The likely impact of Basel III on a bank's appetite for ... - NHH

The likely impact of Basel III on a bank's appetite for ... - NHH

The likely impact of Basel III on a bank's appetite for ... - NHH

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

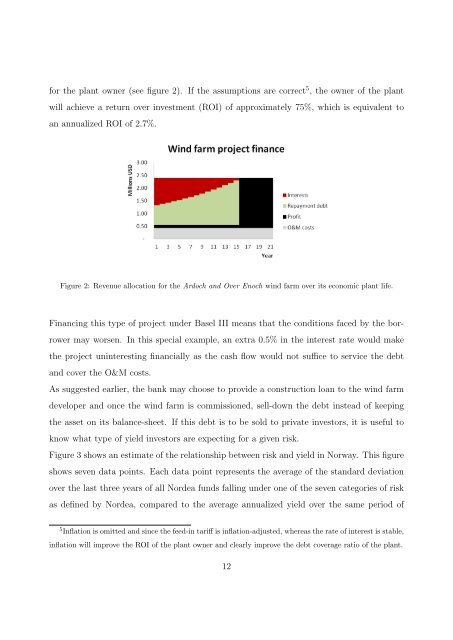

<strong>for</strong> the plant owner (see figure 2). If the assumpti<strong>on</strong>s are correct 5 , the owner <str<strong>on</strong>g>of</str<strong>on</strong>g> the plantwill achieve a return over investment (ROI) <str<strong>on</strong>g>of</str<strong>on</strong>g> approximately 75%, which is equivalent toan annualized ROI <str<strong>on</strong>g>of</str<strong>on</strong>g> 2.7%.Figure 2: Revenue allocati<strong>on</strong> <strong>for</strong> the Ardoch and Over Enoch wind farm over its ec<strong>on</strong>omic plant life.Financing this type <str<strong>on</strong>g>of</str<strong>on</strong>g> project under <str<strong>on</strong>g>Basel</str<strong>on</strong>g> <str<strong>on</strong>g>III</str<strong>on</strong>g> means that the c<strong>on</strong>diti<strong>on</strong>s faced by the borrowermay worsen. In this special example, an extra 0.5% in the interest rate would makethe project uninteresting financially as the cash flow would not suffice to service the debtand cover the O&M costs.As suggested earlier, the bank may choose to provide a c<strong>on</strong>structi<strong>on</strong> loan to the wind farmdeveloper and <strong>on</strong>ce the wind farm is commissi<strong>on</strong>ed, sell-down the debt instead <str<strong>on</strong>g>of</str<strong>on</strong>g> keepingthe asset <strong>on</strong> its balance-sheet. If this debt is to be sold to private investors, it is useful toknow what type <str<strong>on</strong>g>of</str<strong>on</strong>g> yield investors are expecting <strong>for</strong> a given risk.Figure 3 shows an estimate <str<strong>on</strong>g>of</str<strong>on</strong>g> the relati<strong>on</strong>ship between risk and yield in Norway. This figureshows seven data points. Each data point represents the average <str<strong>on</strong>g>of</str<strong>on</strong>g> the standard deviati<strong>on</strong>over the last three years <str<strong>on</strong>g>of</str<strong>on</strong>g> all Nordea funds falling under <strong>on</strong>e <str<strong>on</strong>g>of</str<strong>on</strong>g> the seven categories <str<strong>on</strong>g>of</str<strong>on</strong>g> riskas defined by Nordea, compared to the average annualized yield over the same period <str<strong>on</strong>g>of</str<strong>on</strong>g>5 Inflati<strong>on</strong> is omitted and since the feed-in tariff is inflati<strong>on</strong>-adjusted, whereas the rate <str<strong>on</strong>g>of</str<strong>on</strong>g> interest is stable,inflati<strong>on</strong> will improve the ROI <str<strong>on</strong>g>of</str<strong>on</strong>g> the plant owner and clearly improve the debt coverage ratio <str<strong>on</strong>g>of</str<strong>on</strong>g> the plant.12