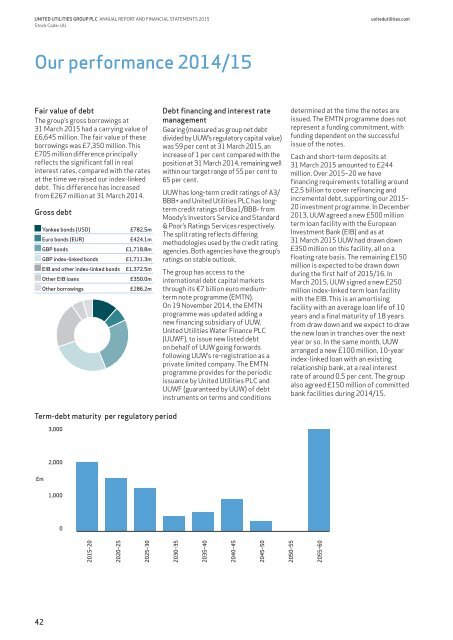

UNITED UTILITIES GROUP PLC ANNUAL REPORT AND FINANCIAL STATEMENTS <strong>2015</strong>Stock Code: UU.<strong>united</strong><strong>utilities</strong>.comOur performance 2014/15Fair value of debtThe group’s gross borrowings at31 March <strong>2015</strong> had a carrying value of£6,645 million. The fair value of theseborrowings was £7,350 million. This£705 million difference principallyreflects the significant fall in realinterest rates, compared with the ratesat the time we raised our index-linkeddebt. This difference has increasedfrom £267 million at 31 March 2014.Gross debtYankee bonds (USD)Euro bonds (EUR)GBP bondsGBP index-linked bondsEIB and other index-linked bondsOther EIB loansOther borrowings£782.5m£424.1m£1,718.8m£1,711.3m£1,372.5m£350.0m£286.2mDebt financing and interest ratemanagementGearing (measured as group net debtdivided by UUW’s regulatory capital value)was 59 per cent at 31 March <strong>2015</strong>, anincrease of 1 per cent compared with theposition at 31 March 2014, remaining wellwithin our target range of 55 per cent to65 per cent.UUW has long-term credit ratings of A3/BBB+ and United Utilities PLC has longtermcredit ratings of Baa1/BBB- fromMoody’s Investors Service and Standard& Poor’s Ratings Services respectively.The split rating reflects differingmethodologies used by the credit ratingagencies. Both agencies have the group’sratings on stable outlook.The group has access to theinternational debt capital marketsthrough its €7 billion euro mediumtermnote programme (EMTN).On 19 November 2014, the EMTNprogramme was updated adding anew financing subsidiary of UUW,United Utilities Water Finance PLC(UUWF), to issue new listed debton behalf of UUW going forwardsfollowing UUW’s re-registration as aprivate limited company. The EMTNprogramme provides for the periodicissuance by United Utilities PLC andUUWF (guaranteed by UUW) of debtinstruments on terms and conditionsdetermined at the time the notes areissued. The EMTN programme does notrepresent a funding commitment, withfunding dependent on the successfulissue of the notes.Cash and short-term deposits at31 March <strong>2015</strong> amounted to £244million. Over <strong>2015</strong>–20 we havefinancing requirements totalling around£2.5 billion to cover refinancing andincremental debt, supporting our <strong>2015</strong>–20 investment programme. In December2013, UUW agreed a new £500 millionterm loan facility with the EuropeanInvestment Bank (EIB) and as at31 March <strong>2015</strong> UUW had drawn down£350 million on this facility, all on afloating rate basis. The remaining £150million is expected to be drawn downduring the first half of <strong>2015</strong>/16. InMarch <strong>2015</strong>, UUW signed a new £250million index-linked term loan facilitywith the EIB. This is an amortisingfacility with an average loan life of 10years and a final maturity of 18 yearsfrom draw down and we expect to drawthe new loan in tranches over the nextyear or so. In the same month, UUWarranged a new £100 million, 10-yearindex-linked loan with an existingrelationship bank, at a real interestrate of around 0.5 per cent. The groupalso agreed £150 million of committedbank facilities during 2014/15.Term-debt maturity per regulatory period3,0002,000£m1,0000<strong>2015</strong>–202020–252025–302030–352035–402040–452045–502050–552055–6042

UNITED UTILITIES GROUP PLC ANNUAL REPORT AND FINANCIAL STATEMENTS <strong>2015</strong>Stock Code: UU.