The likely impact of Basel III on a bank's appetite for ... - NHH

The likely impact of Basel III on a bank's appetite for ... - NHH

The likely impact of Basel III on a bank's appetite for ... - NHH

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

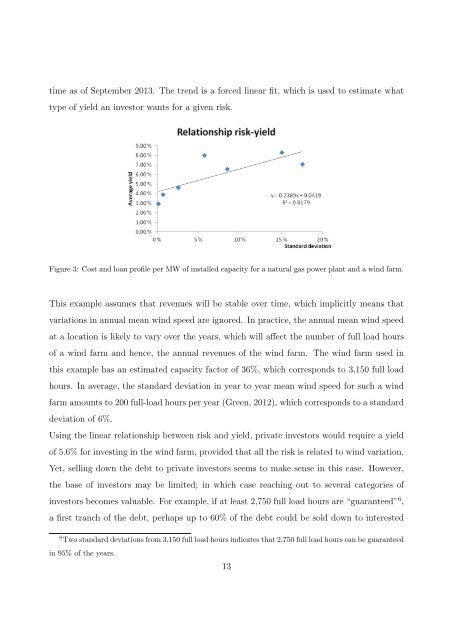

time as <str<strong>on</strong>g>of</str<strong>on</strong>g> September 2013. <str<strong>on</strong>g>The</str<strong>on</strong>g> trend is a <strong>for</strong>ced linear fit, which is used to estimate whattype <str<strong>on</strong>g>of</str<strong>on</strong>g> yield an investor wants <strong>for</strong> a given risk.Figure 3: Cost and loan pr<str<strong>on</strong>g>of</str<strong>on</strong>g>ile per MW <str<strong>on</strong>g>of</str<strong>on</strong>g> installed capacity <strong>for</strong> a natural gas power plant and a wind farm.This example assumes that revenues will be stable over time, which implicitly means thatvariati<strong>on</strong>s in annual mean wind speed are ignored. In practice, the annual mean wind speedat a locati<strong>on</strong> is <str<strong>on</strong>g>likely</str<strong>on</strong>g> to vary over the years, which will affect the number <str<strong>on</strong>g>of</str<strong>on</strong>g> full load hours<str<strong>on</strong>g>of</str<strong>on</strong>g> a wind farm and hence, the annual revenues <str<strong>on</strong>g>of</str<strong>on</strong>g> the wind farm. <str<strong>on</strong>g>The</str<strong>on</strong>g> wind farm used inthis example has an estimated capacity factor <str<strong>on</strong>g>of</str<strong>on</strong>g> 36%, which corresp<strong>on</strong>ds to 3,150 full loadhours. In average, the standard deviati<strong>on</strong> in year to year mean wind speed <strong>for</strong> such a windfarm amounts to 200 full-load hours per year (Green, 2012), which corresp<strong>on</strong>ds to a standarddeviati<strong>on</strong> <str<strong>on</strong>g>of</str<strong>on</strong>g> 6%.Using the linear relati<strong>on</strong>ship between risk and yield, private investors would require a yield<str<strong>on</strong>g>of</str<strong>on</strong>g> 5.6% <strong>for</strong> investing in the wind farm, provided that all the risk is related to wind variati<strong>on</strong>.Yet, selling down the debt to private investors seems to make sense in this case. However,the base <str<strong>on</strong>g>of</str<strong>on</strong>g> investors may be limited; in which case reaching out to several categories <str<strong>on</strong>g>of</str<strong>on</strong>g>investors becomes valuable. For example, if at least 2,750 full load hours are “guaranteed” 6 ,a first tranch <str<strong>on</strong>g>of</str<strong>on</strong>g> the debt, perhaps up to 60% <str<strong>on</strong>g>of</str<strong>on</strong>g> the debt could be sold down to interested6 Two standard deviati<strong>on</strong>s from 3,150 full load hours indicates that 2,750 full load hours can be guaranteedin 95% <str<strong>on</strong>g>of</str<strong>on</strong>g> the years.13