Page 1130 and 1131:

I.T. ACT, 1961 1.1100- not a capita

- Page 1132 and 1133:

I.T. ACT, 1961 1.1102Income-tax aut

- Page 1134 and 1135:

I.T. ACT, 1961 1.1104- associated e

- Page 1136 and 1137:

I.T. ACT, 1961 1.1106- tax on Secti

- Page 1138 and 1139:

I.T. ACT, 1961 1.1108- sportsmen/sp

- Page 1140 and 1141:

I.T. ACT, 1961 1.1110- expenditure

- Page 1142 and 1143:

I.T. ACT, 1961 1.1112Probation of O

- Page 1144 and 1145:

I.T. ACT, 1961 1.1114Rent- deductio

- Page 1146 and 1147:

I.T. ACT, 1961 1.1116Scrap- collect

- Page 1148 and 1149:

I.T. ACT, 1961 1.1118Step child- wh

- Page 1150 and 1151:

I.T. ACT, 1961 1.1120Trade Union- i

- Page 1152 and 1153:

DIVISION TWOFinanceAct, 2010

- Page 1154 and 1155:

FINANCE ACT, 2010 2.4SECTIONPAGE18.

- Page 1156 and 1157:

*FINANCE ACT, 2010An Act to give ef

- Page 1158 and 1159:

2.9 CH. II - RATES OF INCOME-TAX S.

- Page 1160 and 1161:

2.11 CH. II - RATES OF INCOME-TAX S

- Page 1162 and 1163:

2.13 CH. III - DIRECT TAXES - INCOM

- Page 1164 and 1165:

2.15 CH. III - DIRECT TAXES - INCOM

- Page 1166 and 1167:

2.17 CH. III - DIRECT TAXES - INCOM

- Page 1168 and 1169:

2.19 CH. III - DIRECT TAXES - INCOM

- Page 1170 and 1171:

2.21 CH. III - DIRECT TAXES - INCOM

- Page 1172 and 1173:

2.23 CH. III - DIRECT TAXES - INCOM

- Page 1174 and 1175:

2.25 CH. III - DIRECT TAXES - INCOM

- Page 1176 and 1177:

2.27 CH. III - DIRECT TAXES - WEALT

- Page 1178 and 1179:

2.29 INCOME-TAX Sch. I(II) In the c

- Page 1180 and 1181:

2.31 RATES FOR TDS IN CERTAIN CASES

- Page 1182 and 1183:

2.33 RATES FOR TDS IN CERTAIN CASES

- Page 1184 and 1185:

2.35 RATES FOR TDS IN CERTAIN CASES

- Page 1186 and 1187:

2.37 RATES FOR TDS IN CERTAIN CASES

- Page 1188 and 1189:

2.39 RATES FOR CHARGING INCOME-TAX

- Page 1190 and 1191:

2.41 RULES FOR COMPUTATION OF NET A

- Page 1192 and 1193:

2.43 RULES FOR COMPUTATION OF NET A

- Page 1194 and 1195:

2.45 RULES FOR COMPUTATION OF NET A

- Page 1196 and 1197:

NATIONAL TAX TRIBUNAL ACT, 2005Arra

- Page 1198 and 1199:

NATIONAL TAX TRIBUNALACT, 2005[49 O

- Page 1200 and 1201:

3.7 CH. II - ESTABLISHMENT OF NATIO

- Page 1202 and 1203:

3.9 CH. II - ESTABLISHMENT OF NATIO

- Page 1204 and 1205:

3.11 CH. III - JURISDICTION, POWERS

- Page 1206 and 1207:

3.13 CH. III - JURISDICTION, POWERS

- Page 1208 and 1209:

3.15 AMENDMENT OF CERTAIN ENACTMENT

- Page 1210 and 1211:

3.17 AMENDMENT OF CERTAIN ENACTMENT

- Page 1212 and 1213:

DIVISION FOURSecuritiesTransaction

- Page 1214 and 1215:

SECURITIES TRANSACTION TAX*CHAPTER

- Page 1216 and 1217:

4.7 CH. VII OF FINANCE (NO. 2) ACT,

- Page 1218 and 1219:

4.9 CH. VII OF FINANCE (NO. 2) ACT,

- Page 1220 and 1221:

4.11 CH. VII OF FINANCE (NO. 2) ACT

- Page 1222:

4.13 CH. VII OF FINANCE (NO. 2) ACT