<strong>united</strong><strong>utilities</strong>.comFollowing the year-end, UUWF issuedtwo index-linked notes totalling £60million, split by a £25 million, 10-yearmaturity and a £35 million, 15-yearmaturity. UUWF also issued a €52million note (swapped to floatingsterling) with a 12-year maturity. Allthese notes were issued via privateplacement off our EMTN programme.The group now has headroom to coverits projected financing needs into2017.Long-term borrowings are structured orhedged to match assets and earnings,which are largely in sterling, indexedto UK retail price inflation and subjectto regulatory price reviews every fiveyears.Long-term sterling inflation indexlinkeddebt provides a natural hedgeto assets and earnings. At 31 March<strong>2015</strong>, approximately 52 per cent ofthe group’s net debt was in index-linkedform, representing around 31 per centof UUW’s regulatory capital value, withan average real interest rate of 1.6per cent. The long-term nature of thisfunding also provides a good match tothe company’s long-life infrastructureassets and is a key contributor to thegroup’s average term-debt maturityprofile, which is over 20 years.Where nominal debt is raised in acurrency other than sterling and/or witha fixed interest rate, to manage exposureto long-term interest rates, the debt isgenerally swapped to create a floatingrate sterling liability for the term of thedebt. To manage exposure to mediumterminterest rates, the group fixesunderlying interest costs on nominaldebt out to 10 years on a reducingbalance basis. This is supplemented byfixing substantially all remaining floatingrate exposure across the forthcomingregulatory period around the time of theprice control determination.In line with this, the group has nowfixed interest costs for substantially allof its floating rate exposure over the<strong>2015</strong>–20 period, locking in an average<strong>annual</strong> interest rate of around 3.75 percent (inclusive of credit spreads). For<strong>2015</strong>/16, the rate is slightly higher,as we transition between the tworegulatory periods.LiquidityShort-term liquidity requirements aremet from the group’s normal operatingcash flow and its short-term bankdeposits and supported by committedbut undrawn credit facilities. Thegroup’s €7 billion euro medium-termnote programme provides furthersupport.In line with the board’s treasury policy,United Utilities aims to maintain a robustliquidity position. Available headroom at31 March <strong>2015</strong> was £616 million basedon cash, short-term deposits, mediumtermcommitted bank facilities, alongwith the undrawn portion of the EIB termloan facilities, net of short-term debt.United Utilities believes that it operatesa prudent approach to managingbanking counterparty risk. Counterpartyrisk, in relation to both cash depositsand derivatives, is controlled throughthe use of counterparty credit limits.United Utilities’ cash is held in the formof short-term money market depositswith prime commercial banks.United Utilities operates a bilateral,rather than a syndicated, approach toits core relationship banking facilities.This approach spreads maturitiesmore evenly over a longer time period,thereby reducing refinancing riskand providing the benefit of severalrenewal points rather than a large singlerefinancing requirement.PensionsAs at 31 March <strong>2015</strong>, the group hadan IAS 19 net pension surplus of £79million, compared with a net pensiondeficit of £177 million at 31 March2014. This £256 million favourablemovement mainly reflects a decreasein inflation expectations alongside anincrease in corporate credit spreads. Incontrast, the scheme specific fundingbasis does not suffer from volatilitydue to inflation and credit spreadmovements as it uses a fixed inflationassumption via the inflation fundingmechanism and a prudent, fixed creditspread assumption. Therefore, therecent inflation and credit spreadmovements have not had a materialimpact on the deficit calculated on ascheme specific funding basis or thelevel of deficit repair contributions.The triennial actuarial valuations ofthe group’s defined benefit pensionschemes were carried out as at31 March 2013 and the overallfunding position has improved sinceMarch 2010. Following the de-riskingmeasures we have implemented overrecent years, our pension fundingposition remains well placed and in linewith our expectations. There has beenno material change to the scheduledcash contributions as assessed at theprevious valuations in 2010.Further detail is provided in note 18(‘Retirement benefit obligations’)of these consolidated financialstatements.SHAREHOLDER INFORMATION FINANCIAL STATEMENTS GOVERNANCE STRATEGIC REPORT43