- Page 5 and 6:

ACTA WASAENSIA 52.10.1 Cross-Sectio

- Page 7 and 8:

ACTA WASAENSIA 7A5 Matlabcodeforerr

- Page 10 and 11:

10 ACTA WASAENSIAIn chapter 5 I sha

- Page 12 and 13:

12 ACTA WASAENSIA2 Statistical Prop

- Page 14:

14 ACTA WASAENSIA2.2 Absence of Ser

- Page 17 and 18:

ACTA WASAENSIA 17The survival or ta

- Page 19 and 20:

ACTA WASAENSIA 19& Scheinkman (1987

- Page 21 and 22:

ACTA WASAENSIA 212.6 Long Range Dep

- Page 23 and 24:

ACTA WASAENSIA 23A particular class

- Page 26 and 27:

26 ACTA WASAENSIAMultiscaling may t

- Page 28 and 29:

28 ACTA WASAENSIAHansen (1982) to c

- Page 30 and 31:

30 ACTA WASAENSIAThe leverage hypot

- Page 32 and 33:

32 ACTA WASAENSIAIn order to aviod

- Page 34 and 35:

34 ACTA WASAENSIAon a risk-adjusted

- Page 36 and 37:

36 ACTA WASAENSIAplanations for the

- Page 38 and 39:

38 ACTA WASAENSIAspeculative prices

- Page 40 and 41:

40 ACTA WASAENSIAindex α is howeve

- Page 42 and 43:

42 ACTA WASAENSIAThis approach has

- Page 44 and 45:

44 ACTA WASAENSIAimplying exponenti

- Page 46 and 47:

46 ACTA WASAENSIA3.2.4 Descriptive

- Page 48 and 49:

48 ACTA WASAENSIAdivisible version

- Page 50 and 51:

50 ACTA WASAENSIAto check their ade

- Page 52 and 53:

52 ACTA WASAENSIAvolatility into th

- Page 54 and 55:

54 ACTA WASAENSIAfeedback of the co

- Page 56 and 57:

56 ACTA WASAENSIAarriving at the fo

- Page 58 and 59:

58 ACTA WASAENSIAat iteration k com

- Page 60 and 61:

60 ACTA WASAENSIAmultipliers in the

- Page 62 and 63:

62 ACTA WASAENSIALux & Ausloos (200

- Page 64 and 65:

64 ACTA WASAENSIAmarkets dominated

- Page 66 and 67:

66 ACTA WASAENSIAThe “representat

- Page 68 and 69:

68 ACTA WASAENSIA(1983) 114 motivat

- Page 70 and 71:

70 ACTA WASAENSIAIn the following w

- Page 72 and 73:

72 ACTA WASAENSIASethi (1996) exten

- Page 74 and 75:

74 ACTA WASAENSIASummation over all

- Page 76 and 77:

76 ACTA WASAENSIAthe microscopic un

- Page 78 and 79:

78 ACTA WASAENSIA& Winker (2003) an

- Page 80 and 81:

80 ACTA WASAENSIAWe wish to obtain

- Page 82 and 83:

82 ACTA WASAENSIAindividual markets

- Page 84 and 85:

84 ACTA WASAENSIAreturn series. I l

- Page 86 and 87:

86 ACTA WASAENSIASwitches between c

- Page 88 and 89:

88 ACTA WASAENSIAfollowing necessar

- Page 90 and 91:

90 ACTA WASAENSIATable 1. Parameter

- Page 92 and 93:

92 ACTA WASAENSIAin stepwise search

- Page 94 and 95:

94 ACTA WASAENSIA0.2Logreturns Para

- Page 96 and 97:

96 ACTA WASAENSIA0.8Chartist Index

- Page 98 and 99:

98 ACTA WASAENSIATable 3. Kurtosis

- Page 100 and 101:

100 ACTA WASAENSIAthe most extreme

- Page 102 and 103:

102 ACTA WASAENSIATable 4. Estimate

- Page 104 and 105:

104 ACTA WASAENSIATable 8. Results

- Page 106 and 107:

106 ACTA WASAENSIATable 9. Results

- Page 108 and 109:

108 ACTA WASAENSIATable 11. Paramet

- Page 110 and 111:

110 ACTA WASAENSIA1 x 105 Aggr. Inv

- Page 112 and 113:

112 ACTA WASAENSIA200Aggr. Inventor

- Page 114 and 115:

114 ACTA WASAENSIA5 x 105 Aggr. Wea

- Page 116 and 117:

116 ACTA WASAENSIAOverall, we can a

- Page 118 and 119:

118 ACTA WASAENSIAby Lux (1998). Th

- Page 120 and 121:

120 ACTA WASAENSIAwhere s is a disc

- Page 122 and 123:

122 ACTA WASAENSIAprocessing valuat

- Page 124 and 125:

124 ACTA WASAENSIAProof. See append

- Page 126 and 127: 126 ACTA WASAENSIA2.5Logarithmice T

- Page 128 and 129: 128 ACTA WASAENSIA0.4Logreturns Ass

- Page 130 and 131: 130 ACTA WASAENSIA0.4Logreturns Ass

- Page 132 and 133: 132 ACTA WASAENSIATable 17. Probabi

- Page 134 and 135: 134 ACTA WASAENSIATable 18. Median

- Page 136 and 137: 136 ACTA WASAENSIAIn order to test

- Page 138 and 139: 138 ACTA WASAENSIAReferencesAbhyank

- Page 140 and 141: 140 ACTA WASAENSIABaillie, R. T. (1

- Page 142 and 143: 142 ACTA WASAENSIABlack, F. & M. Sc

- Page 144 and 145: 144 ACTA WASAENSIAButler, R. J., J.

- Page 146 and 147: 146 ACTA WASAENSIACont, R. (2001).

- Page 148 and 149: 148 ACTA WASAENSIAEmbrechts, P., C.

- Page 150 and 151: 150 ACTA WASAENSIAFielitz, B. D. (1

- Page 152 and 153: 152 ACTA WASAENSIAGhysels, E., A. C

- Page 154 and 155: 154 ACTA WASAENSIAHeston, S. L. (19

- Page 156 and 157: 156 ACTA WASAENSIAKaldor, N. (1939)

- Page 158 and 159: 158 ACTA WASAENSIALiesenfeld, R. (1

- Page 160 and 161: 160 ACTA WASAENSIALye, J. N. & V. L

- Page 162 and 163: 162 ACTA WASAENSIAMikosch, T. (2003

- Page 164 and 165: 164 ACTA WASAENSIAPindyck, R. S. (1

- Page 166 and 167: 166 ACTA WASAENSIASethi, R. (1996).

- Page 168 and 169: 168 ACTA WASAENSIATesfatsion, L. &

- Page 170 and 171: 170 ACTA WASAENSIAAAppendixA1Matlab

- Page 172 and 173: 172 ACTA WASAENSIA87 % a3 = 1; %imp

- Page 174 and 175: 174 ACTA WASAENSIA181 nmout = max([

- Page 178 and 179: 178 ACTA WASAENSIA45 end464748 % In

- Page 180 and 181: 180 ACTA WASAENSIA454647 % Check wh

- Page 182 and 183: 182 ACTA WASAENSIAA4Matlab code for

- Page 184 and 185: 184 ACTA WASAENSIA888990 % create P

- Page 186 and 187: 186 ACTA WASAENSIA4344 nobs = 500;

- Page 188 and 189: 188 ACTA WASAENSIAA6Matlab code for

- Page 190 and 191: 190 ACTA WASAENSIA9192 for t = 1:T

- Page 192 and 193: 192 ACTA WASAENSIA185 fcash = fcash

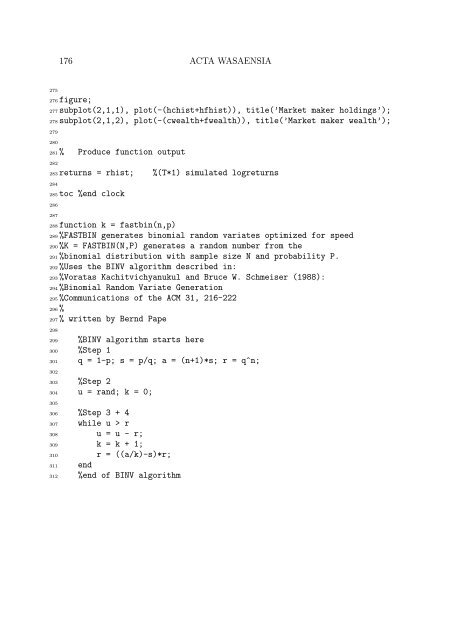

- Page 194 and 195: 194 ACTA WASAENSIA279280281 %Output

- Page 196 and 197: 196 ACTA WASAENSIA(4.20), and o(τ

- Page 198 and 199: 198 ACTA WASAENSIAas t = n k P ˙

- Page 200 and 201: 200 ACTA WASAENSIA nBn˙f2 = v B n

- Page 202 and 203: 202 ACTA WASAENSIA f˙1−c1 = v B

- Page 204 and 205: 204 ACTA WASAENSIAlocal stability o