united-utilities-annual-report-2015

united-utilities-annual-report-2015

united-utilities-annual-report-2015

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

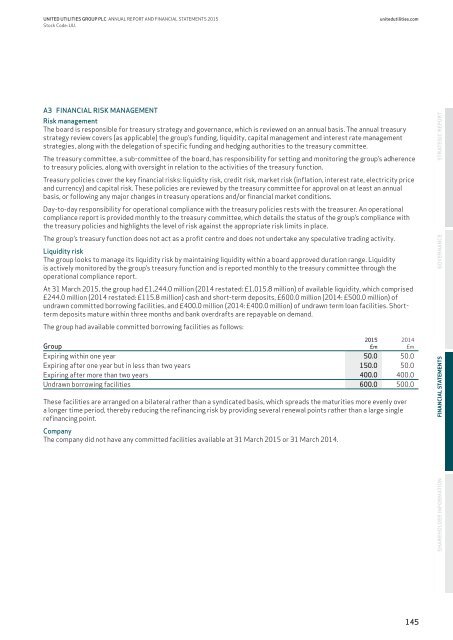

UNITED UTILITIES GROUP PLC ANNUAL REPORT AND FINANCIAL STATEMENTS <strong>2015</strong>Stock Code: UU.<strong>united</strong><strong>utilities</strong>.comA3 FINANCIAL RISK MANAGEMENTRisk managementThe board is responsible for treasury strategy and governance, which is reviewed on an <strong>annual</strong> basis. The <strong>annual</strong> treasurystrategy review covers (as applicable) the group’s funding, liquidity, capital management and interest rate managementstrategies, along with the delegation of specific funding and hedging authorities to the treasury committee.The treasury committee, a sub-committee of the board, has responsibility for setting and monitoring the group’s adherenceto treasury policies, along with oversight in relation to the activities of the treasury function.STRATEGIC REPORTTreasury policies cover the key financial risks: liquidity risk, credit risk, market risk (inflation, interest rate, electricity priceand currency) and capital risk. These policies are reviewed by the treasury committee for approval on at least an <strong>annual</strong>basis, or following any major changes in treasury operations and/or financial market conditions.Day-to-day responsibility for operational compliance with the treasury policies rests with the treasurer. An operationalcompliance <strong>report</strong> is provided monthly to the treasury committee, which details the status of the group’s compliance withthe treasury policies and highlights the level of risk against the appropriate risk limits in place.The group’s treasury function does not act as a profit centre and does not undertake any speculative trading activity.Liquidity riskThe group looks to manage its liquidity risk by maintaining liquidity within a board approved duration range. Liquidityis actively monitored by the group’s treasury function and is <strong>report</strong>ed monthly to the treasury committee through theoperational compliance <strong>report</strong>.At 31 March <strong>2015</strong>, the group had £1,244.0 million (2014 restated: £1,015.8 million) of available liquidity, which comprised£244.0 million (2014 restated: £115.8 million) cash and short-term deposits, £600.0 million (2014: £500.0 million) ofundrawn committed borrowing facilities, and £400.0 million (2014: £400.0 million) of undrawn term loan facilities. Shorttermdeposits mature within three months and bank overdrafts are repayable on demand.The group had available committed borrowing facilities as follows:GroupExpiring within one year 50.0 50.0Expiring after one year but in less than two years 150.0 50.0Expiring after more than two years 400.0 400.0Undrawn borrowing facilities 600.0 500.0These facilities are arranged on a bilateral rather than a syndicated basis, which spreads the maturities more evenly overa longer time period, thereby reducing the refinancing risk by providing several renewal points rather than a large singlerefinancing point.CompanyThe company did not have any committed facilities available at 31 March <strong>2015</strong> or 31 March 2014.<strong>2015</strong>£m2014£mSHAREHOLDER INFORMATION FINANCIAL STATEMENTSGOVERNANCE145